Market Movers & Shakers

All major U.S. equity indices closed out the month of January higher. The S&P 500 advanced 2.70%, while the Dow Jones Industrial Average and Nasdaq gained 4.70% and 1.64%, respectively. Small-cap stocks bounced back a bit in January, with the Russell 2000 climbing 2.58%, following a decline of more than 8% in December. The S&P 500 notched new record highs in January, topping 6,100 for the first time ever. Ten out of eleven sectors in the S&P 500 were higher for the month, with Information Technology the sole sector to finish lower, weighed down by weakness in semiconductor and semiconductor equipment stocks. Communication Services, Health Care, and Financials were the month’s top performing sectors.

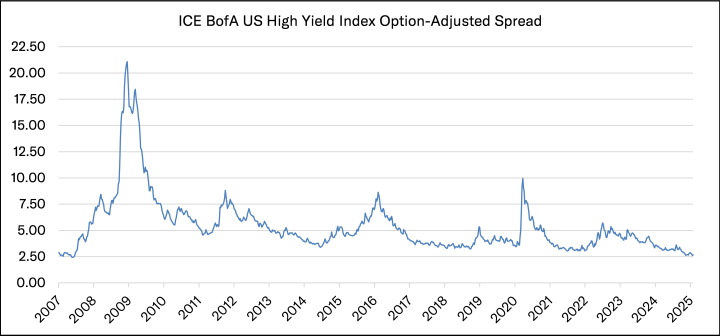

Market breadth notably improved over the course of January. At the start of the month, only 17.5% of stocks in the S&P 500 were trading above their 50-day moving average. By month end, that percentage had climbed to more than 50%. The broader market strength in January was also reflected in the 70-basis point outperformance of the equal-weighted S&P 500 relative to the market-cap weighted index. Treasury yields pulled back from their intramonth highs following the release of cooler than anticipated inflation data. The 10-Year U.S. Treasury yield settled at 4.52% to close out the month, down nearly 30-basis points from recent highs. Credit spreads, as measured by the ICE BofA US High Yield Index Option-Adjusted Spread, moved down to 2.59% in January, the tightest level since June 2007. Gold continued to hit new highs last month, advancing 7.10% and pushing above $2,800/ounce for the first time.

Source: FactSet

The past few weeks have brought a whirlwind of market-moving headlines. DeepSeek, a Chinese artificial intelligence startup, triggered a selloff in technology stocks following the release of its R-1 model that rivals OpenAI’s ChatGPT. DeepSeek claimed the model required less than $6 million to develop, raising concerns about the level of spending by U.S. technology companies on their models and America’s position in the global AI race. The idea that AI applications could be developed at a significantly lower cost than previously thought possible called into question the expansive capital expenditure plans of the hyperscalers (Amazon, Microsoft, Google, Meta, and Apple). Nvidia shares fell by nearly 17%, erasing $593 billion in market capitalization and marking the largest single-day decline for any company in history. To put Nvidia’s market cap loss in context, the $593 billion decline in value was equivalent to the entire market cap of Coca-Cola, McDonald’s, and Nike combined, and greater than the market cap of 487 companies in the S&P 500. Taiwan Semiconductor Manufacturing Co (TSMC) shares fell by 13%, while Broadcom shares shed more than 17%. In the Energy sector, nuclear and electric utility stocks like Constellation Energy, GE Vernova, and Vistra posted double digit declines as investors questioned the AI-driven electricity demand thesis that had caused the stocks to more than double over the last twelve months. The sharp selloff in Nvidia and AI related names pushed the S&P 500 lower by 1.5% on the day. However, despite the definitive move lower at the index-level, more than 300 of the stocks in the S&P 500 finished the day in the green – the first time this has ever happened since the index became a 500-stock index in 1957.

Elsewhere, the Trump administration announced it would levy 10% tariffs on imports from China and 25% tariffs on goods from Mexico and Canada, with no industry or company exemptions and eliminating the de minimis exemption that applies to packages worth less than $800. The administration cites large trade deficits, illegal immigration, and the flow of fentanyl across both the southern and northern borders as key reasons for implementing the tariffs against America’s three largest trade partners. The news gave a boost to the U.S. dollar, marking its largest single-day gain since the election and strengthening against the Canadian dollar, Mexican peso, and Chinese yuan. The Canadian dollar sank to its weakest levels since 2003, while the U.S. dollar set a fresh 3-year high relative to the Mexican peso and the offshore Chinese yuan hovered close to an all-time low against the greenback. The impact of tariffs on U.S. consumer prices remains uncertain. Canada is a major supplier of lumber and energy, while Mexico provides key agricultural products such as tomatoes and avocados. Both countries also account for a significant share of U.S. automobile imports. Meanwhile, tariffs will affect a range of goods from China, including electronics like smartphones, TVs, and gaming consoles.

Source: FactSet

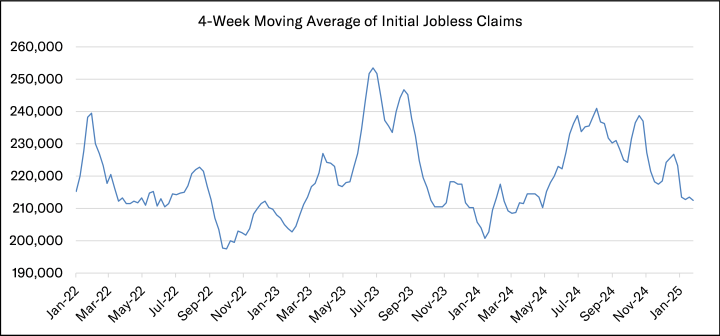

On the macroeconomic front, the Federal Reserve held interest rates at 4.25-4.50% at the January FOMC meeting, which was widely anticipated. Fed Chair Jerome Powell was perceived as taking a more dovish stance during the press conference, commenting that monetary policy remains “meaningfully restrictive” after recent rate cuts. Powell also highlighted encouraging inflation readings, suggesting they could improve further as shelter costs continue to ease. Economists largely expect the Federal Reserve to remain on hold for an extended period, though some believe that steady inflation readings drifting toward the Fed’s 2% target could prompt additional cuts by midyear. Recent preliminary Q4 GDP and December PCE data, along with positive results and commentary from Visa and Mastercard, further highlighted the continued resilience of the U.S. consumer. The labor market appears to remain resilient as well, with initial jobless claims coming in at 207,000 last week, well below consensus estimates for 225,000 and the prior week’s unrevised 223,000 figure. The four-week moving average of initial claims ticked down by 1,000 to 212,500. Continuing claims, which measure the number of people who have already filed for unemployment benefits and are still filing for benefits each week, came in at 1.85 million compared to estimates for 1.90 million.

Updates & News*

Earnings season has brought a wave of news across Tandem’s portfolio. Visa reported better-than-expected results, reflecting healthy spending during the holiday season and improving trends in payments, volume, cross-border volume, and processed transactions growth. Similarly, Mastercard’s quarterly results also topped analyst expectations. Mastercard CEO Michael Miebach said on the company’s conference call that “the macroeconomic environment continues to perform well, and it is underpinned by healthy consumer spending”. HR and payroll giant ADP reported double-digit earnings growth and margin expansion during its fiscal second quarter, citing a strong overall business environment and all-time high client satisfaction levels. Roper Technologies delivered an earnings beat and guided for double-digit revenue growth in 2025, fueled by improving organic growth and meaningful contributions from acquisitions made last year.

Florida-based insurance broker Brown & Brown reported higher year-over-year organic growth and margin expansion as the firm experienced record new business across all divisions. Microsoft’s earnings were dampened by light Azure cloud growth numbers, though CEO Satya Nadella said the company’s AI business topped an annual revenue run rate of $13 billion. ResMed, the largest provider of CPAP machines to treat sleep apnea and COPD, reported top-line growth, margin expansion, and double-digit EPS growth last fiscal quarter as demand increased for its medical devices. ResMed’s management team believes GLP-1s (weight loss drugs) will drive increased patient flow as people become more educated about sleep apnea and also views tariffs as a potential tailwind given none of their masks or machines sold in the U.S. are made in the countries subject to proposed tariffs like some of its competitors.

Elsewhere in the health care space, Stryker reported top and bottom line fourth quarter results ahead of consensus and provided full year 2025 guidance above expectations. Outside of earnings, BlackRock announced an increase to its quarterly dividend to $5.21 per share from $5.10 per share, while Becton Dickinson’s board of directors authorized the company to repurchase an additional 10 million shares of BDX’s common stock.

Source: Source of all data is FactSet, unless otherwise noted.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

The Tandem Report

With 2024 now in the books, it was certainly another good year for the S&P 500. The index gained more than 20% for the second consecutive year and the third time in the past four years.

Notes from the Trading Desk

U.S. stocks have stumbled out of the gate to start 2025, with the S&P 500 and Nasdaq both registering back-to-back weekly losses in the first two weeks of the year. The S&P 500 declined 1.94% last week, its fourth weekly decline in...

Observations

December painted a mixed picture across U.S. financial markets with varied performance among major indices. The S&P 500 declined by 2.50%, while the small-cap Russell 2000 suffered a sharp 8.40% loss and nearly gave back all of November’s huge gains.