Market Movers & Shakers

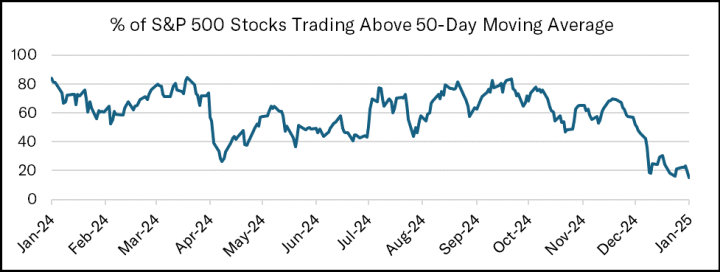

U.S. stocks have stumbled out of the gate to start 2025, with the S&P 500 and Nasdaq both registering back-to-back weekly losses in the first two weeks of the year. The S&P 500 declined 1.94% last week, its fourth weekly decline in the past five weeks, while the tech-heavy Nasdaq fell 2.34%, led lower by declines in Nvidia and Tesla. The small-cap Russell 2000 shed 3.49% last week, erasing all of the index’s post-election gains and falling into “correction” territory, down more than 10% from November 25th’s intraday all-time high. Energy, Health Care, and Communication Services have been the top performing sectors year-to-date, while yield-sensitive sectors like Real Estate and Consumer Staples have underperformed. Energy stocks have benefitted from a recent rise in oil and natural gas prices. WTI Crude Oil prices broke out of a multi-month consolidation, surpassing $78/barrel, as the United States imposed additional sanctions on Russian oil tankers and producers. Natural gas prices remain elevated as frigid temperatures continue to sweep across most of the country, bolstering demand for the commodity. Speaking of cooling down, market breadth has also notably cooled of late, with only 15% of stocks in the S&P 500 trading above their 50-day moving average, a stark decline from just 8 weeks ago when over 75% of S&P 500 constituents were trading above their 50-day moving average.

Source: FactSet

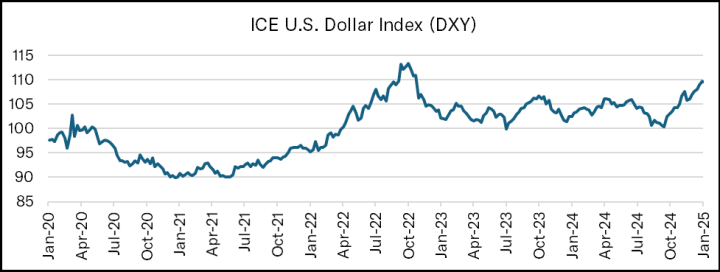

The recent weakness in stocks comes amid a stronger dollar and rising bond yields. The ICE U.S. Dollar Index hit its highest levels since November 2022 last week. A number of the major currency crosses are nearing levels that traders are watching closely, such as the EUR/USD, which is nearing parity for the first time since 2022, when Russia’s invasion of Ukraine sparked an energy crisis in Europe and provoked fears of a recession. Another major currency cross, the Dollar/Yen (USD/JPY) is currently hovering near 158, back to levels last seen just prior to the early August selloff which saw the Nikkei down 17.5% in two trading sessions, surpassing the October 1987 crash to become the largest 2-day decline in the Nikkei’s history. Additionally, the People’s Bank of China (PBOC) announced over the weekend that it would step in to support the yuan after the Chinese currency dropped close to a record low against the U.S. dollar in offshore trading, trading down to 7.35 yuan per dollar. A rising dollar puts pressure on U.S. multinational companies, as profits are repatriated back to the U.S. at less favorable exchange rates. According to data from FactSet, 41% of revenues in the S&P 500 come from abroad. A continued rise in the dollar could have significant impacts on earnings for S&P 500 companies.

Source: FactSet

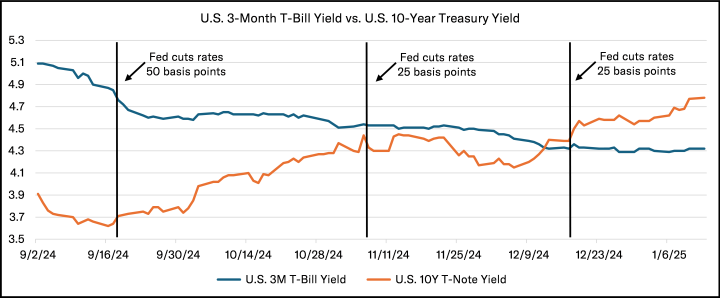

Turning to yields, the benchmark 10-Year U.S. Treasury yield recently touched 4.80%, its highest level since November 2023. Higher Treasury yields, particularly on the long end of the curve, create headwinds for stocks for a whole host of reasons. For starters, a higher discount rate equates to a lower present value of discounted future cash flows — Finance 101, right? This is a key reason why growth stocks, whose future cash flows tend to be more heavily weighted further out in time, are pressured from rising yields. Just take a look at how a basket of non-profitable growth stocks, which were all the rage in 2020-2021 when interest rates were near zero, have fared since then. Higher long-term Treasury yields also generally increase corporate borrowing costs, making it more expensive for companies to fund growth, operations or expansion using debt. This is a key reason why smaller companies tend to bear more of the brunt from higher yields than their larger counterparts, as smaller companies typically rely more on external financing from debt markets than larger firms. From an asset allocation standpoint, higher Treasury yields create increased competition for stocks as investors may allocate marginal dollars to fixed income or shift capital away from equities in favor of more attractive yields.

Source: FactSet

The Federal Reserve cut interest rates three times for a total of 100 basis points over the final four months of 2024. Meanwhile, the yield on the U.S. 10-Year Treasury steadily moved in the opposite direction of short-term rates, climbing nearly 110 basis points since the Fed’s first cut in September. Markets initially embraced higher long-term yields, as investors anticipated that deregulation and lower corporate taxes proposed by the incoming administration would boost economic growth. Higher yields caused by stronger growth expectations have usually been fine for stocks, as faster growth means a more robust economy which in turn means higher profits. However, more recently, markets have become increasingly concerned that lower taxes and higher tariffs may cause a resurgence in inflation and further budget deficits, adding to the already burdensome $36 trillion in national debt. What is unnerving markets is that much of the recent rise in yields does not appear to reflect expectations of stronger growth, but rather a rising term premium. According to the Federal Reserve Bank of New York, the term premium is defined as the compensation that investors require for bearing the risk that interest rates may change over the life of the bond (also known as duration risk). Since the term premium is not directly observable, it must be estimated, most often from financial and macroeconomic variables. The New York Fed’s measure of term premium climbed to its highest levels in at least a decade following Friday’s blockbuster December jobs report. The nonfarm payrolls report showed the U.S. economy added 256,000 jobs in December, well ahead of consensus expectations for 155,000 additions. The unemployment rate, which had been expected to hold steady at 4.2%, ticked lower to 4.1%. The report highlighted the continued resiliency of the U.S. economy and labor market, which should be good news for markets, right? Wrong! The market has once again found itself back in a “good news is bad news” environment, as probabilities of additional rate cuts in 2025 rapidly decline and get pushed back well into the second half of the year. In fact, Bank of America, which previously expected two quarter-point cuts this year, no longer expects any additional easing by the Federal Reserve. Instead, the firm now believes the cutting cycle is over and that the conversation should move to rate hikes in the event that inflation expectations drift higher.

Updates & News*

Transition activity has increased amid the recent pullback in stocks. Accounts that have been under Tandem’s management for two weeks are nearly 60% of the way transitioned, while those that have been with us for two months are 80% of the way in-line with our strategies. By the four-month mark, new accounts and new deposits are over 90% of the way transitioned. Turning to portfolio news, a recent blog post from Microsoft president Brad Smith titled “The Golden Opportunity for American AI” outlined the tech-giant’s plan to invest $80 billion this fiscal year to build out AI-enabled data centers to train AI models and deploy AI and cloud-based applications. That figure compares to the $55.7 billion that Microsoft spent in capital expenditures last fiscal year, highlighting the ramp in investment the company is making to further scale its AI offerings and capabilities. More than half of the proposed $80 billion investment will be made in the United States. There has been a flurry of M&A news to note in the portfolio. Stryker recently announced the acquisition of Inari Medical for $80/share, or $4.9 billion, in cash. Stryker believes the addition of Inari’s medical devices for treating venous thromboembolism (VTE) in the arms, legs and lungs will be highly complementary to its current neurovascular business aimed at treating strokes within the brain. Sticking within the health care space, Johnson & Johnson announced it would buy neurological drug maker Intra-Cellular Therapies for $132 a share in cash, for a total purchase price of $14.6 billion. The acquisition, JNJ’s largest in more than two years, serves to boost the company’s presence in the neuropsychiatry space. Intra-Cellular’s key drug, Caplyta, is approved in the U.S. to treat schizophrenia and depression associated with bipolar disorder, and last week, the company settled a patent dispute that delays generic biosimilars until 2040. Elsewhere, the European Commission approved Synopsys’ $35 billion acquisition of Ansys after the companies offered to divest parts of their business to ease fears it could hinder competition. Both companies have agreed to divest Synopsys’ optics and photonics software and Ansys’ PowerArtist software. In other news, Q4 2024 earnings season officially kicks off this week! Abbott Labs, Amphenol, BlackRock, Intuitive Surgical, Johnson & Johnson, and NextEra Energy are a handful of Tandem holdings set to report earnings over the next two weeks.

Source: Source of all data is FactSet, unless otherwise noted.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Observations

December painted a mixed picture across U.S. financial markets with varied performance among major indices. The S&P 500 declined by 2.50%, while the small-cap Russell 2000 suffered a sharp 8.40% loss and nearly gave back all of November’s huge gains.

Notes from the Trading Desk

As we enter the final trading sessions of 2024, U.S. equities are sitting on significant year-to-date gains. The S&P 500 has advanced just over 27% this year, while the Nasdaq Composite has surged more than 34%.

Observations

The momentum in stocks showed no signs of slowing down, as November delivered a strong rally across U.S. equity markets, characterized by broad participation. The S&P 500 rose 5.73%, and the Nasdaq Composite advanced 6.21%.