Financial Markets Review

U.S. equities closed January on a notably positive note after a challenging December, as a broad-based rally lifted key indices within spitting distance of all-time highs. The S&P 500 advanced by 2.70%, the Nasdaq climbed 1.64%, and the Russell 2000 recovered with a gain of 2.58%, clawing back some of the 8% loss experienced in the previous month. Despite December’s difficulties and in contrast to the last few months, the breadth of the market was robust, with the equal‐weighted S&P 500 outperforming the market‐cap weighted S&P 500 by over 70 basis points. This divergence underscores a more balanced participation among market segments as ten of the eleven sectors in the S&P 500 ended the month with gains. The broad participation was a breath of fresh air and a welcomed sign, given the relative underperformance of most other stocks not part of the Magnificent 7 over the past two years.

January started out weak as interest rates on the long end of the curve rose precipitously, with the 10-year U.S. Treasury hovering around 4.80%, climbing roughly 30 basis points in two weeks and 70 basis points since the beginning of December. Worries of a resurgence in inflation and whispers of the Fed not only halting their recent interest rate cutting cycle, but possibly having to raise interest rates at some point over the next year led to the sharp rise in interest rates and weakness in equities. By mid-month, equities regained their footing as interest rates pulled back following a cooler December CPI report and fears of a Fed policy adjustment were assuaged.

In addition to fears of a resurgence in inflation, there was no shortage of other events that spurred a bout of volatility in equity markets. The technology sector, particularly the AI growth narrative, experienced a setback this past month and was the only sector to close lower. The launch of China’s low-cost DeepSeek AI model triggered a significant selloff in AI-linked stocks, fueling scrutiny over U.S. tech companies’ spending on AI research and development, pricing power, and the broader question of whether America can maintain its lead in the global AI race.

The market reaction to the news was what one would’ve expected – technology and AI-related stocks got punished with the S&P dropping 1.5% on the day. However, not all stocks sold off that day and in fact there was significant strength under the surface in the broader market. According to Jason Goepfert of White Oak Consultancy LLC,

“Even with the S&P 500 losing nearly 1.5%, more than 300 of its stocks rose on the day. Since the index became a 500-stock index in 1957, this had never happened before. The only days with more than 250 advancers, (while the index fell 1.5%) were April 14, 1999, April 19, 1999, and April 12, 2000.” – Jason Goepfert, posted on X, January 17, 2025

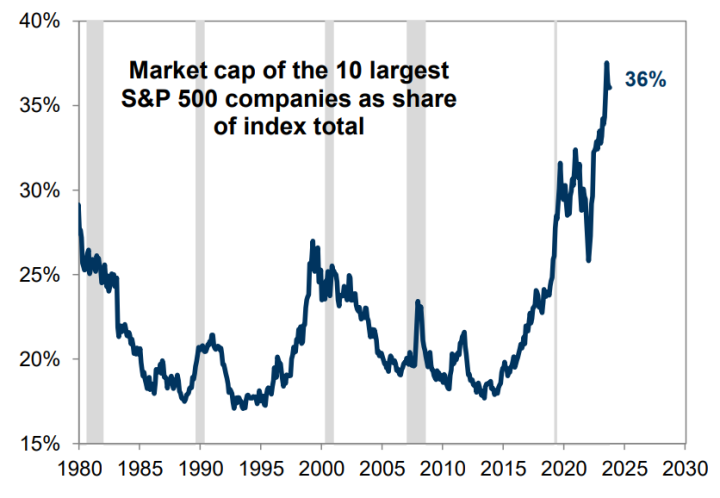

While the S&P 500 fell nearly 1.5% and the Nasdaq Composite plummeted by over 3%, the S&P 500 Equal-Weight Index was marginally higher on the day. The market reaction on that day is worth noting as the year progresses, as it underscores one of the greatest risks to the market, namely the S&P 500, that we have been discussing for some time now. Over the past two years, the Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) have accounted for a significant portion of the S&P 500’s gains. In fact, last year, these seven stocks and Broadcom contributed over 55% of the S&P 500’s 23% return. In doing so, the S&P 500 has become increasingly concentrated among a handful of companies. According to Goldman Sachs, the S&P 500 is now the most concentrated it has been going back to 1980.

Source: FactSet, Compustat, Goldman Sachs Global Investment Research

One day or even one month of underperformance in the mega-cap tech stocks doesn’t constitute a trend. However, as concerns mount over elevated valuation levels and lower-cost competition in the development of AI applications, the risks are ever increasing that the overconcentration of mega-cap tech stocks could put downside pressure on the S&P 500. At the same time, a long-awaited rotation amongst the other 493 companies may be underway. Just as the strong headline performance in the S&P 500 over the past two years wasn’t necessarily indicative of the average stock, any weakness in the S&P 500 might also not be reflective of what’s really taking place under the surface. Probably now more than at any other time in history, the lack of diversification and overconcentration within the S&P 500 truly masks the bigger picture and underscores the importance of a balanced investment strategy.

Tandem Strategy Update*

Between large swings amongst interest rates, the emergence of DeepSeek, or discussions around tariffs, the various headline events have reignited volatility in equity markets. As we often say, volatility begets opportunities. And this past month, we were presented with a few opportunities to put cash to work.

As interest rates rose throughout the first couple of weeks in January, we took advantage of the sell-off in REITs to add to our Terreno Realty (TRNO) position within the Equity strategy. TRNO is a real estate company that acquires, owns, and operates industrial properties in six major coastal U.S. markets. The types of properties include warehouse/distribution, flex, research and development, and trans-shipment. TRNO’s focus is to purchase industrial real estate in areas where there is growing demand but limited or shrinking supply. This strategy has worked well for TRNO since they became public in 2009, as seen by their consistent growth in revenues, earnings, and cash flows. And due to their strong fundamental growth, TRNO has been able to grow their dividend at a compounded annual growth rate of 12% over the past 10 years.

In addition, we had opportunities to add to our core positions of Roper Technologies (ROP) and Zoetis (ZTS) within the Large Cap Core and Equity strategies. ROP designs and develops software and technology solutions to several niche markets, which include everything from law and professional service firms to higher education and the healthcare industry. Just recently, ROP announced a 10% increase to their quarterly dividend on the back of continued strong fundamental growth in their business. Zoetis is the largest global animal health company focused on developing and manufacturing medicines, vaccinations and diagnostics for pets and livestock. Originally, ZTS was a subsidiary of Pfizer and ultimately spun off as an independent company in 2013. Since the spin-off from Pfizer, ZTS has consistently grown revenues, earnings and cash flows and has done so at a compound annual growth rate of 6%, 15%, and 16%, respectively. And not to be outdone by ROP, ZTS also recently announced a 15% increase to their quarterly dividend.

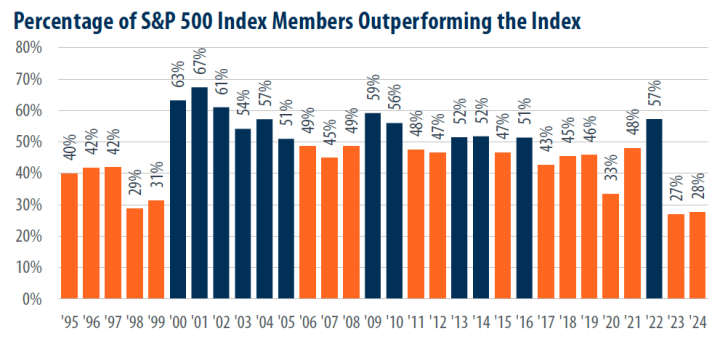

It’s been widely discussed for months now, but it is worth noting just how difficult it’s been to keep pace with the S&P 500 for everything outside of the Magnificent 7 over the course of the past two years. According to data from Capital IQ and First Trust Advisors, the percentage of S&P 500 Index members that outperformed the index in 2023 and 2024 was at a low going back to 1995.

Source: Capital IQ, First Trust Advisors. Data from 12/30/94 – 12/31/24.

The only time period comparable to the past two years was at the height of the Tech Bubble and we all know how that ended for the S&P 500 – a lost decade. However, what many people might not realize is that not every strategy succumbed to a lost decade. Recently, Ben Carew wrote about this topic in the Market Commentary section in his January edition of The TANDEM Report, which I urge you all to read.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Source: Source of all data is FactSet, unless otherwise noted.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

All major U.S. equity indices closed out the month of January higher. The S&P 500 advanced 2.70%, while the Dow Jones Industrial Average and Nasdaq gained 4.70% and 1.64%, respectively.

The Tandem Report

With 2024 now in the books, it was certainly another good year for the S&P 500. The index gained more than 20% for the second consecutive year and the third time in the past four years.

Notes from the Trading Desk

U.S. stocks have stumbled out of the gate to start 2025, with the S&P 500 and Nasdaq both registering back-to-back weekly losses in the first two weeks of the year. The S&P 500 declined 1.94% last week, its fourth weekly decline in...