Market Movers & Shakers

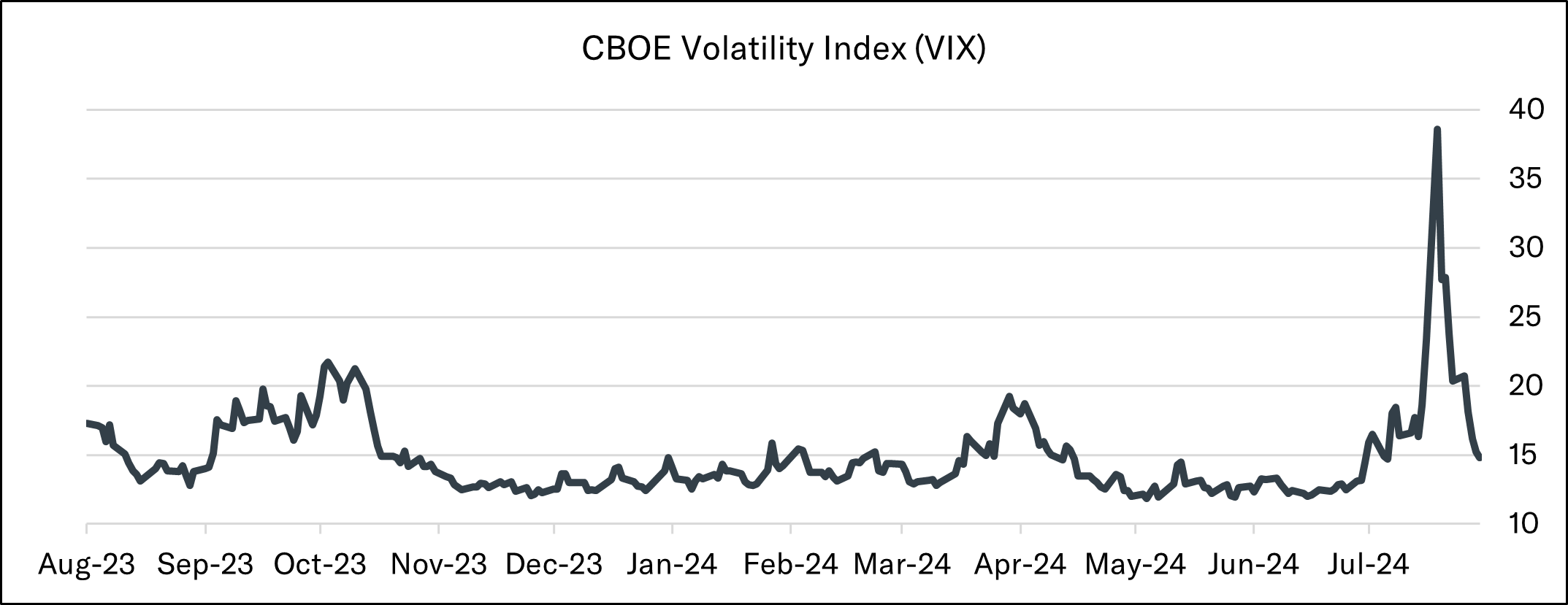

U.S. stocks recovered ground last week as the S&P 500 and Nasdaq broke a four-week losing streak and posted their best weekly performances since November 2023. The S&P 500 finished out the week on a seven-day winning streak and reclaimed its 50-day moving average. The rally comes after an early August selloff that market participants are ascribing to U.S. economic slowdown fears and an unwind of the Yen carry trade. Japan’s Nikkei 225 Index plunged 12.4% on August 5th, its worst day since 1987’s “Black Monday”. A flight to safety amid the global equity selloff and U.S. growth slowdown fears caused Treasury yields to sink across the curve. The 10-year U.S. Treasury yield fell below 3.70%, while the shorter dated 2-year U.S. Treasury yield touched 3.65% at the height of the selling, briefly un-inverting the 2/10 spread for the first time since July 2022. The U.S. Dollar Index followed the move lower in yields, falling to its lowest levels since January. Defensive sectors like Utilities, Consumer Staples, and Health Care have outperformed over the past month, while Consumer Discretionary, Information Technology, and Communication Services were the largest underperformers. WTI crude oil notched its fifth weekly decline in the past six weeks despite heightened geopolitical tensions in the Middle East and remains range bound between $70-80 a barrel. Gold set another fresh record high, with spot prices topping $2,500 an ounce for the first time. The recent global selloff spiked the VIX to its highest level since the depths of the 2020 COVID crash. The CBOE Volatility Index (“VIX”), often referred to as Wall Street’s fear gauge, logged its largest ever intraday increase on August 5th, printing at levels as high as 65 early in the trading session before closing well off the highs near 38. Volatility has since cooled as markets have recouped losses, with the VIX returning to its pre-selloff levels below 15.

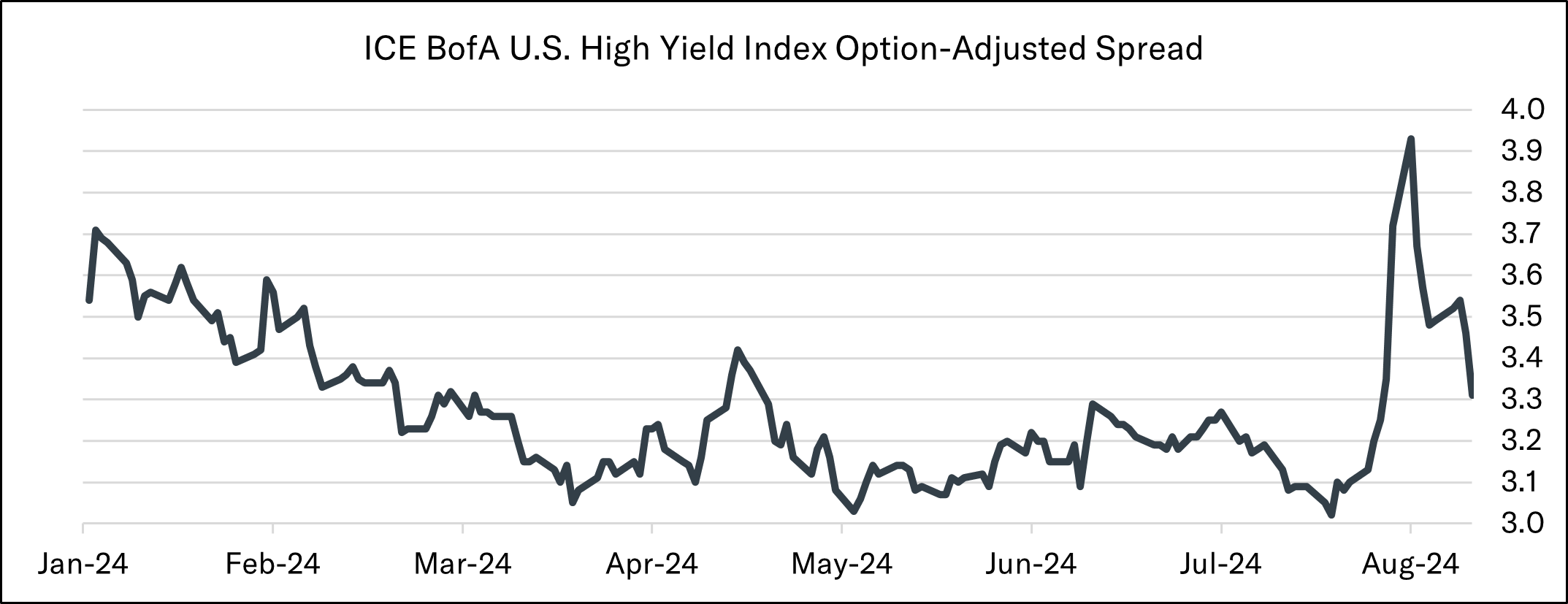

High-yield credit spreads—the difference in yield between high-yield bonds and investment grade government bonds and often viewed as a reflection of the market’s perception of credit risk and economic uncertainty—also made a sharp move higher in early August. High-yield credit spreads, as measured by the ICE BofA U.S. High Yield Index Option-Adjusted Spread, touched their lowest levels in nearly 2.5 years in late July before rising 91 basis points in 2 weeks to 3.93% on August 5th. Like the U-turn seen in the VIX, high-yield spreads are also off their recent highs but have not completely round-tripped, settling at 3.31%.

Recent positive economic data and corporate commentary surrounding the health of the consumer has helped to quell recession fears and provide a tailwind to equity markets. July retail sales data came in stronger than expected, posting the largest month-over-month increase since January 2023. Walmart’s earnings report provided relief, as the country’s largest retailer noted that it has not seen any incremental fraying of consumer health. Recent initial jobless claims data showed the number of Americans filing new applications for unemployment benefits fell to a one month low. Initial jobless claims came in at 227,000 for the week ended August 10th, compared to economists’ forecasts for 235,000 claims—a second straight weekly decline following elevated readings last month that have been largely attributed to temporary disruptions caused by Hurricane Beryl in Texas. July’s CPI and PPI data showed continued progress on the inflation front. Core CPI rose 0.2% during the month and 3.2% on an annualized basis, the smallest 12-month increase since April 2021. Shelter inflation remains a key driver of inflation, with the index for shelter prices increasing 0.4% in July and accounting for nearly 90% of the monthly increase in consumer prices. Producer prices have also moderated, with July core and headline PPI data coming in cooler than expected as prices for services fell 0.2% during the month, the largest decrease since March 2023. Consumers are starting to take note of cooling inflation and believe that price increases will be less of a problem in the coming years. The New York Fed’s Survey of Consumer Expectations showed three-year inflation expectations fell to 2.3%, the lowest reading in the history of the survey going back just over a decade. All eyes now turn to Jackson Hole, Wyoming as Fed Chair Jerome Powell is set to deliver remarks on the economic outlook at the Federal Reserve’s annual symposium.

Updates & News*

At Tandem, we believe that volatility creates opportunity. Tandem invests new accounts and new deposits into its strategies over time rather than all at once, paying prices our disciplined investment process suggests are reasonable to pay rather than buying for the sake of buying just because a client hired us today or because it’s the third Wednesday of the month. A spike in volatility like we experienced over the past few weeks can create an environment ripe to deploy cash. The recent selloff provided us with an opportunity to accelerate our transition process a bit more. Since the start of the month, we have had the chance to purchase twenty-two names on the transition level, including names like Amphenol, Microsoft, Roper Technologies and Stryker. Unrestricted accounts that have been with Tandem for one month are currently ~60% of the way through their transition.

As earnings season has come to an end, it has been relatively quiet on the portfolio news front. Bloomberg reported that Johnson & Johnson’s $6.5 billion settlement plan related to talc baby powder lawsuits received approval from a majority of the claimants—a key hurdle in resolving the legal battle that has been an overhang on the stock. Elsewhere, Cboe Global Markets announced a $500 million increase in its share repurchase program and a 14.5% increase in its quarterly dividend. This marks the 14th consecutive year that Cboe has increased its dividend.

Source: Source of all data is FactSet, unless otherwise noted.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

The Tandem Report

With 2024 now in the books, it was certainly another good year for the S&P 500. The index gained more than 20% for the second consecutive year and the third time in the past four years.

Notes from the Trading Desk

U.S. stocks have stumbled out of the gate to start 2025, with the S&P 500 and Nasdaq both registering back-to-back weekly losses in the first two weeks of the year. The S&P 500 declined 1.94% last week, its fourth weekly decline in...

Observations

December painted a mixed picture across U.S. financial markets with varied performance among major indices. The S&P 500 declined by 2.50%, while the small-cap Russell 2000 suffered a sharp 8.40% loss and nearly gave back all of November’s huge gains.