Financial Markets Review

December painted a mixed picture across U.S. financial markets with varied performance among major indices. The S&P 500 declined by 2.50%, while the small-cap Russell 2000 suffered a sharp 8.40% loss and nearly gave back all of November’s huge gains. By contrast, the Nasdaq eked out a modest gain of 0.48%, driven by resilience in select mega-cap technology stocks. This divergence underscored the increasingly narrow leadership in equity markets and was a microcosm of the last two years.

The Federal Reserve’s December FOMC meeting stood as the month’s pivotal event. As anticipated, the Fed implemented a 25 basis point rate cut, yet the tone of the meeting and its accompanying commentary leaned unexpectedly hawkish. A subtle but important change in the Fed’s statement emphasized the committee’s intent to assess the “extent and timing” of additional rate moves, signaling caution regarding further easing. The new Summary of Economic Projections revealed a reduced forecast for 2025 rate cuts, with the median projection dropping to 50 basis points from September’s forecast of 100 basis points. At the same time, growth and inflation projections for the near term were revised upward. These adjustments rattled market participants, with the S&P 500 experiencing its second-weakest trading day of the year following the announcement. Reflecting this shift in outlook, futures markets are now pricing in a 90% probability that the Fed will hold rates steady at its next meeting in January.

Beyond the Fed’s actions, broader market dynamics in December reflected a more defensive tone. The much-anticipated “Santa Rally” and favorable December seasonality failed to materialize, leaving investors grappling with deteriorating market breadth and stretched sentiment. Throughout the year, we have highlighted the divergence between the S&P 500 market cap-weighted index and the S&P 500 equal-weighted index to illustrate how the S&P 500 is driven by a handful of the largest companies as opposed to a majority of the companies. By mid-month, the S&P 500 hit a record of 14 days in a row of more declining stocks than advancing. Even in the face of such deterioration under the market’s surface, the S&P 500 market-cap weighted index was barely unchanged over that stretch, while the S&P 500 equal-weight index was down by over 4%. The over-concentration and dependence on just a few companies is a clear vulnerability and risk in the S&P 500’s underlying structure, even as investors maintain a generally optimistic outlook for the coming year.

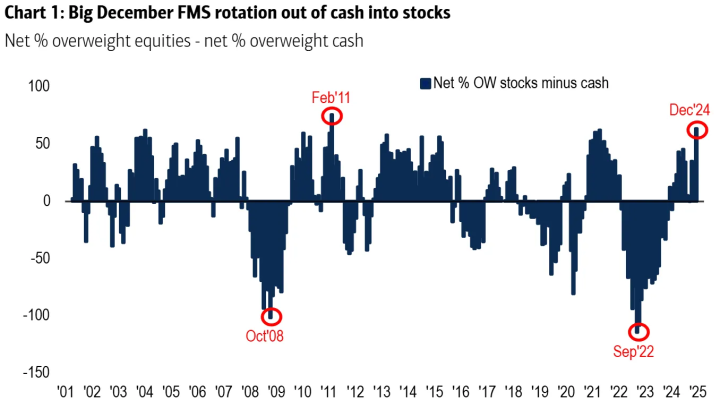

Despite the challenges faced in December, the broader narrative for U.S. equities remained constructive, with the S&P 500 achieving its second consecutive year of 20%+ annual returns for the first time since 1998. Bulls continued to focus on themes of consumer resilience, advancements in AI and computing, strong equity inflows, and optimism surrounding pro-growth policies expected under the incoming administration. However, as seen in the chart below, data from Bank of America’s Fund Manager Survey revealed record-high allocations to U.S. equities and record-low allocations to cash, which may signal a little bit of over-exuberance amongst investors.

Source: BofA Global Fund Manager Survey

As the focus shifts to 2025, market analysts have outlined a broadly positive outlook for equities. Consensus forecasts for the S&P 500 suggest a year-end target in the range of 6,500 to 6,600, building on the market’s strong performance in 2024. Expectations are anchored on several key drivers, including continued corporate earnings growth, incremental progress on inflation, further rate cuts by the Fed, and a broadening of market leadership beyond the Mag 7. However, the outlook is not without risks. Analysts have highlighted concerns about a slower-than-anticipated pace of Fed rate cuts, heightened equity valuations and rising interest rates, which could all dampen market enthusiasm into the New Year.

Tandem Strategy Update*

Outside of the Magnificent 7, the weakness amongst U.S. equities was pretty widespread in December. In fact, every sector was down over 5% last month, except for Communication Services, Consumer Discretionary and Information Technology, which were all positive for the month. And as you might expect, the Magnificent 7 live within those sectors. Given the pervasive weakness across most of the U.S. equity market, we had a few opportunities to put cash to work.

Within the Large Cap Core and Equity strategies, we initiated a position in Zoetis (ZTS). Zoetis is the largest global animal health company focused on developing and manufacturing medicines, vaccinations and diagnostics for pets and livestock. Originally, ZTS was a subsidiary of Pfizer and ultimately spun-off as an independent company in 2013. Since the spin-off from Pfizer, ZTS has consistently grown revenues, earnings and cash flows and has done so at a compound annual growth rate of 6%, 15%, and 16%, respectively. As a result of their consistent fundamental growth, ZTS returns cash back to shareholders through a combination of dividends and share buybacks. Since 2013, they have managed to grow the dividend at a 20% compound annual growth rate.

Across all three strategies, Large Cap Core, Equity and Mid Cap Core, we continued to build our position in Genpact (G). Genpact is a multinational information technology services, consulting and outsourcing company that spun out of General Electric in 2005. The company works with businesses across a multitude of industries – banking, insurance, consumer goods, healthcare, technology and media. Throughout all these industries, companies hire Genpact to transform and modernize their businesses, such as finding ways to use AI to better operate and compete in today’s world. For years, Genpact has proven the ability to grow revenues, earnings and cash flows through any economic environment. As a result, the company initiated their first quarterly dividend in 2017 and has since been able to grow the dividend at a 14% compound annual growth rate.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Source: Source of all data is FactSet, unless otherwise noted.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

As we enter the final trading sessions of 2024, U.S. equities are sitting on significant year-to-date gains. The S&P 500 has advanced just over 27% this year, while the Nasdaq Composite has surged more than 34%.

Observations

The momentum in stocks showed no signs of slowing down, as November delivered a strong rally across U.S. equity markets, characterized by broad participation. The S&P 500 rose 5.73%, and the Nasdaq Composite advanced 6.21%.

Notes from the Trading Desk

U.S. stocks continued their march higher during last week’s holiday-shortened trading week. The S&P 500 finished the week at a record high and closed out the month of November 5.73% higher, its best monthly performance of the year, closing higher for the...