Market Movers & Shakers

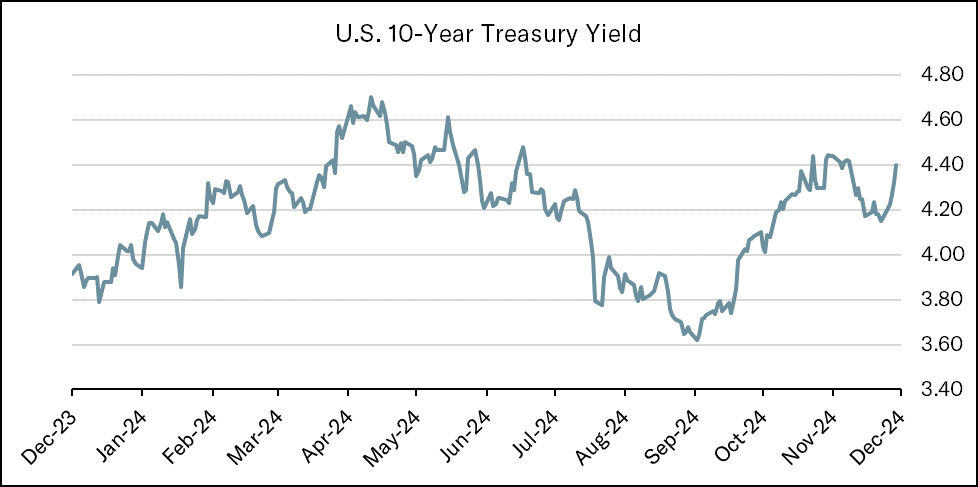

As we enter the final trading sessions of 2024, U.S. equities are sitting on significant year-to-date gains. The S&P 500 has advanced just over 27% this year, while the Nasdaq Composite has surged more than 34%. Lagging the pack is the Dow Jones Industrial Average, up roughly 16% this year – which, relatively speaking, may seem below par – however, on a standalone basis, the Dow’s year-to-date return is twice its average annual return over the past 25 years. The gap in performance between the major indices has widened further over the past few weeks. In fact, the Dow Jones Industrial Average just logged an 8-day losing streak for the first time since June 2018. The price-weighted index has taken a leg lower following a recent selloff in shares of UnitedHealth Group, which held the largest weighting in the Dow at the start of the month, amid heightened scrutiny of the health insurance industry following the fatal shooting of UnitedHealthcare CEO Brian Thompson. Weakness in cyclical and value-oriented stocks, such as Caterpillar, Chevron, and Home Depot has also weighed on the index. Treasury yields saw a notable uptick last week. The yield on the benchmark 10-Year U.S. Treasury closed Friday at 4.40%, up from 4.15% the previous Friday. The increase of 25 basis points marks the largest one-week gain since October 2023. The rise in yields comes amid inflation data that largely met investor expectations and weaker than expected labor market data, with unemployment claims coming in above economist forecasts.

Source: FactSet

Source: FactSet

In our last edition of Notes from the Trading Desk, we discussed a broadening out of the rally during much of November as small- and mid-cap stocks outperformed their larger counterparts. However, since the week of Thanksgiving, that broadening out has come to a resounding halt. Since November 25th, the Invesco S&P 500 Equal Weight ETF (RSP) has posted a total return of -3.02%, while the market-cap weighted S&P 500 ETF (SPY) logged a total return of 1.55%. Meanwhile, the Roundhill Magnificent Seven ETF (MAGS) surged by more than 14% during the same period, significantly outperforming the major averages.

Source: FactSet

Source: FactSet

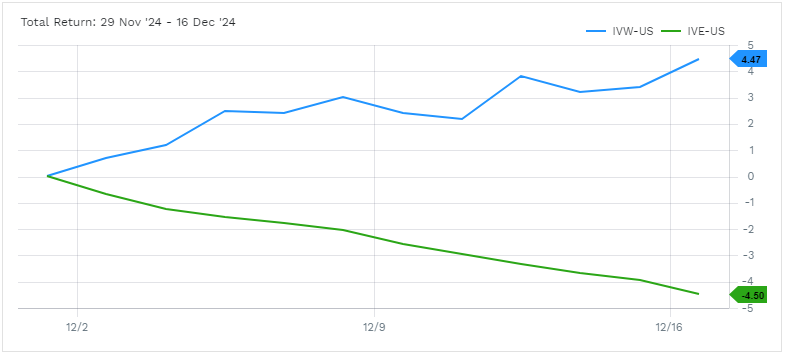

Consumer Discretionary, Communication Services, and Information Technology were the top performing sectors over the last month, given outperformance from mega-cap technology stocks like Alphabet, Amazon, Apple, Meta, Microsoft, and Tesla. Shares of Tesla are up more than 40% over the last month and have more than doubled since the start of the quarter. Nvidia is notably absent from the list above, as the chip maker’s stock has recently entered a slump following a stellar year. Nvidia shares have surged more than 160% in 2024, and the firm briefly became the world’s most valuable publicly traded company in June. However, since then, the baton has been passed back to Apple and Microsoft. Meanwhile, Energy, Health Care, and Materials were the worst performing sectors over the last month as value stocks underperformed. S&P 500 value stocks, as measured by the iShares S&P 500 Value ETF (IVE), have now declined for 11 consecutive trading sessions – the longest losing streak on record. In contrast, S&P 500 growth stocks, as measured by the iShares S&P 500 Growth ETF (IVW), have closed higher 7 out of the last 11 trading days.

Source: FactSet

Source: FactSet

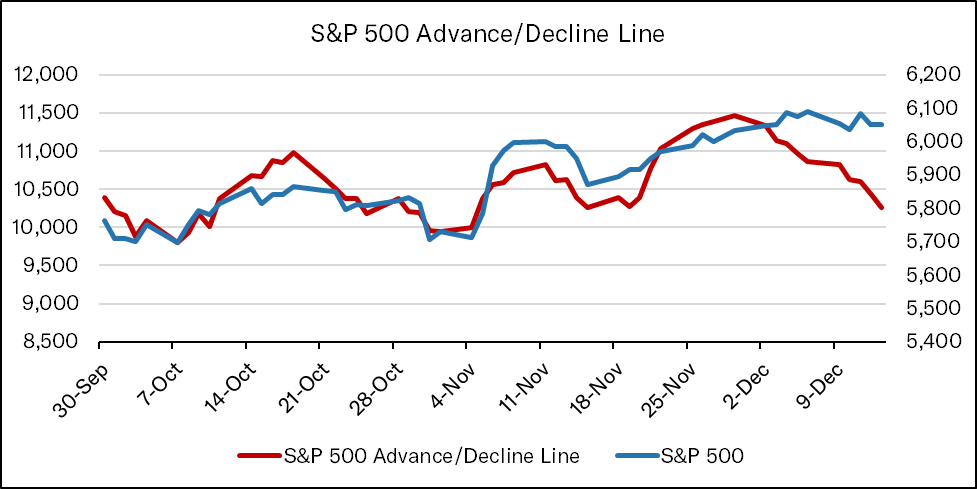

A commonly used indicator of market breadth is the advance/decline (A/D) line, which shows how many stocks are participating in a stock market rally or decline. The advance/decline line plots the difference between the number of advancing and declining stocks on a daily basis. Breadth for the S&P 500 has been negative for the entire month of December so far, with 11 consecutive days of more declining stocks than advancing. To find a longer streak of negative breadth via the A/D line, you would have to go all the way back to September 11, 2001. Yet, despite 11 days of more stocks falling than rising, the S&P 500 is up nearly 1% this month.

Source: FactSet

Source: FactSet

A rise in animal spirits following the presidential election results has fueled a surge of optimism in the business community and U.S. stock market. Small business sentiment, as measured by the National Federation of Independent Business’s (NFIB) small business optimism index, posted its largest monthly gain on record in November. The jump in optimism puts the index at June 2021 levels and above its 50-year average for the first time in years. Investors have also piled into U.S. stocks this year at a record pace. According to Bank of America, U.S. equities have seen 10 straight weeks of inflows and retail investor volumes remain elevated relative to history. U.S. stocks now account for 65% of global equity market capitalization, their highest weighting in history, and more than 11x bigger than the second largest country by market cap (Japan at 5.5%). Enthusiasm for stocks is hitting extreme levels. According to Bank of America’s latest survey of fund managers, cash allocations have hit a record low while the allocation to U.S. equities has surged to a record overweight position. As we look ahead, market participants will be keenly focused on this week’s December FOMC meeting and forward guidance regarding the future path of monetary policy.

Updates & News*

With a recent wave of weakness under the surface of the market, activity at the transition level has picked up a bit. In fact, since the start of December, we have transitioned into 22 different securities across our three strategies, including names like Brown & Brown, Cboe Global Markets, Mastercard, and Waste Connections. Accounts that have been under Tandem’s management for a week are ~45% of the way in-line with our strategies, while those that have been with us for a month are nearly 60% of the way transitioned. In portfolio news, Costco Wholesale reported a strong fiscal first quarter last week. Costco’s revenues rose by 7.5% during the quarter, while earnings-per-share increased by 13% from the same period a year ago. Revenue from membership fees rose nearly 8% following Costco’s first membership price increase since 2017. E-commerce sales continue to be a key growth area for the wholesale club giant, up 13% year-over-year as consumers shopped online for everything from gold bars to home furnishings. Costco’s Chief Financial Officer, Gary Millerchip, said on the company’s earnings call that customers remain selective about purchases; however, they are willing to spend if they find a combination of newness of items, quality, and value. Elsewhere, Abbott Labs recently announced a 7.3% increase to its quarterly dividend, marking its 53rd consecutive year of dividend growth. Stryker also announced a dividend increase, hiking its quarterly payment to shareholders by 5.0%.

Source: Source of all data is FactSet, unless otherwise noted.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Observations

U.S. equities closed January on a notably positive note after a challenging December, as a broad-based rally lifted key indices within spitting distance of all-time highs. The S&P 500 advanced by 2.70%, the Nasdaq climbed 1.64%, and the Russell 2000 recovered with...

Notes from the Trading Desk

All major U.S. equity indices closed out the month of January higher. The S&P 500 advanced 2.70%, while the Dow Jones Industrial Average and Nasdaq gained 4.70% and 1.64%, respectively.

The Tandem Report

With 2024 now in the books, it was certainly another good year for the S&P 500. The index gained more than 20% for the second consecutive year and the third time in the past four years.