Financial Markets Review

Major U.S. equity markets experienced some consolidation in October after several months of upward momentum. The S&P 500 broke a streak of five consecutive monthly gains, declining 0.99%. The Nasdaq finished lower for the first time in three months, dropping 0.52%, while the small cap Russell 2000 fared the worst with a 1.49% decline, which also marked the third straight month the Russell has underperformed the S&P 500.

The headline event for October was the sharp selloff in Treasuries, marking the most significant monthly rise in yields since September 2022. Treasury yields surged across the curve, with the 2-year Treasury yield rising over 50 basis points, now above 4.15%, and the 10-year yield climbing nearly 50 basis points to approach 4.30%. The most surprising aspect of the rise in yields was that it followed a 50 basis point rate cut by the Federal Reserve. Historically, yields across the curve fall as the Fed commences a rate cutting cycle, signaling their efforts to stem a weakening economy. However, an ongoing debate about the debt and deficit trajectory, along with a string of positive economic data releases reinforcing a potential “soft-landing”, contributed to the sharp spike in Treasury yields this past month.

Despite the surge in Treasury yields, equities managed to hold relatively steady. The S&P 500’s modest decline underscores the resiliency of the market in the face of the shifting U.S. political landscape and constant geopolitical tensions. Much of the resilience can be chalked up to the stronger than expected economic backdrop and continued strength in corporate earnings. As October came to a close, nearly 70% of the S&P 500 constituents had reported Q3 results that had come in better than expected. At the start of the quarter, analysts were calling for the S&P 500 Q3 earnings to grow at a 4.3% year-over-year clip. And so far, earnings growth is tracking a little bit better at 5.1%.

There is a great deal to feel good about in terms of economic growth and corporate earnings. In addition, we are entering a period of positive seasonality that typically lasts through year-end. And hopefully by the time you read this, the U.S. Presidential election will be resolved, removing any uncertainty weighing on the market. All these factors point to potential tailwinds for equities, which could pave the way for continued strength in the U.S. equity market.

However, there is an increasing risk to the market that is seemingly being underappreciated. Many would say that the biggest risk to the market is who may or may not occupy the White House for the next four years. Roughly half of the population will say a Republican president would be better for future stock market returns and the other half will say it’s a Democrat that would be better for the stock market. History has proven the S&P 500 tends to rise no matter who is in charge, with Democratic presidents holding just a marginally better return profile. Regardless of who ends up occupying the White House, the reality is the next President will be inheriting a stock market at near historic valuations. And that is the biggest risk we face!

In a recent article published on Bloomberg.com, Emily Roland, co-chief investment strategist for John Hancock Investment Management commented…

“While the next 12-month earnings revisions have been flatlining over the last month at around $267, the S&P 500 is up another 5%. This has caused the valuations on the market to rise to a two-year high, moving closer to 2021 levels. The S&P 500 forward P/E is now 21.8x and the trailing is now 26.58x. We are at the third highest valuation on the S&P 500 in modern history, only behind 1999/2000 and 2021. If this valuation upside continues, it leaves forward looking returns less compelling.”

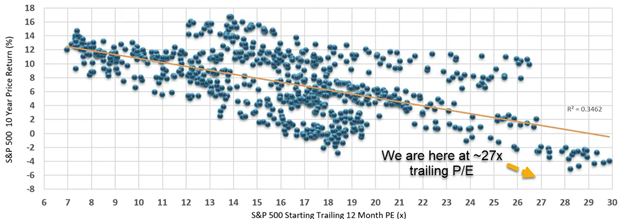

The Bloomberg article also shared the following chart, which depicts the correlation between S&P 500 trailing P/E ratios and the 10-year price return of the S&P 500. Generally speaking, higher valuations coincided with subdued 10-year returns, while lower valuations were met with higher future returns.

Source: Bloomberg

In my humble opinion, today’s valuations will be more of a determinant of future returns rather than who is ultimately voted into office. In the short-term, markets will move based on seasonality, sentiment and positioning; however, over the long-term, valuation and the price you pay for something ultimately will dictate your future return.

Tandem Strategy Update*

Over the past few months, we have highlighted that between seasonal effects and the numerous risks leading up to the Presidential election, equity markets would likely experience a bit of volatility. Well, for at least this past month, that volatility has surprisingly not really come to fruition. Equity markets have recently traded in a tight range, so maybe the volatility we have all expected will just be pushed out into the future. In any case, given the lack of volatility, there was not a lot of action to be taken at the strategy level.

Across all strategies, we continued the process of selling our long-term core position in Brown Forman (BF.B) and completed the liquidation in MarketAxess Holdings (MKTX). Both companies have failed to jump start growth since the Covid pandemic and no longer fundamentally pass through our quantitative screen. Each company has had fits and starts to only go on and disappoint, which has led BF.B and MKTX to fail to sustain consistent growth in revenues, earnings and cash flows.

Within our Large Cap Core and Equity strategies, we have trimmed our position in Costco (COST). COST has also been a long-term core holding of ours and continues to demonstrate consistent revenue, earnings and cash flow growth. COST has done everything we seek in a company; however, the price has just gotten a bit ahead of its fundamental growth, which has caused our quantitative model to flag the company as being unsustainably overvalued. For this reason, we continue to hold our position in COST, but to manage the risk around such an extreme valuation, we have reduced our allocation in the position.

Outside of the few companies we have written about over the past couple of months that no longer met our fundamental criteria, our core holdings have continued to demonstrate the fundamental growth we seek in an investment. So far this quarter, two-thirds of our companies have reported Q3 earnings, and sales and earnings growth have come in at 7.36% and 7.77%, respectively. This compares favorably to S&P 500 sales and earnings growth of 5.3% and 5.1%, respectively, over the same time period. As a result of this fundamental growth, several of our companies have rewarded shareholders by increasing their dividend. In the past couple of months, Accenture, Brown & Brown, CBOE, Microsoft, Terreno Realty, Visa and Waste Connections have all increased their dividend by an average of 12.6%. The consistency in growth may not always be rewarded in the moment, but as long as these companies continue to exhibit solid fundamental growth and consistently grow their dividend, eventually the market will take notice.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Source: Source of all data is FactSet, unless otherwise noted.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Observations

U.S. equities closed January on a notably positive note after a challenging December, as a broad-based rally lifted key indices within spitting distance of all-time highs. The S&P 500 advanced by 2.70%, the Nasdaq climbed 1.64%, and the Russell 2000 recovered with...

Notes from the Trading Desk

All major U.S. equity indices closed out the month of January higher. The S&P 500 advanced 2.70%, while the Dow Jones Industrial Average and Nasdaq gained 4.70% and 1.64%, respectively.

The Tandem Report

With 2024 now in the books, it was certainly another good year for the S&P 500. The index gained more than 20% for the second consecutive year and the third time in the past four years.