Financial Markets Review

In March, U.S. equities continued their steady ascent with all major indices experiencing gains. The S&P 500 extended its winning streak, marking its fifth consecutive monthly increase and closing higher for the 10th time in the past 13 months. Throughout the month, the S&P 500 set multiple record highs, reflecting the ongoing strength in the market. Notably, market breadth improved, as indicated by the outperformance of the equal-weight S&P 500 index, which rose by 4.0% versus the market cap weighted S&P 500’s advance of 3.1%. Another sign of the market rally broadening out was seen in the Russell 2000, as small-cap stocks climbed higher by 3.4% and outperformed the technology centric Nasdaq’s advance of 1.8%.

The highlight of the month was the Federal Reserve’s meeting held during the third week of March. Since the beginning of the year, the FOMC’s forecast has been for three rate cuts through the end of 2024. However, leading up to the meeting, speculation was building about the possibility of downgrading this forecast to two cuts due to hotter inflation readings throughout the first quarter. Despite these concerns, Chair Powell’s commentary leaned dovish, emphasizing that recent data didn’t fundamentally alter the disinflation narrative. The median policymaker forecast for 2024 continued to suggest three rate cuts, although opinions have begun to vary among Fed officials based on the stability and strength of recent economic data.

Economic indicators released during the month continue to be nuanced, but for the most part support the narrative of a soft/no landing for the economy. February’s headline CPI was largely in line with expectations but with a notable deceleration in core services. The Fed’s overall view of disinflation remained intact. However, February’s PPI marked its highest level since September, with core PPI surpassing consensus. Additionally, February nonfarm payrolls exceeded expectations, indicating a robust labor market, although a significant downward revision to January figures hinted at some cooling. Weakness was also evident in February retail sales along with downward revisions to prior months, suggesting a consumer that might be a little stretched. Depending on your view of the world, you can likely find an economic report to support your thesis.

However, as March transitioned into April, the narrative of a strengthening U.S. economy was taken up a notch. Two economic reports that had been showing economic contraction for nearly two years finally changed direction. The Conference Board’s Leading Economic Indicators (LEI) flipped positive after a 23-month streak of negative readings. And the March manufacturing ISM moved into expansionary territory for the first time since September 2022. These positive developments, coupled with a strong March nonfarm payrolls report coming in well ahead of consensus, gave new life to the “no landing” scenario. And it also stirred up questions regarding the need for the Fed to cut at all this year.

Throughout most of this year, bond yields and stocks have moved in the same direction – higher – which is counter to their relationship over the past couple of years. However, market dynamics began to shift a bit as we rolled into the second quarter. Interest rates have taken another leg higher in the first week of April with the 10-year U.S. Treasury rising 20 basis points to a yield of 4.4% and U.S. equities showed their first signs of volatility in quite some time. Given the nearly 30% rise in the S&P 500 over a 5-month period, investor sentiment has become extremely stretched. The most recent Investors Intelligence Sentiment Survey showed one of the largest bull-bear spreads on record with the greatest number of bulls since the summer of 2021 and the lowest number of bears since late January of 2018. It’s too early to tell what, if anything, to make of all this, but if nothing else it is worth noting that a higher volatility regime could very well be in the cards.

Tandem Strategy Update

At the strategy level it has been quiet over the past few weeks. Since the last time Observations was published, we have not made a change – purchase or sale – to our core equity positions. It happens from time to time, given we look to be opportunistic and not trade for the sake of trading. However, what is most important to remember is that whether we buy, sell or do nothing, we are never making a “call” on the direction of the market. Each transaction we make is derived from our quantitative model, rooted in math and designed to remove biases. The following excerpt from Observations in April 2021 is a good reminder of why we manage money the way we do.

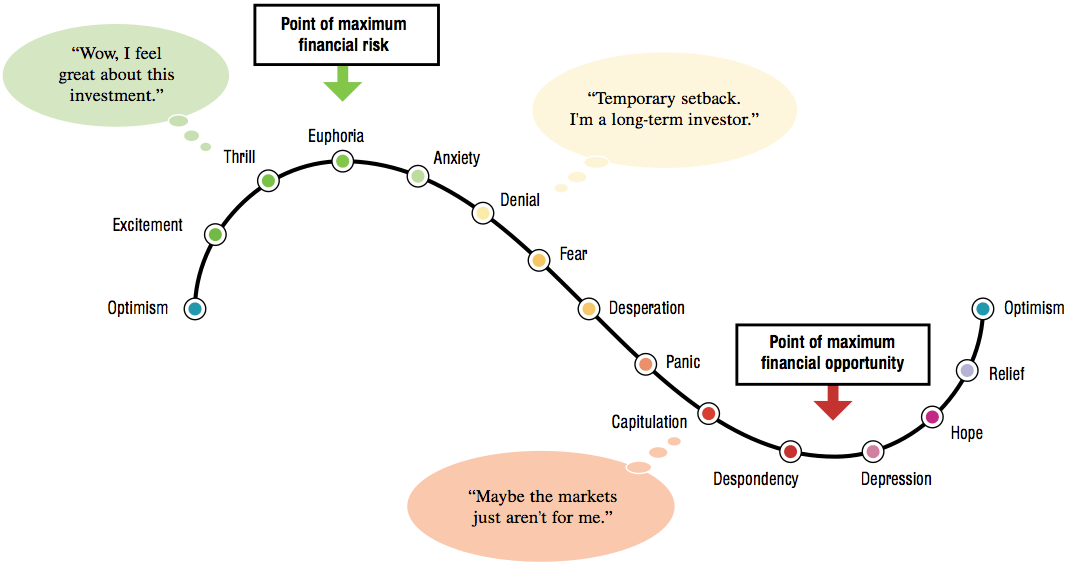

“There is an awful lot to like about the direction of the U.S. economy and subsequently, U.S. equity markets. It is hard to imagine what could derail or even pause the equity rally at this time. Economic data points are accelerating, S&P 500 earnings estimates are consistently being revised higher and technicals are about as bullish as they can get with 95% of S&P 500 stocks trading above their 200-day moving average and the index at an all-time high. The backdrop and justification to invest in equities could not be easier or make more sense than it does today. And oddly enough, it is also the most prudent time to revisit your approach to, and tolerance for, risk. The picture below is a good reminder of how risk correlates with the investor emotion cycle.

Source: https://moderntimesinvestors.com/investor-emotion-cycle/

Behavioral finance is a fascinating topic and likely not discussed enough when it comes to investing. Understanding the different behavioral biases and how they affect your decision making when it comes to money is just as important as what you actually invest in. Dr. Brad Klontz, a financial psychologist and Managing Principal of Your Mental Wealth Advisors, said it well:

“As an investor, you need to have a fundamental understanding that you are wired to do the absolute wrong thing at every point in the process.” – Dr. Brad Klontz

We are all human and thereby susceptible to the different behavioral biases that cloud our decision making.

• Confirmation bias – tendency to interpret new evidence as confirmation of one’s existing beliefs or theories

• Hindsight bias – tendency for people to perceive past events as having been more predictable than they actually were

• Overconfidence bias – tendency to hold a false and misleading assessment of our skills, intellect or talent

• Self-control bias – tendency that causes people to fail to act in pursuit of their long-term overarching goals because of a lack of self-discipline in the short term

• Regret-aversion bias – tendency to refuse to make any decisions because of the fear that the decision will turn out to be wrong and then later lead to feelings of regret

• Recency bias – tendency to favor recent events over historic ones

This list of biases barely scratches the surface of what we all experience when making an investment decision. Ultimately, if we can limit the amount of “thinking” and approach an investment decision objectively, instead of emotionally, the better off we are likely to be. We made the choice a long time ago to manage money in a very disciplined, quantitative fashion. Investment decisions are made based on numbers and math, not emotions and personal beliefs. It is Tandem’s investment philosophy that allows us to remain grounded and rooted in our principles in times of despair, euphoria and everything in between.

Unlike myself and every other human being on this planet, our quantitative model does not suffer from any of the following biases: confirmation, overconfidence or regret-aversion. In fact, it does not suffer from any of the biases previously mentioned. Our model analyzes several different fundamental and valuation factors and signals whether a stock is over, under or fairly valued. Then our disciplines prescribe the action to be taken in our clients’ portfolios. If a stock is overvalued enough, we sell it. If it is deemed to be undervalued, we buy it. There is no hemming and hawing over whether we think it is the right decision. If we waivered, then we would be doing you a disservice, since we would not be doing what we say. Just as it was not easy to buy a year ago in the face of significant unclarity, it is equally hard to sell given the clarity in markets and the economy today. Thankfully, we have a process to follow.” – Observations, April 2021

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Source: Source of all data is FactSet, unless otherwise noted.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

The Tandem Report

The first half of the year is now in the rearview mirror. And, the first six months of 2024 marked one of the strongest rallies to start the year since the lead up to the dotcom bubble in the late 90s.

Observations

Last month, strength in the market-cap weighted S&P 500 and the tech centric Nasdaq persisted with both indices logging their second straight monthly gain and fifth monthly gain since the start of the year. The S&P 500 rose 3.5%, while the Nasdaq...

Notes from the Trading Desk

Markets experienced continued strength throughout the first few weeks of June as the S&P 500 logged its third consecutive weekly gain, up for the eighth week in the past nine. The benchmark index closed higher by 0.61% last week, bringing its month-to-date...