Market Commentary— Buckle up for a bumpy ride, but bumpy rides bring opportunity

The U.S. stock market continues to be extremely volatile, taking its cues from interest rates and the strength of the U.S. Dollar. As evidenced by the chart of the S&P 500 below, the last 12 months have been quite the bumpy ride. For the 1st quarter of 2023, the S&P posted a very strong gain of 7.50%, and that comes on the heels of an advance of 7.56% in the 4th quarter of last year. While back-to-back quarters of such incredible strength are likely unsustainable, they are certainly a welcome change from the first three quarters of 2022.

In January, interest rates fell as investors began to anticipate an end to the Federal Reserve’s aggressive rate hiking. As a result, stocks rallied. Or at least a few, very large, Tech stocks rallied. This was also the case in March, and even fewer stocks participated in the rally, but they were the right ones to move the index again.

In February, Jay Powell and others from the Federal Reserve yet again made clear their intention to aggressively fight inflation, and the market briefly acquiesced.

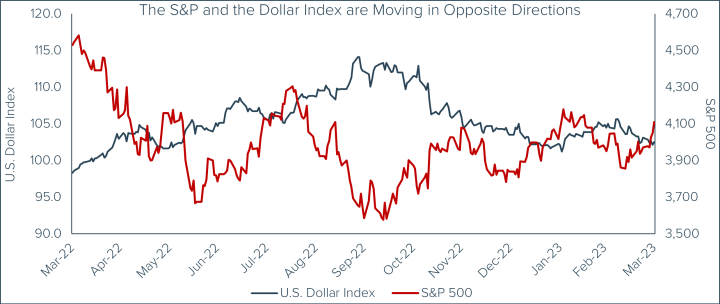

To say the market’s year-to-date rally has been narrow would be an understatement. But sometimes it only takes a few large stocks to move the index. According to noted market observer Jim Bianco, 80% of 2023’s rally can be attributed to just eight stocks (Meta, Apple, Amazon, Netflix, Google, Microsoft, Nvidia and Tesla). So far, the magic formula has been lower rates + weaker dollar = rising prices for a select group of stocks. The opposite of that formula has also held true. Rising rates + dollar strength = declining prices for a select group of stocks.

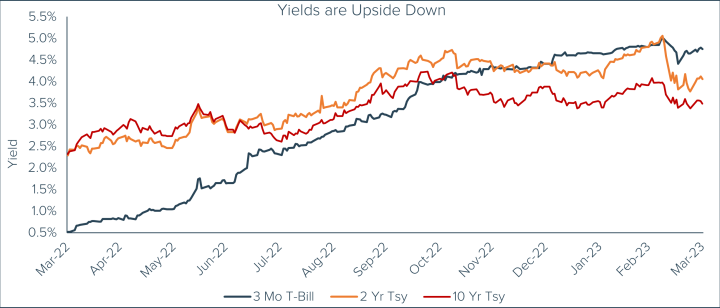

Rising rates and a strengthening dollar have put pressure on corporate profits. The charts below clearly illustrate how dramatically rates have risen over the past 12 months. The interest rate chart also shows that short term rates have risen faster and further than longer term rates, and are now higher. This is typically a precursor to a recession.

The chart showing the S&P and the U.S. Dollar index indicate a very strong inverse correlation. When one rises, the other falls, and vice versa. So for the time being, as the Fed fights inflation and rates remain high, expect significant headwinds for stocks. When rates pause or contract, enthusiasm for certain stocks returns aggressively.

If you know which direction rates will go in the next 12 months, you may be able to predict the direction of the market as well. Yet such predictions are nearly impossible to make with any certainty. It seems fair to say that investors should buckle up for a bumpy ride.

The good news is that bumpy rides create opportunity. At Tandem, we are serious about the notion of buying low and selling high. This crazy market may just give us plenty of opportunity to do both.

Commentary— Risk is always present – not just when things go poorly

Risk is really hard to quantify. Most times we only fully appreciate risk when it results in a loss. Risk is always present – not just when things go poorly. But how are we supposed to know how much risk is present in the moment, particularly when things are trending in our favor?

If we think of risk only in terms of actual outcomes, we miss the point. In a binary world, one where we clearly either succeed or fail, risk is very easy to quantify. We either win it all or lose it all. Hopefully we only risk what we can afford to lose. Outside of the world of gambling, however, binary outcomes are rarely the case. We may win, but how much? We may lose, but not everything. How are we supposed to quantify this risk?

Well, maybe the best answer is that we don’t need to quantify the risk at all. We just need to acknowledge and respect its presence. Simply remembering that risk is present can serve to positively influence the decisions that we make. As always, examples may serve to better illustrate this point.

Think back to the last time the stock market was at an all-time high. Being completely honest with yourself, how did you feel about the investing landscape at the time? If you were like most, you felt pretty positive, and why wouldn’t you? Stocks were at all-time highs, the economy was humming along, unemployment was low, interest rates were low, and inflation wasn’t even a concern. It is easy to take comfort in such positive things. In moments like these, many may even feel emboldened enough to increase their exposure to the stock market.

Unfortunately, most good things usually come to an end. So now think about what happened after the stock market fell from its historic highs. How did you feel then, with stock prices in decline, interest rates and inflation on the ascent, and the economy no longer humming? Were you nervous, or even scared? Were you tempted to get out? Did you?

Let’s ask a simple question. Accepting that risk is always present, at which point did you perceive risk to be the greatest? Most, if answering truthfully, would conjecture that risk must have been rising when the market was in decline. With the benefit of hindsight, is your answer still the same?

Perhaps looking backward it is now easier to see that risk was greater when the market was at all-time highs, right? After all, a market that is about to fall is more risky than a market that has already fallen.

More to the point, when things are so good that they could hardly get better, they rarely do. When things are going swimmingly, enjoy the ride, but resist the temptation to chase prices as they rise. Be content with what you have, and think about the risk/reward you face. Perhaps it would be a good time to reduce exposure as potential reward lessens. Something that has already doubled in value may do so again, but the odds are far less likely. Reduce, don’t chase.

Conversely, there is an old saying that it is always darkest before the dawn. When prices have fallen, try to avoid the temptation to get out. Instead, think like a shopper. If you admire something at full price, you will like it even more at a discount.

Being aware that risk is present is the key. You don’t have to know exactly how much risk, but you should be able to accurately perceive when risk is rising and when it is declining. Don’t rely on your emotions. Rely on the evidence.

Unfortunately, few actually behave this way in practice. We see time and again investors chasing prices higher because they perceive less risk and fear they might be missing out on a great opportunity. The result is that, oblivious to risk, they buy high. And as prices decline, we see investors throw in the towel because they perceive risk to be rising. With emotions getting the better of them, they sell low. Buying high and selling low is not a successful investment strategy. You do not need to avoid risk. You need to understand and respect that it is always present.

After all, the key to successful investing is to buy low and sell high. These are actually very different things. Rarely does the opportunity to buy low coexist with the opportunity to sell high. Much like with real estate or private equity, there are markets that are more compelling to buy than sell, and others that are more compelling to sell than buy. When there are lots of indiscriminate sellers, it is generally a buyers market, and vice versa. Public equities, or stocks, are no different. Yet for some reason, most investors feel the need to be all in, or all out. We believe otherwise.

What makes valuations compellingly low? Most likely they are low because investors are fleeing. The discipline to buy low means you are likely buying when others are not. Are you willing to be different?

Buying low is often easier said than done. Even if you are willing to do the opposite of what others are doing, there is still a hurdle to clear before you can buy low. You must have the capital to invest at the precise time valuations become compelling. In other words, you must have been willing to sell high, and then have the discipline to protect those proceeds until a use for them comes along. This requires a great deal of discipline, and sometimes patience.

To sell high is not, in our view, market timing. It is purely about reducing exposure to an overvalued asset. Overvalued assets may stay overvalued for some time, but typically not forever. To sell high is to acknowledge that gains have been made to such a degree that they are not likely to be repeated to the same extent going forward. The balance of risk vs. reward is starting to tip toward risk. To our way of thinking, this is the time to reduce exposure to an overvalued company. If it meets our criteria, we want to own it. We just want to own less of it, and we want to do this proactively, before it falls in value.

This willingness to sell when others do not yet perceive the presence of risk can be difficult. But it can also create the liquid capital (cash) required to buy low when the opportunity presents itself. Again, to our way of thinking, this is acknowledging that risk is declining. An attractive business whose price has fallen is now likely more attractive, not less. Having the discipline to wait for these opportunities decreases the impact of risk. Buying low because we sold high means we are putting capital back to work at more compelling valuations. This is not market timing, at least not in our view. This is company-specific risk reduction or risk acceptance. And it is discipline that acknowledges risk without having to quantify it.

There is risk everywhere. To ignore it is folly. To avoid it is potentially missed opportunity. Since the Financial Crisis, investors have been forced to accept risk they might not otherwise have been willing to accept. But when interest rates are zero for riskless assets, by definition we must accept risk if we seek a return greater than zero.

For roughly 13 years, interest rates rewarded borrowers at the expense of savers. Now, in a very short time, that circumstance has dramatically changed. Savers are now being rewarded at the expense of borrowers. And the speed with which this occurred can be very disruptive. We have already seen bank failures because those banks failed to properly manage their risk. There were certainly other circumstances that contributed uniquely to each bank’s downfall, but poor risk management can not be ignored.

These banks failed in the blink of an eye. There was no warning. This was not a slow motion train wreck. This was one day solvent, the next day not. Will there be other bank failures? Possibly, but that seems less likely now than it did a few weeks ago. Will there be other disruptions that we cannot predict? Absolutely!

The point to all of this is simply to remind you that risk is always present, and can manifest itself very, very quickly – sometimes seemingly out of nowhere. No one that I know of forecast bank failures in 2023, a global pandemic in 2020, a financial crisis in 2008 or a horrific terrorist attack on The World Trade Center in 2001. But they all happened.

As investors, we can’t possibly anticipate the curveballs the world will throw at us. But we don’t need to, either. Some people use words like conservative or aggressive to describe investment psychology. Those labels are meaningless to me. Conservative to one may be recklessly aggressive to another.

At Tandem, we believe that worrying about or concerning ourselves with larger global or economic concerns is counterproductive. We find it practically impossible to have conviction about world events, economic forecasts and fiscal or monetary policy. How can we have conviction about something that is completely unpredictable?

For those that make their investment decisions based upon expectation or understanding of big events, good luck. It is quite a challenge to be correct so many times. Instead, we believe it is far easier to have conviction about a company. We believe that math, not human emotion, interpretation, or perhaps even bias, tells a consistent, repeatable, predictable and less volatile story. Follow the math.

Tandem’s discipline, rooted in fundamental, math-based principals that are company specific, allows us, we hope, to be proactive to companies rather than reactive to events. We endeavor to sell high and buy low, proactively. In this way, we respect risk and accept more or less of it as the math dictates. Risk is always present, not just when things go poorly.

Tandem News

There is a lot going on these days at Tandem. Since we last wrote we have celebrated 2 anniversaries and added two new team members.

Our flagship Large Cap Core strategy was incepted on March 31st, 1991. This March represents 32 years of serving investors. We offer our heartfelt thanks and gratitude to all those that have supported Large Cap Core over the years, and we look forward to a bright future. Also on March 31st, our Mid Cap Core strategy turned 13. We have a teenager on our hands, but are very proud of this one. Hopefully those investors using this strategy are pleased.

On February 15th, we welcomed Brett Ballenger to our Investment Operations team as our newest Investment Operations Associate. Brett is a graduate of Hunter College and joins us after many successful years in management in another industry. He decided to follow his heart and begin what we expect to be a long career in financial services with Tandem.

On March 15th, Alex Robinette joined our team as our first Senior Relationship Manager. After working closely with Tandem at one of our partner firms, Alex knows the Tandem story intimately. A graduate of Penn State University, Alex will support and educate our financial advisor partners.

We are thrilled that Brett and Alex have joined our ranks, and hope that you will make them both feel welcome.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

A post-election surge in U.S. stocks drove major equity indices to all-time highs last week. The S&P 500 surpassed 6,000 and logged its 50th record high of the year, while the Dow Jones Industrials Average crossed 44,000 for the first time.

Observations

Major U.S. equity markets experienced some consolidation in October after several months of upward momentum. The S&P 500 broke a streak of five consecutive monthly gains, declining 0.99%.

The Tandem Report

The stock market continued its impressive run in the third quarter—albeit with a small hiccup in early August. The S&P 500 closed 5.5% higher, which brought the year-to-date gain through September to nearly 21%.