Market Commentary— 2022 brought change from 2021. What does 2023 have in store?

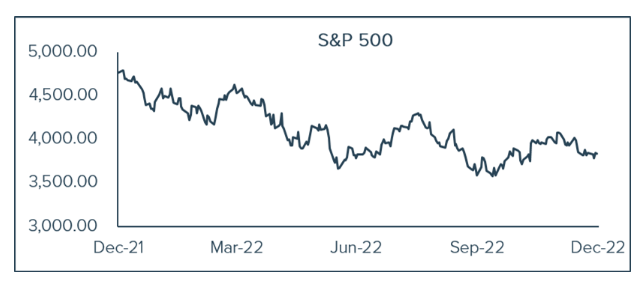

Thankfully, 2022 has come to a close. The severely turbulent year brought an end to the short-lived post-COVID bull market. That short, but mighty, bull market saw the S&P 500 run from its March 23, 2020 low to its January 4th, 2022 high on its way to a nearly 120% gain. After setting its last all-time high, rising rates, volatility, and uncertainty ushered in a market decline.

The end of 2021 and the end of 2022 could not have been more dissimilar. At the end of 2021, the S&P 500 was near all-time highs. Geopolitical tensions were fairly low. The 10-year U.S. Treasury was right around 1.5%. Inflation was climbing but was not yet ringing any alarm bells. And the Federal Reserve was standing pat with rates near zero. By the end of 2022, none of these things were true.

2022 was a complex year in a multitude of ways. Russia invaded Ukraine, sending shockwaves across the world. Inflation hit 40-year highs, and although the peak seems to be in, the rate of inflation remains elevated relative to historical norms. Finally, global growth began to slow, and consensus seems to be that a global recession is either already upon us or right around the corner.

Despite the apparent global slowdown, central banks have continued to raise rates in a concerted effort to tame inflation. As a result of both the central bank action and the rampant inflation, interest rates have soared, which leads to higher borrowing costs for consumers, businesses, and governments alike. Rising interest rates inhibit a consumer’s ability to consume; they impair the profits of corporations that are regular borrowers; they likely don’t cause government to spend any less, but they make it more expensive to do so. Just twelve months ago the 2-year U.S. Treasury was less than 1%. At one point, it was yielding more than 4.80% in 2022. According to the St. Louis Fed, the average 30-year fixed rate mortgage rose from 2.65% to 7.08% by November of 2022.

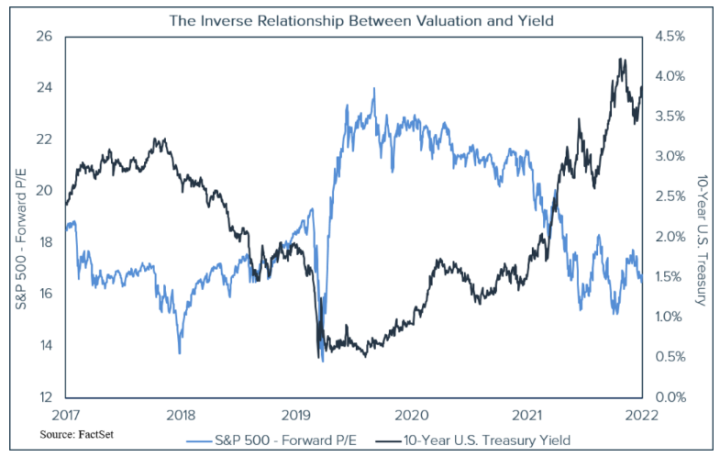

Interest rates tend to share an inverse relationship with valuations of stocks. When interest rates rise, valuations decline. On the other hand, when interest rates fall, valuations tend to rise. In other words, the equity market seems to prefer lower, or at the very least stable, rates. An increase in valuations, all else being equal, will lead to a rise in prices – which as investors, we certainly appreciate! Declining interest rates provide a tailwind for the stock market as the lower rates allow for higher valuations. The same is true of the housing market. Historically, lower rates beget higher housing prices. Higher rates, on the other hand, can lead to a decline in the price of homes while compressing the valuations in the stock market as well. A commonly used valuation metric for stocks is the Price/Earnings (PE) ratio. The chart below illustrates the nearly perfect relationship between the U.S. 10-year Treasury and the Price-to-Earnings Ratio for the S&P 500. Other than the pandemic-induced meltdown in the S&P, when yields are at their lowest, valuations are at their highest, and vice versa.

Rising rates impact other markets as well. Interest rates and bonds share an inverse relationship. When yields rise, bond prices fall. Bonds, usually thought to be a safe haven during periods of stock market weakness, provided no shelter in 2022. This left most investors with no obvious place to seek refuge. In fact, when taking a look at Callan’s Periodic Table of Investment Returns for 2022 (a fun graphic showing the annual performance of various asset classes) one can see that cash was not only the only asset class that produced a positive return, but it was the only one that didn’t produce a double-digit decline.

Cash is certainly useful during periods of market drawdowns. However, the usefulness of cash is found not in holding it during such downturns, but instead in deploying it when opportunities become more plentiful during those downturns. 2022 was an unusually volatile year. But it is during such times of volatility that the ability, or perhaps the willingness, to use cash becomes more impactful. Deploying cash to buy low during the declines and adding to cash by selling high during the subsequent rallies, would have proven fortuitous. For us, that is what active and prudent investment management should be. Buy what ought to be bought when our process says it should be bought. And sell what ought to be sold when our process says it should be sold.

Looking forward, it becomes less clear what 2023 will hold. Would it be surprising to see a strong bounce back following such a weak year? Certainly not. Sentiment is woeful. Generally, sentiment can be viewed as a contrarian indicator. Could further weakness be around the corner? Certainly. Markets don’t often bottom before a recession, and it looks like a recession is likely. Further weakness or volatility in the face of such an environment would not be altogether surprising. What is certain in 2023 is that regardless of market direction, the market can move up, down, or sideways, and we will continue to do what we believe to be prudent – buying stocks when our process says that they should be bought and selling stocks when our process says that they should be sold.

– Ben Carew, CFA

Commentary— Looking backward to move forward

For most investors, 2022 was a challenging year. The struggle to regain some sense of normalcy following a global pandemic took a new twist. Volatility stood the market on its head in 2022. Stock prices fell, interest rates rose, bond prices fell, and cash was the only traditional asset class that provided a positive rate of return for the year. Most non-traditional assets fared poorly too. Despite an overwhelming desire for it, normalcy may take longer to find than we wish.

The rise in stock prices from the depths of the pandemic-induced decline were as impressive as we have seen in some time. According to Ben Carew in this issue’s Market Commentary, the S&P advanced nearly 120% from low to high. That’s not normal, yet few complained in the moment. The market’s decline from its high has been far less dramatic, yet it has been accompanied by much handwringing. I have heard countless complaints about losing money in 2022. I suppose this is true, but unless you began investing in January 2022, you probably have not lost any money. Let’s have perspective.

It is true that the S&P 500 (including dividends) was down 18.11% for the year. However, despite last year’s decline, the 3-year annualized rate of return for the S&P is 7.66%, the 5-year annualized return is 9.42%, and the 10-year annualized return is an eye-popping 12.56%. These rates of return remain near or above historical norms, but they are approaching normalcy. By comparison, at the end of 2021, the 3-, 5-, and 10-year annualized returns were 26.07%, 18.47%, and 16.55% respectively. These returns were far from normal, yet they were accepted by most without question or concern.

As ex-Redskin head coach Steve Spurrier once said, “hindsight is 50-50”. With the benefit of that hindsight, it’s easy to say now that the rates of return the market had been producing were unsustainable. But in the moment, few had the audacity to openly discuss the inherent risk in stock valuations. We did. And not only did we discuss the risk, but we also reduced our exposure to it.

In the fall of 2021, the S&P was near all-time highs, interest rates were near zero, inflation was only a rumor, and the Federal Reserve hadn’t raised rates since 2018. All was right in the world for investors, and risk was widely viewed to be minimal. And Tandem had unusually high levels of cash in our portfolios as the market was setting new records. Why? Because we actually practice the discipline of buying low and selling high. In 2021, by following our time-tested investment methodology, we simply had more stocks to sell than buy. We were not making a market call, we were not allocating to cash, and we did not have a view of the market that influenced our decision-making. We simply had more companies to sell than to buy, so cash levels rose. We were reducing risk. This was quite a contrarian position to take.

By year-end 2022, the S&P was well below its all-time high, interest rates were higher than they had been in more than a decade, inflation had set a record, and the Federal Reserve raised rates 7 times, taking the Fed Funds target rate from 0.00% – 0.25% all the way to 4.25% – 4.50%. This marked one of the steepest rate hikes in history, and the world was recognizing a very different reality. The amount of cash in our portfolios declined significantly, even though most perceived risk to be greater. Why? Opportunity was abundant and we were able to put capital to work at valuations that were finally compelling. We were buying low. We had more things to buy than sell, and cash levels declined.

Too often, investors fall victim to recency bias. If something is working, the belief is that it will continue to work. Similarly, if something isn’t working it must be abandoned. At Tandem, we believe in looking backward to move forward. Our logo (recently trade trademarked) is the perfect illustration of this. But in looking backward, we must look beyond recent to gain a fuller understanding of what is possible.

A common mistake among investors is to assume that investment performance last year is likely to be replicated again this year. This “buy the winner” mentality is understandable, but stock price performance is not, in our view, what we should be observing. Companies cannot control their stock price performance in the short run. Some can, however, control the things that lead to business success. When this occurs, stock price appreciation is more likely to follow in a consistent, sustained manner.

Our discipline is designed to reduce risk by reducing volatility, while delivering a consistent, repeatable experience. We believe that volatility is the enemy of most investors because it tempts us to do the wrong thing at the wrong time. When we see the market going ever higher, we want in, and we risk buying high. When we see the market going lower, the temptation is to assume that risk is rising and to get out. This can lead to selling low. Buying high and selling low is not a winning formula.

In order to reduce the volatility of the portfolio, we must reduce volatile components within the portfolio. We attempt to identify businesses with a sustained history of growth, through any economic environment. Businesses that are better able to control their own destiny are more likely to be less volatile.

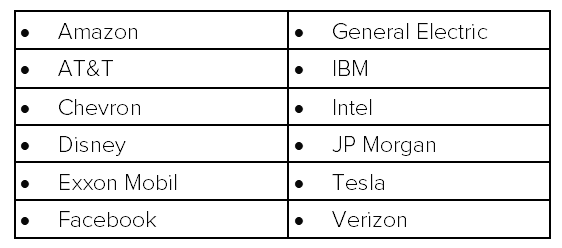

Growth through any economic environment is a tall order, and not many companies can meet this demanding criteria. In fact, many companies that most would consider to be blue chip, whatever that means, fail to meet our criteria, and are therefore not included in our portfolios. A sampling of such companies that we exclude is:

Our companies have demonstrated the ability to grow earnings, revenue, and cash flow consistently over time, regardless of the economic environment. Every name we own in our portfolios is listed on the next page. Every one of these has met this criteria, and if they pay a dividend, that has grown as well. Every holding in our Large Cap Core portfolio pays, and grows, a dividend.

I sincerely hope that Tandem continues to meet your expectations. Hopefully, we have done what we said we would do – deliver a more consistent, repeatable, less volatile experience. In times of uncertainty, consistency can provide comfort. Yet in a chaotic world, consistency can prove elusive. I believe that Tandem provides consistency, at least in terms of the investment experience it delivers, by looking backward to move forward.

– JBC

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

The Tandem Report

With 2024 now in the books, it was certainly another good year for the S&P 500. The index gained more than 20% for the second consecutive year and the third time in the past four years.

Notes from the Trading Desk

U.S. stocks have stumbled out of the gate to start 2025, with the S&P 500 and Nasdaq both registering back-to-back weekly losses in the first two weeks of the year. The S&P 500 declined 1.94% last week, its fourth weekly decline in...

Observations

December painted a mixed picture across U.S. financial markets with varied performance among major indices. The S&P 500 declined by 2.50%, while the small-cap Russell 2000 suffered a sharp 8.40% loss and nearly gave back all of November’s huge gains.