Market Commentary— Does a bumpy start portend a rough year, or an opportunity?

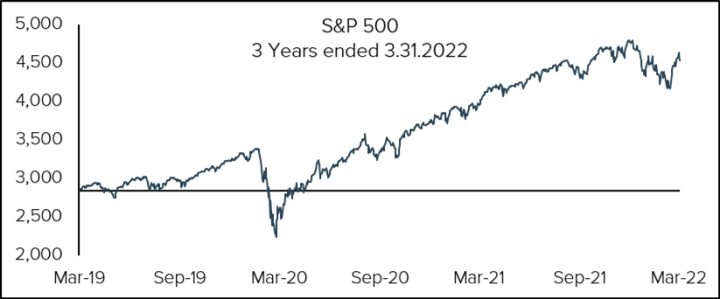

U.S. equities broke their quarterly winning streak, declining for the first time since the depths of the pandemic. The S&P 500 notched its first quarterly setback since Q1 2020. The S&P posted a quarterly decrease of -4.95%, while the tech-heavy Nasdaq fell -9.10% during the quarter as growth meaningfully underperformed value in the face of higher interest rates and a more hawkish Federal Reserve. While market declines are rarely admired, the resiliency of the U.S. equity market amidst the whirlwind of negative data and frantic headlines may warrant the slightest pat on the back. Upended global supply chains, 40-year high Inflation data, yield curve inversions, surging energy prices, war on continental Europe—and in the face of all this the S&P 500 closed out the quarter just outside of 5% from all-time highs. Truly remarkable.

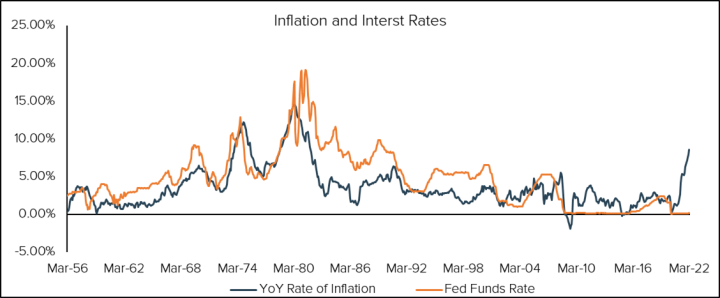

One of the largest developments of the year thus far has been the shift in policy stance from the Federal Reserve and the market’s subsequent repricing of the future path of interest rates. The Federal Reserve conducts monetary policy operations to achieve two primary goals: maximum employment and price stability. March’s employment report from the Bureau of Labor Statistics showed continued strength in the labor market, with the unemployment rate falling to 3.6% and the number of unemployed declining to 6 million. These figures differ little from their values in February 2020 prior to COVID-induced lockdowns. With the U.S. economy nearing full employment and the belief of inflation being “transitory” laid to rest by Fed Chairman Jerome Powell last November, Fed policy has taken a clear and definitive shift toward reining in rampant price increases throughout the economy.

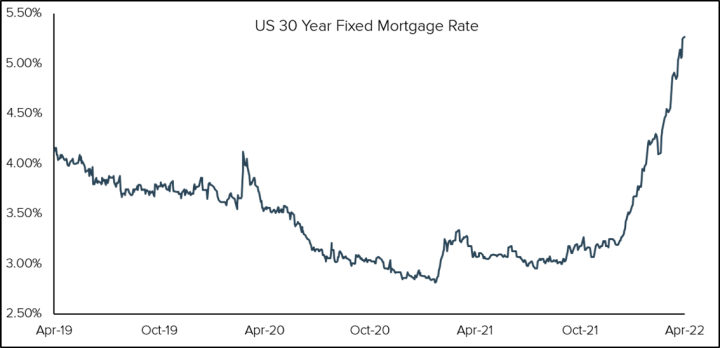

Expectations of a more aggressive unwinding of the Fed’s massive balance sheet mixed with substantial hikes in interest rates this year sparked a remarkable runup in bond yields during the first quarter. A sharp selloff in Treasuries drove yields across the curve to multi-year highs. You will recall that bond prices and bond yields move in opposite directions. In the past, Treasuries have provided relief during periods of stock market volatility given their negative correlation with equity prices. This relationship has certainly broken down over the past few months. In fact, Treasuries suffered one of their worst quarters on record. Elsewhere in the rate market, mortgage rates logged their fastest three-month increase since 1987. The average rate on a 30-year fixed mortgage surpassed 5% for the first time in over a decade. Rising financing costs along with higher home prices are a one-two-punch for first-time buyers. The housing market has remained tight despite these factors as record low housing supply and favorable demographics underpin demand.

Unless you’ve been living under a rock for the past year, you’ve likely noticed the cost for seemingly everything has been on the rise. Prices of commodities like oil, metals, grains, coffee, and cotton are climbing at their fastest rate in decades. Oil prices briefly surpassed $130 a barrel at the start of March amid geopolitical tensions around the Russia/Ukraine conflict. As a result, the national average for regular gas swelled to over $4.30 a gallon. Prices even topped $6 a gallon in some states. When energy prices rise too far too fast, a chain reaction begins to ripple its way through other sectors of the economy. Take this short example: An increase in natural gas prices results in higher costs to produce ammonia, a primary component of fertilizer. Higher fertilizer prices in turn increases the cost for farmers to grow crops, like coffee and grain. And higher coffee and grain prices likely means a few extra bucks tacked on to your weekly grocery bill or Starbucks order. Nearly all goods and services are impacted in some shape or form by higher energy prices.

It’s been a bumpy start to 2022—though it’s worth noting that weakness in the early months of a midterm election year is quite normal for markets. As Summer approaches, we will see how the unrelenting game of tug o’ war between the bulls and the bears continues to play out!

Commentary— Inflation is here. Now what?

Inflation is here, and it is making its presence known. Those of us with gray and/or less hair may remember what inflation is like, but for most, this is new stuff. The cost of everything is going up. Rent, groceries, gas, and used cars are rising at a rate not seen in decades, if ever. Inflation as a whole is increasing at the fastest annual rate in over 40 years, and it is costing us all. This isn’t a red vs. blue, politically divisive issue. Inflation is present, and it is costly. There can be no debating these facts.

The biggest problem with inflation is that once it takes hold, it is tough to get rid of. Why, you ask? It’s really quite simple. The definition of inflation is too much money chasing too few goods and services. If you expect inflation to be present, then you change your behavior. There is little incentive to wait to buy something if the price is likely to rise, so you buy it now. Once we all begin to behave this way, there is too much money chasing too few goods and services because we are all buying sooner or more than we otherwise would. It is very much like toilet paper during a pandemic.

Think about price in relation to supply and demand. If there are 100 widgets available, and 100 people each want one, price is stable because supply and demand are in harmony. But if 100 people now demand 2 widgets each, and there are still only 100 widgets, price is no longer stable as demand exceeds available supply. In a free market, how do the widgets get allocated? Ultimately they will go to the highest bidders. The pervasive expectation of inflation actually begets inflation. It is a self-fulfilling prophecy. And how then do we actually break the expectation? Herein lies the challenge.

After the Financial Crisis, the Federal Reserve and other central banks took actions that flooded global financial markets with lots of liquidity. While their intentions were no doubt noble, and some would argue both necessary and effective, those actions were not without consequence. There was too much money chasing too few financial assets. Stocks, bonds, real estate, collectibles, cryptocurrencies, and any other asset you might name benefitted tremendously from this asset-price inflation. Over time, investors began to expect this inflation in asset prices to persist, so they bought more in anticipation of prices being higher in the future. Expectation changed behavior, which resulted in increased demand, followed by increased prices. How will this behavior come to end? By changing investor expectations. A dramatic change in Federal Reserve policy is likely necessary.

Staying with the post Financial Crisis asset-price inflation for a moment more, the Fed has already indicated its intention to change its policy. Many investors have taken them at their word and stock prices have stumbled out of the gate so far this year. The challenge for the Fed will come when they are tested. If markets fall too far, will the Fed stay true to its new anti-inflation policies, or will it cave and go back to its old policies once the going gets rough? In order to prove that the Fed is now ready to combat inflation, they must absolutely be willing to risk causing, or at least contributing to, a recession. Markets will certainly test the Fed’s mettle. How it responds will determine investor expectations in the long run.

It is interesting to note that the Fed’s stimulus had no impact on prices beyond financial assets. They actually hoped to stimulate inflation, but they failed miserably. It seems their stimulus did not find its way into the hands of those without financial assets. In other words, the average person did not have too much money chasing too few goods as a result of the Fed. Not until Congress and two Administrations began pumping money into the system did the non-investor class experience inflation.

Asset-price inflation is rewarding to those fortunate enough to own assets. It also creates a tremendous wealth gap between those with assets and those without. Traditional inflation is rewarding to no one. It is particularly cruel to those with a fixed income, as rising prices erode purchasing power. Inflation is a tax with no beneficiary of the tax. Well, a cynic might say that there is a beneficiary – the Federal Government. It seems that inflation decreases the burden of debt to the borrower, and our government is a large and frequent borrower.

It seems clear then that monetary policy (the Fed) did not succeed in causing inflation, while fiscal policy (the Government) has. In the 1970s and 1980s the Federal Reserve aggressively raised interest rates to “break the back of inflation”, as it was said at the time. The present-day Fed seems to be of the opinion that this playbook will work again. Suppose that it doesn’t.

Before we consider the consequences if this policy doesn’t work, it is important to examine why it worked in the past. In the 1970s, consumer debt began to really take off. Credit cards were a relatively new thing and they were still a growth industry as the use of plastic spread throughout consumer land. In fact, consumers were even rewarded for using credit because the interest paid to credit card companies was a tax deduction! Can you imagine? Now that is an incentive to spend on credit if ever there was one.

With expanding purchasing power, consumers had too much money chasing too few goods. To be clear, there were other equally important reasons for inflation, including fiscal policy. But the consumer’s behavior was a key driver at the time.

If we fast-forward to today, the consumer looks very different. As we emerged from the Financial Crisis, we tended to pay down our debt. We learned a lesson about borrowing, and we collectively began to change our behavior. Zero interest rates did not cause us to run up the balance on our credit cards. It may have caused us to borrow to buy houses and stocks, but not consumer goods. Consumer use of credit changed post financial crises.

Government and corporate use of credit, in the form of direct borrowing, also changed, but in a very different way. The amount of debt on government and corporate balance sheets exploded during this period of zero interest rates. If the Fed reverses course and begins a period of meaningful rate hikes, it won’t impact the consumer’s behavior radically. We are already not borrowing to purchase consumer goods and services to the extent we once did. Therefore, the Fed won’t slow us down. But higher rates will certainly effect the cost of borrowing for governments and corporations. Government deficits will rise while corporate profits will shrink and defaults will increase. And so it would seem that raising rates, in and of itself, will certainly have an economic impact, but not the one it had in the 1970s.

The Fed alone will not be able to curb excess demand when there really isn’t any. It will not be able to increase supply either. Unlike past inflationary periods, much of today’s price increases are due more to supply shortages than to increased demand. Certainly fiscal policy has put money into consumers’ hands, but the pandemic caused serious supply issues that have led to short supply of a lot of goods. Decreased supply has the same effect on prices as rising demand. That is to say when there are too few goods for present demand, in order to decrease demand, prices must rise. This is supply-driven inflation as opposed to the more traditional demand-driven inflation.

If excessive consumer demand isn’t the root cause of our current inflation, rising interest rates will likely have less impact today than in past inflationary cycles. Rising rates will also have little to no impact on supply. Therefore we must ask if the Fed is capable of successfully combating inflation this time. It seems unlikely. At least not without help. There would also need to be change in fiscal policy, tax policy and government action to incentivize desired behavior. This is much bigger than the Fed alone.

Absent political will to seriously rein in the excesses, more than likely, in its stare down with the economy and markets, the Fed will blink. Those predicting as many as 7 interest rate hikes this year may be right, but it is hard to imagine this Fed, given all that we have discussed, will intentionally sink the economy by its own hand. There might be 7 rate changes this year. It just seems unlikely they will all be hikes. Afterall, recessions can cure persistent inflation as well.

The Fed is indeed capable of causing a recession. It’s zero interest policy has been in place for more than a decade. It’s impact cannot be reversed in short order without collateral damage. To engineer a soft landing for our economy, the Fed will need help. Anyone here optimistic Washington will rise to the occasion?

There is certainly a lot to consider, but the road to investment success is rarely a smooth one. Yet, as the chart at the bottom of page 3 clearly illustrates, stocks go higher over time. Do not let the noise force you to make emotional decisions. Stay the course. Stay invested. We will try to limit the risk within your portfolio.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

The Tandem Report

With 2024 now in the books, it was certainly another good year for the S&P 500. The index gained more than 20% for the second consecutive year and the third time in the past four years.

Notes from the Trading Desk

U.S. stocks have stumbled out of the gate to start 2025, with the S&P 500 and Nasdaq both registering back-to-back weekly losses in the first two weeks of the year. The S&P 500 declined 1.94% last week, its fourth weekly decline in...

Observations

December painted a mixed picture across U.S. financial markets with varied performance among major indices. The S&P 500 declined by 2.50%, while the small-cap Russell 2000 suffered a sharp 8.40% loss and nearly gave back all of November’s huge gains.