Market Commentary— The Fantastic Five

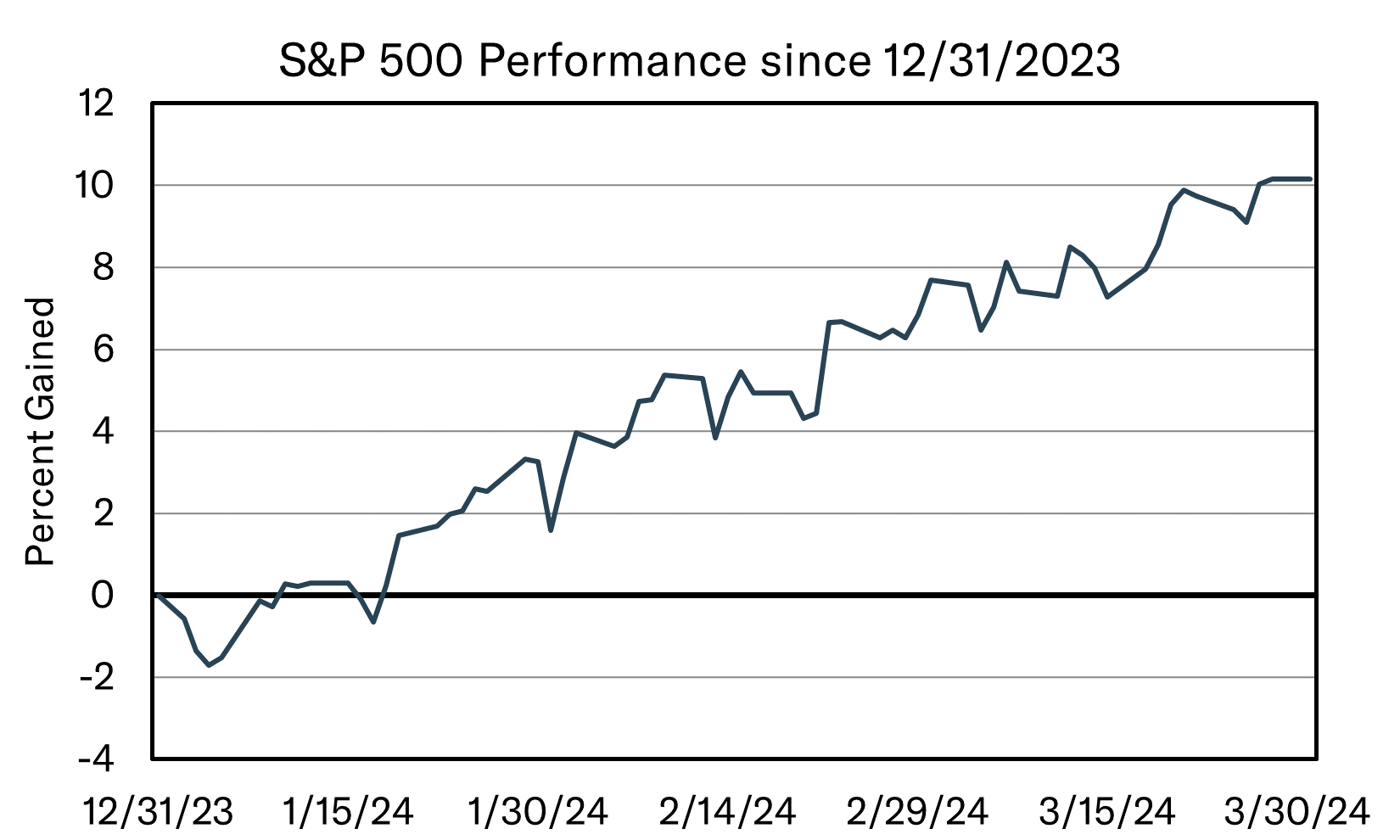

Rising more than 10% since the end of 2023, the S&P 500 is off to its best start since 2019. The path of least resistance has been higher on the backs of AI, the diminishing likelihood of a recession, and the strength of just a few stocks. Throughout 2023, we discussed the Magnificent Seven’s captivation of the market. Seven companies (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) seemingly garnered most of the headlines and generated much of the market’s gain. Well, three of the seven are off to a bit of a slower start this year, which means that we have been left with what The Wall Street Journal called the Fantastic Four – Nvidia, Meta, Microsoft and Amazon. I would likely add Eli Lilly to the mix to create the Fantastic Five instead. Those five stocks contributed nearly 50% of the market’s gain in the first quarter.

Source: FactSet

If someone had told me ahead of time that Apple would be down to start the year, I likely would have guessed (incorrectly!) that the market would also be down. If they had thrown in that yields would also be up substantially, I would have guessed even more confidently (and I would have been incorrect again!) that the market would be down. That’s a credit to how important Apple has been to the broader market and how much of a driver yields have been over the past few years.

Tim Cook and Apple have been kicked to the curb though because investors have eyes for one company and one company only, Nvidia! According to The Wall Street Journal and VandaTrack, Nvidia has become the largest average holding in individual investors’ portfolios at about 9%. The chipmaker had the best quarter of all the S&P 500 constituents (that were in the index for the entire quarter) as its stock appreciated more than 80% over the past three months. The push higher has been thanks in large part to an insatiable demand for the computing power that is required for AI that is fueled in part by Nvidia’s chips.

Over the past few years, the stock market and yields have shared a very strong inverse correlation, as discussed in last quarter’s market commentary. When interest rates moved higher, stocks seemed to move lower. The opposite was also true – as interest rates fell, stocks seemed to rally. In other words, falling or low interest rates were a boon for stock market investors during a strong year like 2021, whereas interest rates created a much more tumultuous market in 2022. This year, the correlation between interest rates and asset prices has further deteriorated. In fact, the stock market has risen despite the rise in yields. Coming into this year, the 10-year U.S. Treasury was yielding less than 4%. At the time of writing, that yield had climbed close to 4.6%. Historically, those sorts of moves would generate headwinds that would be difficult for the stock market to overcome. Yet, when looking at the major indices, it’s clear that was not the case in the first quarter.

Part of the strong rally over the past 6 months can be chalked up to the belief that the Federal Reserve would be cutting rates. In turn, lower yields would be a boon for asset prices. Thus, the stock market was rising in part because of the expectation that the Federal Reserve would be cutting this year. Coming into 2024, the Federal Reserve indicated that they would likely cut three times during the year. The market didn’t believe it, and instead indicated its belief that the Fed could cut six or even seven times. This belief, which started in Q4 of 2023, led to the dramatic decline in yields towards the end of last year. Throughout Q1, the Fed continued to maintain that they would cut three times and gradually the market got with it. As a result, yields moved higher once more as the market’s expectation for cuts came in line with the Fed’s own expectations.

Now the market is changing its tune again. This time, the pendulum has swung in the opposite direction. A number of recent economic data points have indicated that perhaps inflation is not as tamed as we were once led to believe. As a result, the Fed’s fight against inflation may not be over. Presently, the market is pricing in two rate cuts, with about a 50/50 chance for a third. However, some economists have begun to discuss rate hikes once more. We even discussed this possibility on our podcast Tandem Talk. The market’s reaction has caused yields to rise again recently and has arguably caused a bit of volatility since the end of the first quarter.

Another part of the stock market’s ability to overcome rising yields is due to how concentrated the market has become. The S&P 500 has arguably become more concentrated than during any period since the late 1920s. According to a recent Bloomberg article, which cited Kenneth French and Deutsche Bank, the top 10% of names in the stock market now account for nearly three-quarters of the total market’s size. Looking at it in a slightly different way, the top 10 companies now make up 1/3 of the market’s total value, which is the largest weighting in at least 44 years. Bringing it full circle, the market is being driven by just a few names while the average stock is not experiencing nearly the same appreciation as the headlines would indicate. It’s the performance of just a mighty few that is lifting the market higher.

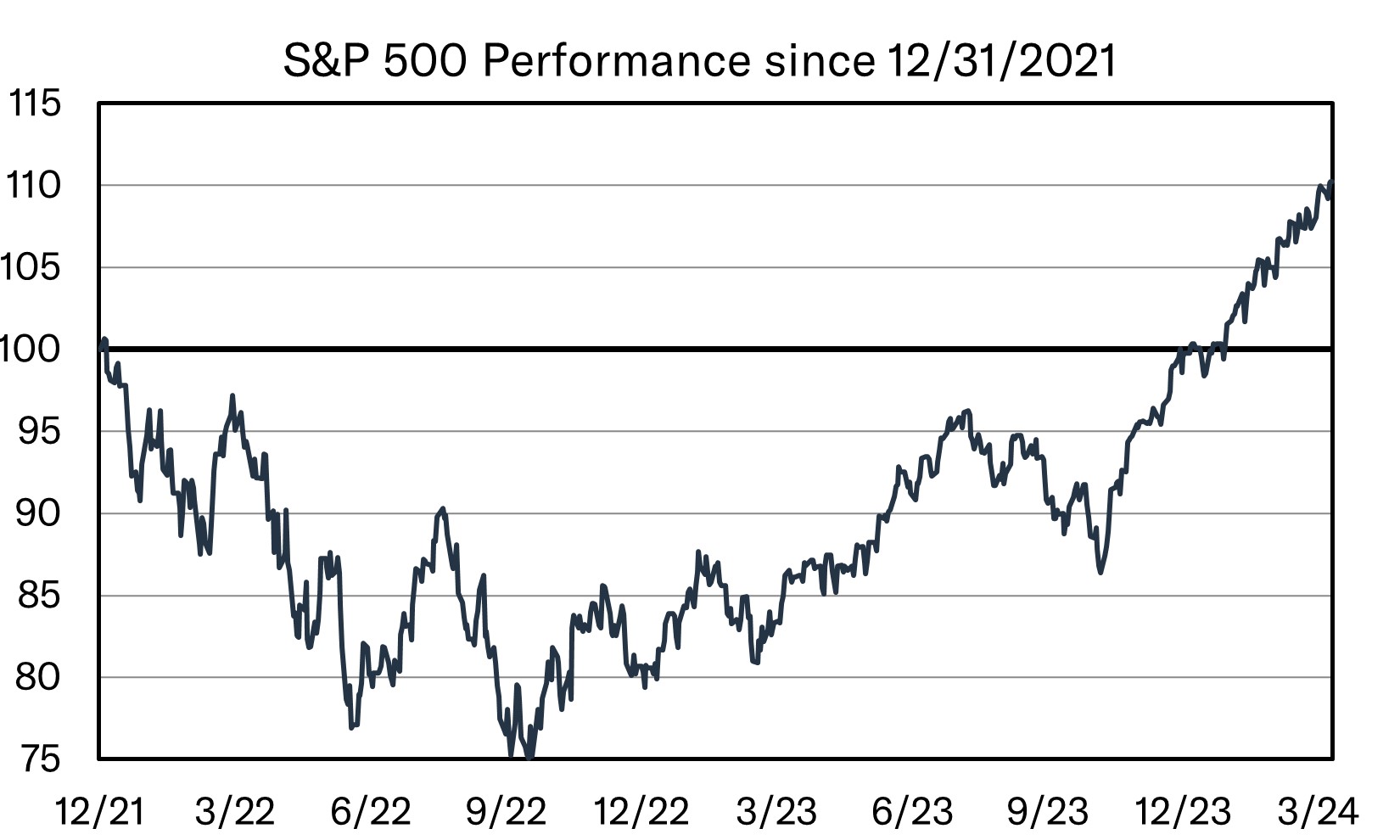

It would be ideal to see a market that broadens out and sees wider participation than that which we are currently experiencing. It would also be ideal to see yields stop rising and to see inflation continue to move lower. Time will tell if we get those or not. In the meantime, it’s important to put the recent strength of the S&P 500 into context. Yes, it’s up 10% to start off the year. However, it’s also up just 10+% since the end of 2021. For two years, the broader market essentially went nowhere.

Source: FactSet

It’s also worth remembering that at Tandem we are not invested “in the market”. We invest in individual companies that have displayed the ability to grow through different economic environments. Occasionally these stocks will fall out of favor as the market becomes enamored with some new shiny thing. Recently it has been AI. In 2021 it was tech stocks or energy stocks. In 2017 it was cryptocurrencies and betting that volatility would not re-enter the marketplace. There are always some perpetually shifting but overarching thematic trends that seem to drive markets. We are trend agnostic. We are theme agnostic. We are market agnostic. We simply look for companies that can grow regardless of where we find ourselves in the economic cycle. By investing in companies that can hopefully continue to grow, we believe we will do well over time.

Commentary— 33 Years Later, a Business Plan Revisited

Our Large Cap Core strategy just celebrated its 33rd birthday, which means it has seen plenty of different markets. Some markets have been favorable for us, while others have not been. Some markets have roared higher, while others have seemingly been in a never-ending descent. Some markets have moved quickly, while others have taken their time. Regardless of market type, Large Cap Core has survived each and every one to fight another day.

Recently, we were reminiscing over the past 33 years here at Tandem and we stumbled upon something that predates even Large Cap Core – John’s original business plan. Reading it humanized the growth of Tandem – its trials and tribulations. It certainly wasn’t always easy, and it took time to build what and who Tandem is today – thanks largely to the trust that you, our clients, have put in us. Reading through John’s business plan made me a proud son and a proud shareholder of Tandem. It’s a Field of Dreams business model – if you build it, hopefully they will come. We’ve often discussed how Tandem strives to excel at this one thing that we do and how we do not try to be all things for all people. And it struck me, more than anything else in the business plan, how consistent our message has been since our founding in 1990.

While Tandem was still just an idea, John wrote “We are conservative, which is an over-used word in the investment industry. We use it to highlight our two goals for every account: 1) Protect assets during market downturns and 2) Seek prudent growth of portfolio wealth over a complete market cycle.”

Nearly 34 years later, those goals still ring true today. It is not our goal to beat “the market” each and every day, month, quarter, or even year (which we do not do). It’s not our goal to be the largest and most renowned asset manager (which we are far from being). It’s not our goal to be on CNBC or to be quoted in the Wall Street Journal (which we are not). It is our goal to protect and grow the wealth of those who have entrusted us to do so, and to do that over complete market cycles. We strive to be a manager for all of the different markets we mentioned above – not just the ones roaring higher or the ones that spiral lower. By doing so, and by managing money this way, we hope to keep our clients invested and give them peace of mind to stay the course. Because we believe staying invested is key.

As we have discussed in previous TANDEM Reports, staying invested does not, however, mean all in at all times. Staying invested does not mean owning everything under the sun. It means controlling risk and being prudent when taking risk – adding risk when it makes sense to do so, and taking risk off the table when it’s sensible to do so. Our methodology requires us to own companies that can consistently grow through all sorts of economic periods – good times and bad. We require not just profitability, but consistent profitability. We require consistent growth of sales – not perfect growth, just consistent growth. We require that if a dividend is paid, it continues to not only be paid, but grow consistently over time as well. These requisites eliminate a lot of terrific investments. But, we believe that these requirements allow us to find investment opportunities that are more likely to reward patient shareholders and that it will allow us to protect and grow your capital over complete market cycles.

Sometimes that patience is easier to come by than others, and the past 18 months have perhaps been more trying. The market has been led higher by a space, and more specifically, a few names, that we do not own, nor could we own if we even wanted to. For the most part, the recent market leaders simply do not meet our criteria, and for those that do, we would struggle to own them in a similar weighting. We do not have nearly the same concentration, and thereby the risk (and recently the market’s reward) of being so concentrated.

Since the S&P 500 bottomed in October 2022, it has thundered higher by nearly 47%. The party has been great! However, the revelers have just been a few. Roughly half of that gain has been generated by just 9 companies – Nvidia, Microsoft, Meta, Apple, Amazon, Broadcom, Eli Lilly, Alphabet, and JPMorgan have been the life of this party. The ~50% gain seen in the broader market over the past 18 months is unusually strong. It is only matched by times like the late 90s (which was a prelude to the popping of the Dotcom Bubble), late 2021 (which was a poor time to be getting in), 2004 and 2010 (which followed the runups from the massive market bottoms formed following the bursting of the aforementioned Tech Bubble and the Financial Crisis). So, which is it? Are we in a bubble, or coming out of a massive bottom like we saw in 2004 and 2010?

Could the answer be both? This market certainly shares hallmarks of both. First, the most obvious is that the market advances over the past 18 months are coming on the backs of a rough and tumultuous 2022 for the broader market. Surely that is akin to those markets of 2004 and 2010– though it would be a little hyperbolic to compare 2022 to the three-year bear market that followed the bursting of the Tech Bubble or the near financial calamity that stemmed from the Financial Crisis. However, in September of 2010, the market’s 60+% return generated over its previous 18 months was incredibly broad. The top ten names accounted for less than 20% of the total gain. Everyone was partying! Similarly, by April of 2004, the market rose nearly 50% off of its October 2002 lows. The top ten names accounted for less than ¼ of the market’s gain. Remember, of late roughly ½ of the market’s rally has been generated by just 9 companies. In ’99, approximately 44% of the gain generated over its previous 18 months was attributed to the top ten names. In late ’21, more than 1/3 of the gain was attributable to 10 companies over a similar time period. So, the narrowness of today’s market is not encouraging and is perhaps more similar to times where it was prudent to be taking on less risk.

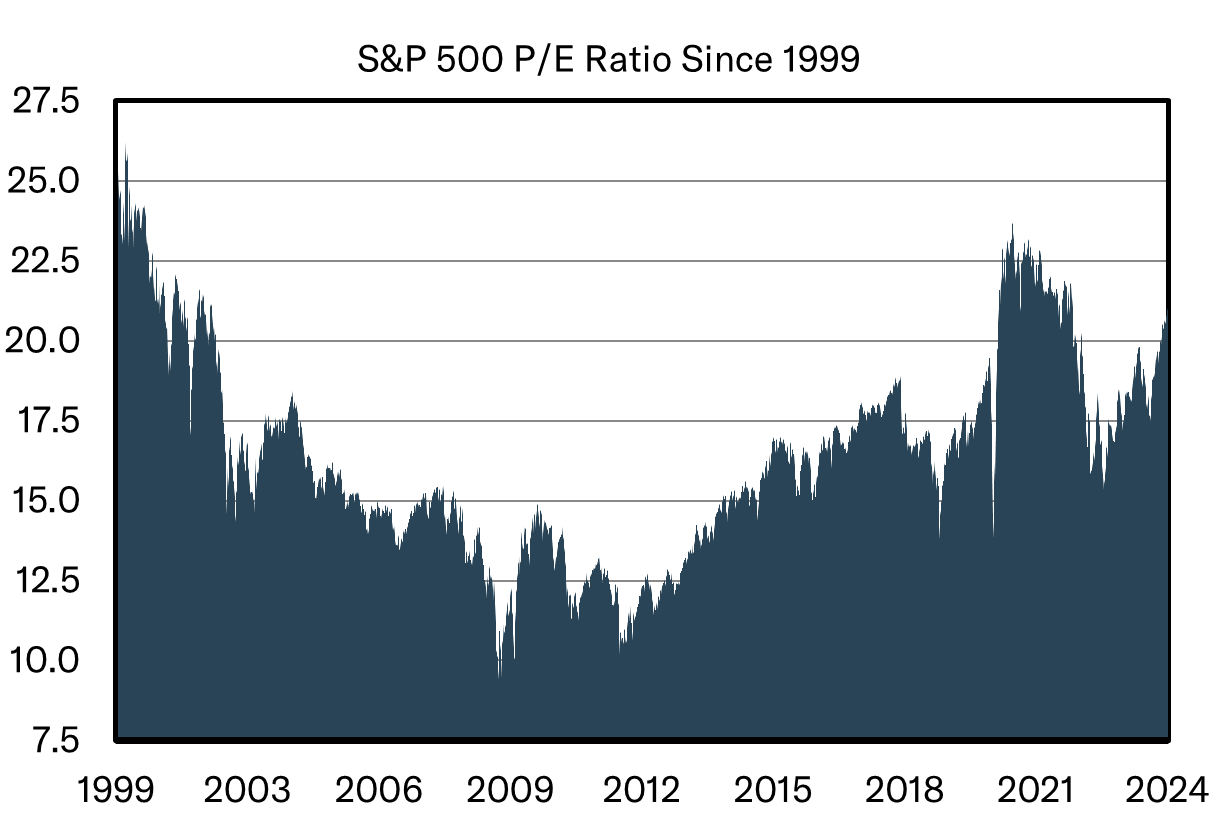

From a valuation perspective, there is more commonality between 1999, 2021, and today than there is between today, 2004 and 2010. One common and simple way to judge the valuation of a stock is using a Price-to-Earnings Ratio, or a P/E Ratio. A P/E ratio is just the price of the stock divided by a company’s earnings per share. It aims to tell you how much one is paying for a stock per unit of profitability. The higher the P/E ratio, the more you are paying for each dollar of earnings, and vice versa. In other words, a higher P/E ratio typically will indicate that something is expensive, while a lower P/E ratio will indicate that something is relatively cheap. Well, coming out of the Financial Crisis, and following the bursting of the Tech Bubble, P/E ratios were a bit more subdued. In those instances, P/E ratios were in the mid-teens or low double digits. Today, we find ourselves with a market whose P/E ratio is north of 20x. The only more expensive times than today were 2021 and 1999. Not great company.

Source: FactSet

Now, a P/E Ratio should not be used as one’s sole means to attempt to time a market. As an aside, it’s my opinion that trying to time a market is foolhardy. That’s not what we do here at Tandem. A P/E ratio can be a pretty decent indicator of value. Today’s narrowly led and perhaps overvalued market leaves something to be desired. That doesn’t mean the party has to end. In fact, the party could continue to rage on for quite a while. It would be healthy to see broader participation in the rally and more contribution from the rest of the stock market. Otherwise, we run the risk of discussing the S&P 1 that is composed of Nvidia and Nvidia only this time next year. Should the market continue to narrow or should the market become even more expensive, then perhaps it would be prudent to consider the risk one is taking to generate their returns.

Naturally, some investors have become concerned that they are missing out on gains. We would ascribe this to FOMO, or the Fear of Missing Out. But we are not here to beat every market. We are here to protect and grow your capital over complete market cycles while practicing the discipline of paying prices, or taking prices when selling, that we think are reasonable to pay/take. Sometimes that will mean cash levels will build in the portfolio. Other times, cash will be spent down in the portfolio. Sometimes there will be very little to buy or sell and little action is taken at all! Never will we invest your money for the sake of being invested. Instead, we invest to produce solid returns over complete market cycles. That’s it. We aren’t running a race against others or even against the market. Maybe it’s because I am writing this as the first golfers are heading out at Augusta, but we are more like golfers that are simply playing against the course that presents itself.

Regardless, it can be frustrating to underperform relative to the market when it results from not owning the names that are taking the market higher. And I’d be the first to admit that it would have been fun to own Nvidia over the past year and a half. However, if the goal is to protect and prudently grow one’s portfolio, it might mean that we don’t always participate in the party quite to the same extent. Hopefully that means we don’t have quite the same hangover though following the party’s inevitable end. Perhaps by sticking to our discipline, Large Cap Core and Tandem will be here to celebrate another 33 years of navigating markets.

Tandem News

Tandem has grown once more. On February 15th, Sam Edwards joined our team as an Associate on our Distribution team. Sam’s duties include advisor relations and helping support our financial advisor partners. Sam graduated from the University of Alabama with a Bachelor of Science in Commerce and Business Administration and a specialization in Investment Management. Prior to working at Tandem, Sam worked in wealth management in Mobile, Alabama as an associate and an advisor. When not in the office, Sam enjoys playing guitar, golfing, running, fishing and spending time with his family.

On March 25th, Jeremy Cox joined the Tandem team as our Chief Distribution Officer. Jeremy will help expand the reach of (what we believe to be) our common-sense approach to investing to more firms, advisors, and clients. Prior to joining Tandem, Jeremy spent 22 years at Truist and its predecessor company, BB&T Scott & Stringfellow, where he held various leadership and product management positions. When not in the office, Jeremy enjoys exercising, traveling, and supporting both the academic and athletic pursuits of his daughter and son.

Please join us in welcoming Sam Edwards and Jeremy Cox to the team!

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

The Tandem Report

With 2024 now in the books, it was certainly another good year for the S&P 500. The index gained more than 20% for the second consecutive year and the third time in the past four years.

Notes from the Trading Desk

U.S. stocks have stumbled out of the gate to start 2025, with the S&P 500 and Nasdaq both registering back-to-back weekly losses in the first two weeks of the year. The S&P 500 declined 1.94% last week, its fourth weekly decline in...

Observations

December painted a mixed picture across U.S. financial markets with varied performance among major indices. The S&P 500 declined by 2.50%, while the small-cap Russell 2000 suffered a sharp 8.40% loss and nearly gave back all of November’s huge gains.