Market Movers & Shakers

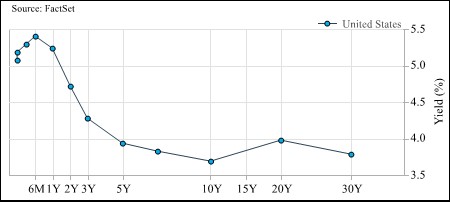

Stocks were under pressure last week as the major U.S. equity indices gave back some of their recent gains. The S&P 500 broke a five-week winning streak, while the Nasdaq fell after eight straight weeks of gains. Small caps bore the brunt of last week’s retracement as the Russell 2000 fell nearly 3%. The Nasdaq and the S&P 500 slipped 1.44% and 1.39%, respectively, while the Dow dropped 1.67%. Last week’s weakness was led by many of the areas that had recently performed best. The PHLX Semiconductor index fell 4.5%, while the S&P 500 banking industry fell 4+% as well. Elsewhere, the back end of the yield curve continued to roll over. The 30-year U.S. Treasury came into June around 4% and it has since retreated 20-25 bps over the past few weeks. The 10-year has made a smaller, but similar move, as it has fallen ~15 bps from its recent high. Meanwhile, the short end of the curve has continued its march higher. The steepest part of the yield curve is now at six months, with a yield of ~5.4%. The spread between 10s and 2s is more than 100 bps once more – nearing its cycle lows set back in early March. Elsewhere, the Dollar Index strengthened a bit while precious metals and industrial metals both fell.

United States Yield Curve

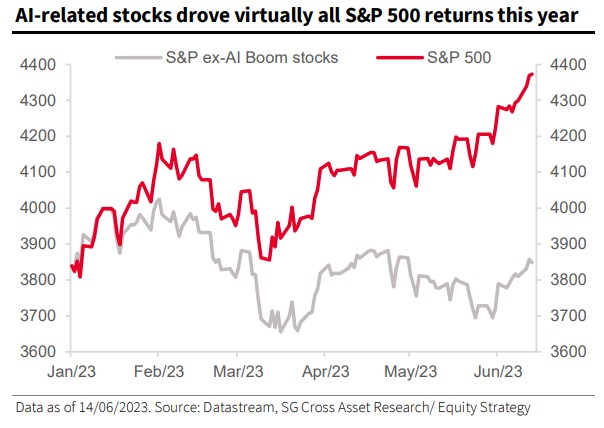

The AI fad by and large has continued throughout the month of June. SocGen pointed out in a recent note that the S&P 500 “ex-AI Boom” stocks would be down for the year. SocGen’s point is depicted in the chart below, which was featured in a recent Bloomberg article by John Authers.

In other words, without AI, the S&P 500 would be at a loss year-to-date. The gains in some of the AI related and other Tech names have been astounding. Apple alone has added nearly $900b to its market cap year-to-date and is very nearly over $3T in total market cap. Tesla, Meta, Nvidia, Microsoft, Alphabet and Apple have seen their collective market caps increase by more than $3.5T YTD. The Russell 2000, which has a total market cap of just $2.3T, has added only $30b to its total market cap in 2023. The allure of these AI related names has mesmerized investors and left the market distracted. Looking under the hood, things took a step back in the last week or two. Regional banks, which largely rallied from mid-May to mid-June, have slumped since then. KRE, a regional bank ETF, has fallen 11.5% over the past two weeks. PacWest, a recent trouble child among regional banks, was off its recent June high by nearly 25% through Friday’s close. Fear in the banking sector was further compounded by recent comments from Treasury Secretary Janet Yellen. Yellen stated that it was likely that we would see further consolidation in the banking sector before the year end, sparking fear that there may still very much be issues among banks. It wasn’t too long ago that moves like that would’ve spooked markets. Fed Chair Jerome Powell did little to allay bank concerns as he testified last week on Capitol Hill that the Fed plans to increase capital requirements on larger banks. Members of both parties expressed displeasure with this plan. Raising capital requirements would likely choke off some additional lending, which could further stunt growth and lead to tighter financial conditions. Interest rate hikes and the collapse of some regional banks have already served to tighten financial conditions. The various Senators have a point. Raising capital requirements would likely tighten conditions, which the Fed is actively doing with rate hikes and its quantitative tightening. However, according to the Chicago Fed National Financial Conditions Index, financial conditions are still accommodative. And financial conditions are more accommodative today than they were throughout the back half of 2022.

While on Capitol Hill, Chairman Powell also asserted that two rate hikes should be expected so long as the economy continues at its current pace. This hawkish tone underscores the continued divergence between the Fed and the Market. The market has one more rate hike priced in for July with a cut in January. The FOMC dot plot suggests two more hikes by the end of the year. Meanwhile, global central banks continue to hike. The Bank of England hiked 50 bps – which was a surprise. The central banks of both Norway and Sweden also hiked. Rising rates, specifically here in the U.S., have caused some of the issues for regional banks. Higher rates depressed asset values while also creating an opportunity for savers to choose Treasuries over a savings account. At least one of those problems seems unlikely to abate in the near future. According to Bankrate, the national average yield for a savings account is still 0.25% APY. Again, a 6-month Treasury is currently yielding ~5.4%.

– Ben Carew, CFA

Transition Updates & News*

A handful of Tandem’s names reported last week.

FactSet (FDS), a financial data provider, reported on June 22nd. Their quarterly revenue increased by 8.4%. Adjusted diluted EPS grew 1%. Growth stemmed from revenue; however, earnings were offset by a higher tax rate and lower operating margins. Management raised their revenue guidance by about a percent, from $2.08B to $2.1B. This is a slight deceleration from their previous guidance. For fiscal year 2023, FDS raised the midpoint of their adjusted diluted EPS guidance by $0.25. Their annual subscriptions value (ASV) retention rate for Q3 remained greater than 95%. 451 new clients were onboarded compared to last year. This was closer to the lower end of their guidance, which management noted was due to tepid markets and reduced spending. While confident in their pipeline, management says the macro landscape is still uncertain. And while the banking sector continues its slowdown, more middle market firms and universal banks are cooling on hiring. We allocated new accounts and new monies to FDS last Thursday after earnings.

Next up on the docket is Accenture (ACN). ACN, an IT and consulting firm, reported on June 23rd. Management noted revenue was up +3% year-over-year. Their Consulting sector missed on the top line, while Managed Services beat. EPS was reported as $3.16, roughly 3% above estimates. Accenture posted solid revenue in product sales and strong free cash flow as they continued to invest in themselves. Revenues were constrained by lower than anticipated small deal sales – especially in Strategy & Consulting. ACN is excited about its latest AI development. The company just acquired Nextira, a company that specializes in cloud-based solutions and services through machine learning, AI, and engineering. ACN is to invest $3 Billion over the next 3 years in AI to accelerate client reinvention.

Steris (STE), a medical equipment company, is set to acquire surgical assets from Becton, Dickinson, and Company (BDX). BDX is also a member of the Tandem portfolio, making and selling medical devices. This transaction is designed to help Steris expand their healthcare products offerings and is estimated to cost $540 million. The deal is expected to close by September 30th this year. The transaction will be financed through a combination of debt and cash.

Terreno (TRNO), Tandem’s only REIT, announced that it has renovated one of its properties near San Jose, CA. They also signed a lease with the city of San Jose to provide safe RV parking over 6.3 acres of land. We have added to its position size in Large Cap and Mid Cap composites this June. We also have been actively transitioning into TRNO.

The Microsoft (MSFT)/Activision Blizzard saga continues as a US Federal Court recently granted a preliminary injunction to block this acquisition. Microsoft is now saying they could abandon this deal if the Judge delays it, according to The New York Times.

We continue to monitor Dollar General (DG) and its potential. Morgan Stanley has added DG to their Focus List. The firm cited several reasons, including DG reaffirming their long-term store saturation targets and favorable valuation with its multiple currently at the bottom of its historical range.

– Annie Klopstock

*The transition update describes activity taken by Tandem on the transition level, not the composite or firm-wide level. The transition update is applicable to new accounts and new money. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. This update describes that transition.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

The Tandem Report

The stock market continued its impressive run in the third quarter—albeit with a small hiccup in early August. The S&P 500 closed 5.5% higher, which brought the year-to-date gain through September to nearly 21%.

Notes from the Trading Desk

U.S. equities saw continued strength last week, building on recent momentum and pushing major indices to record highs. The Dow Jones Industrial Average and S&P 500 notched fresh all-time highs, with the S&P 500 logging its 45th record high of the year...

Observations

In September 2024, U.S. equities continued their upward trajectory, with major indices closing the month higher, extending a strong year-to-date performance. As has been the case for much of the year, the Nasdaq led the way with a 2.68% increase, while the...