Market Movers & Shakers

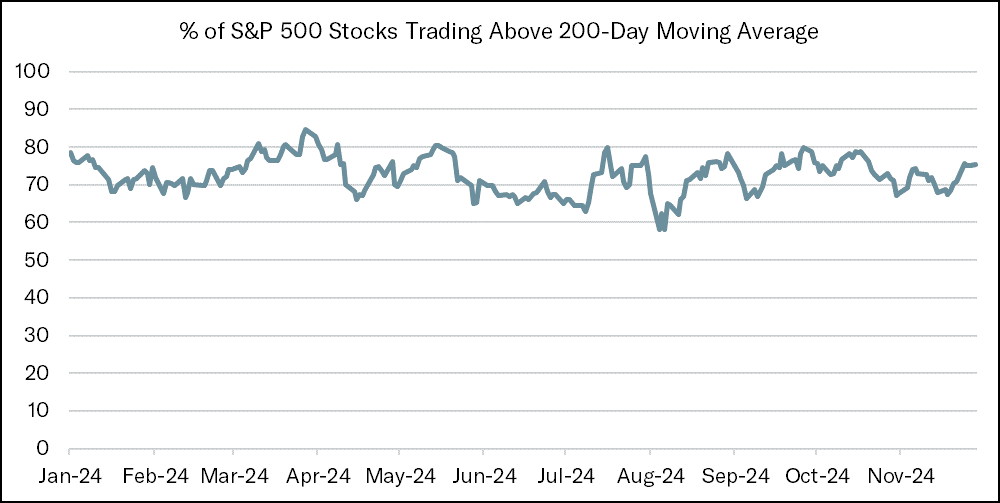

U.S. stocks continued their march higher during last week’s holiday-shortened trading week. The S&P 500 finished the week at a record high and closed out the month of November 5.73% higher, its best monthly performance of the year, closing higher for the ninth time in the last eleven months. The benchmark index has now advanced more than 26% for the year, on track for consecutive annual gains of at least 20% for the first time since the 1990s. The Nasdaq Composite advanced 6.21% in November, logging its second-best month of the year. Consumer Discretionary, Financials, Industrials, and Energy stocks outperformed the broader market, while Healthcare and Materials stocks were the biggest laggards. Market breadth continues to be robust with more than 75% of S&P 500 stocks trading above their 200-day moving average. The breadth profile of the market has been exceptional so far this year. During 2024, the S&P 500 has had no less than 55% of its constituents trading above their 200-day moving average at any given time. The market has also not experienced a correction (a pullback of 10% or more) this year. Historically, a market correction has occurred almost once a year. The equity rally has broadened out of late, as small and mid-cap stocks have seen outsized gains amid expectations for deregulation and corporate tax cuts. The small-cap Russell 2000 index ended November up 10.84%, while the Russell Mid Cap index posted a gain of 8.74%. The broadening out of the rally could also be seen in the S&P 500 Equal Weighted Index, as it outperformed the market-cap weighted index by just over 50 basis points last month. Favorable seasonality trends and a resumption of corporate buybacks stand to provide additional tailwinds going into year end.

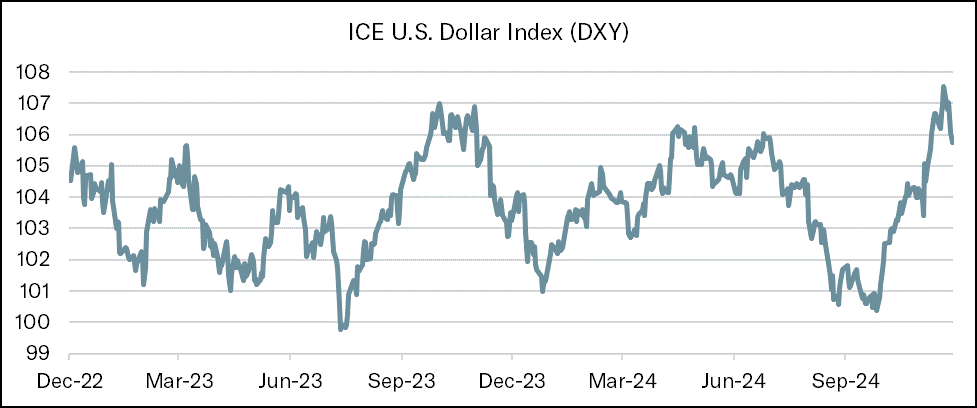

The long-end of the U.S. Treasury curve saw yields decline in November, with the 10-Year U.S. Treasury yield settling at 4.17%, down more than 30 basis points from the post-election peak of 4.50%. The President-elect’s pick of Scott Bessent as the nominee for Treasury Secretary was looked upon favorably by market participants, as equity futures rose and Treasury yields fell immediately following the announcement. Bessent’s 3-3-3 policy, which is focused on driving 3% GDP growth through deregulation, cutting the budget deficit to 3% of GDP by 2028, and producing an additional 3 million barrels of oil a day, is viewed as one that addresses growing concerns of the ballooning national debt and deficits – which pushed down longer-term yields. Short-term yields moderated during the month as market participants continued to recalibrate expectations for the future path of interest rates. The 2-Year U.S. Treasury yield settled at 4.15%, closing higher by 2 basis points for the month. According to the CME FedWatch tool, the probability of a 25 basis point interest rate cut at the December FOMC meeting sits at 65%, up from 50% a week ago, though down from the more than 80% probability seen a month ago. Turning to currencies and commodities, the ICE U.S. Dollar Index cooled off a bit after surging to a more than two year high, while WTI Crude Oil prices continue to oscillate around the $70/barrel level. Gold prices pulled back from their recent record highs of more than $2,800 an ounce, settling around $2,650, while the price of Bitcoin surged to nearly $100,000. Equity volatility, as measured by the VIX, now sits at the lowest level since July.

U.S consumer confidence increased for the second straight month and surged to a 16-month high in November amid optimism over the labor market and expectations for lower inflation and higher stock prices over the next year. According to data from the Conference Board, the percentage of consumers expecting higher stock prices over the next twelve months surged to a record 56.4%. In contrast, the percentage of consumers anticipating declining stock prices in the year ahead slid to 21.3%. The spread between those cohorts, 35.1%, is the highest in the history of the data set dating back to 1987.

Updates & News*

As major indices log fresh highs seemingly every week amid rising valuations and declining volatility, the speed at which we are transitioning new accounts and accounts with recent deposits has slowed a bit since our last transition speed update back in October. That being said, it is important to keep in mind that Tandem’s transition process invests new money on an opportunistic basis, one individual company at a time, while we build out the portfolio. Accounts that have been under Tandem’s management for two weeks are roughly 35% of the way transitioned into our strategies, while those that have been here for a month are just over 50% of the way transitioned. By the three-month mark, new accounts and deposits are nearly 80% of the way in-line with our strategy.

On the portfolio news front, J.M. Smucker reported stronger-than-expected fiscal second-quarter results last week while raising its full-year earnings outlook. CEO Mark Smucker said the company’s Uncrustables, Meow Mix, Café Bustelo, and Jif brands saw notable strength during the quarter. Elsewhere, auto parts retailer O’Reilly Automotive’s board of directors approved a $2 billion increase to the company’s share repurchase program. Since the inception of O’Reilly’s share repurchase program in 2011, the company has repurchased $25 billion worth of its common stock. Lastly, according to reports from Bloomberg, BlackRock is nearing a deal to acquire private credit manager HPS Investment Partners in a cash and stock deal. The acquisition would bolster BlackRock’s alternative assets business as it seeks to become a larger player in the private credit space.

Source: Source of all data is FactSet, unless otherwise noted.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

A post-election surge in U.S. stocks drove major equity indices to all-time highs last week. The S&P 500 surpassed 6,000 and logged its 50th record high of the year, while the Dow Jones Industrials Average crossed 44,000 for the first time.

Observations

Major U.S. equity markets experienced some consolidation in October after several months of upward momentum. The S&P 500 broke a streak of five consecutive monthly gains, declining 0.99%.

The Tandem Report

The stock market continued its impressive run in the third quarter—albeit with a small hiccup in early August. The S&P 500 closed 5.5% higher, which brought the year-to-date gain through September to nearly 21%.