Financial Markets Review

The momentum in stocks showed no signs of slowing down, as November delivered a strong rally across U.S. equity markets, characterized by broad participation. The S&P 500 rose 5.73%, and the Nasdaq Composite advanced 6.21%. However, the standout performer was found in small cap stocks, as the Russell 2000 surged 10.84%, marking its largest monthly gain since December 2023. The S&P 500 notched its biggest monthly increase of the year and finished higher for the ninth time in the last eleven months, all but solidifying a robust performance for 2024. If the trend continues, this would be the first time the S&P 500 has delivered consecutive annual gains of 20% or more since the late 1990s.

The decisive and quick resolution of the U.S. election acted as a major tailwind for equities in November. Market sentiment improved as the removal of the election overhang unwound crowded downside hedges, leading to a sharp retracement in the VIX. This decline in volatility spurred systematic fund buying, further propelling the equity rally. The Republican sweep, coupled with Trump’s victory, added fuel to the post-election surge, as investors viewed the outcome as favorable due to perceived higher economic growth given anticipated deregulation dynamics and potential corporate tax cuts.

Momentum and euphoria within financial markets are extremely powerful forces. In the near-term, it supersedes valuations, as it’s very easy to play the “this time is different” card. Only time will tell if this time is truly different. History has proven in many cases that when optimism and sentiment are too one-sided, while market participants begin to rationalize extreme valuation levels, the market becomes vulnerable and susceptible to shocks. Goldman Sachs noted that U.S. equities have seen the biggest inflows on a 3-month basis since 2021, which was the most recent bout of euphoria coupled with stretched valuations. At the same time, the resurgence in Large Cap Tech has caused the S&P 500 to become ever more concentrated and well above the concentration levels seen at the height of the ‘90s Tech Bubble.

As momentum and euphoria beget increased flows into equities, and prices rise at a faster clip than companies can grow, valuations become detached from fundamentals. The S&P 500 trailing P/E ratio has approached 27x, which marks the fourth highest in the last 125 years, according to Bank of America. On a forward basis, which factors in the nearly 15% expected growth rate of earnings over the next year, the S&P 500 is trading at roughly 23x. This level was last seen in 2021 and near the peak of the Tech Bubble. Other metrics, such as P/B, are also back to Tech Bubble extremes, while P/S is at the highest point on record.

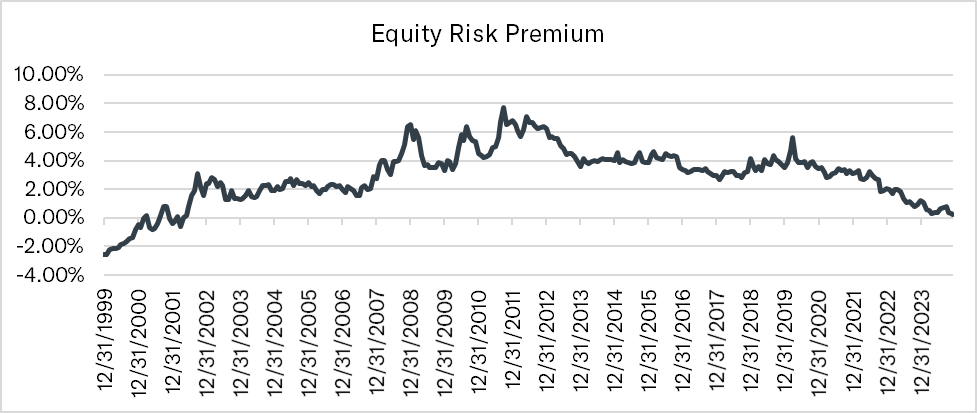

But rather than only comparing valuation levels of the S&P 500 to its own history, it’s also worthwhile seeing how the S&P 500 stacks up against other assets. Per Societe Generale, the S&P 500 has continued its stunning dominance versus the rest of the world, as the S&P 500 trades at a record P/E premium of nearly 60% compared to the MSCI World ex-U.S. index. And one way to compare equities to fixed income is by analyzing the equity risk premium, which is simply the excess return one would expect to earn when investing in equities over fixed income. Often, the equity risk premium compares the earnings yield of the S&P 500 to that of the 10-year U.S. Treasury note yield. All else being equal, a higher equity risk premium indicates equities are more attractive than bonds and vice versa when the equity risk premium is lower.

Source: FactSet

Source: FactSet

None of this is intended to imply a correction in the S&P 500 is imminent, but rather it’s worth understanding where the market is from a risk vs. reward standpoint. Valuations are stretched, but all that really boils down to is a reduction in the margin of safety and little room for error. There is a saying on Wall Street that “markets climb a wall of worry.” Well, it appears we have catapulted ourselves over the wall and are now clear on the other side. The removal of the election overhang, robust economic momentum, and favorable seasonal trends have set the stage for the likelihood of continued gains into year-end. According to Bank of America, going back to 1928, the S&P 500 has traded higher in December 74% of the time for an average return of 1.32%. With history and momentum on our side, there doesn’t look to be much in the way of stopping the continued rally amongst U.S. equities. And looking into 2025, analyst estimates for nearly 15% S&P 500 earnings growth are not showing corporate strength abating anytime soon. Honestly, it’s really hard to see what, if anything, could potentially trip up the market. If there was ever a time you could label the market as “Goldilocks”, this might be it. And maybe that, in and of itself, is worth noting as a tale of caution.

Tandem Strategy Update*

Although we spend a lot of time discussing financial markets in the first section of this column, it doesn’t always coincide with the action we take amongst our investment strategies. The reason for this is that we are solely concerned about individual companies rather than the broader equity indices. Even though the S&P 500 might be trading at a historically elevated level, it doesn’t mean every company is in the same boat. Regardless of how the market is trading, there will always be opportunities to buy and sell individual companies.

Over the past few months, we have written about a couple of companies that were in the liquidation phase due to no longer meeting our fundamental criteria of consistently growing revenues, earnings and cash flows. Within the last few weeks, we have completed the liquidation process of Brown Forman (BF.B) across all strategies. And, we have exited our positions in Henry Schein (HSIC) within our Equity and Mid Cap Core strategies and NV5 Global (NVEE) within our Mid Cap Core strategy.

In addition, we trimmed our position in two companies for valuation reasons – BlackRock (BLK) within our Large Cap Core and Equity strategies and O’Reilly Automotive (ORLY) within our Equity and Mid Cap Core strategies. Both companies have done everything we seek in regard to consistent fundamental growth; however, the price has just gotten a bit ahead of its fundamental growth. When this happens and our quantitative model signals the company as being unsustainably overvalued, we continue to hold the position but manage the risk around such an extreme valuation by reducing our allocation in the company.

We also found opportunities to add to existing positions across all our strategies in Genpact (G), Jack Henry & Associates (JKHY) and Steris (STE). All three companies have consistently demonstrated the ability to grow revenues, earnings and cash flow through any economic cycle, while also trading at an attractive value relative to their growth. Lastly, we initiated a new position in IDEXX Laboratories (IDXX) within our Equity strategy. IDXX is a global leader in pet healthcare innovation through the development, manufacturing and distribution of products primarily for the companion animal veterinary, livestock and poultry, dairy and water testing markets around the world.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Source: Source of all data is FactSet, unless otherwise noted.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

As we enter the final trading sessions of 2024, U.S. equities are sitting on significant year-to-date gains. The S&P 500 has advanced just over 27% this year, while the Nasdaq Composite has surged more than 34%.

Notes from the Trading Desk

U.S. stocks continued their march higher during last week’s holiday-shortened trading week. The S&P 500 finished the week at a record high and closed out the month of November 5.73% higher, its best monthly performance of the year, closing higher for the...

Notes from the Trading Desk

A post-election surge in U.S. stocks drove major equity indices to all-time highs last week. The S&P 500 surpassed 6,000 and logged its 50th record high of the year, while the Dow Jones Industrials Average crossed 44,000 for the first time.