Market Movers & Shakers

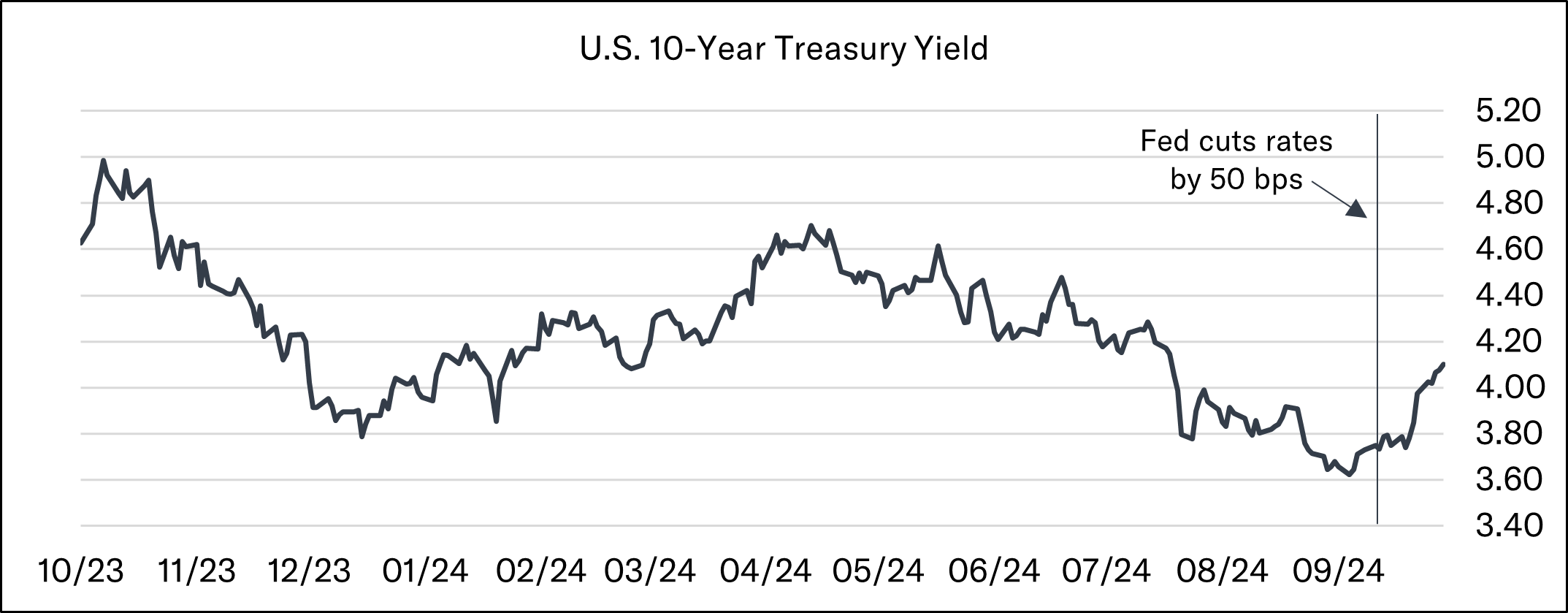

U.S. equities saw continued strength last week, building on recent momentum and pushing major indices to record highs. The Dow Jones Industrial Average and S&P 500 notched fresh all-time highs, with the S&P 500 logging its 45th record high of the year and closing above 5,800 for the first time. The Nasdaq Composite and S&P 500 recorded their fifth straight week of gains as stocks continued their ascent in the face of rising Treasury yields. The 10-year U.S. Treasury yield closed back above 4% for the first time since the end of July, rising 44 basis points over the past month as positive economic data has cooled market expectations for another half-point interest rate cut from the Federal Reserve. The ICE U.S. Dollar Index made a sharp move off its recent low, recording nine straight days of gains. Stronger than anticipated U.S. economic data has provided a tailwind to more cyclical pockets of the market while defensive sectors have lagged. Energy, Industrials, and Materials stocks have outperformed the broader market over the last month, while Health Care, Consumer Staples, and Real Estate stocks have underperformed. Market strength remains broad based, with more than 75% of S&P 500 constituents above their 200-day moving averages. Volatility remains elevated despite equity indices being at or near all-time highs. The VIX closed above 20 last week as the upcoming U.S. presidential election and heightened geopolitical tensions in the Middle East continue to be two of the primary concerns causing angst and uncertainty in markets.

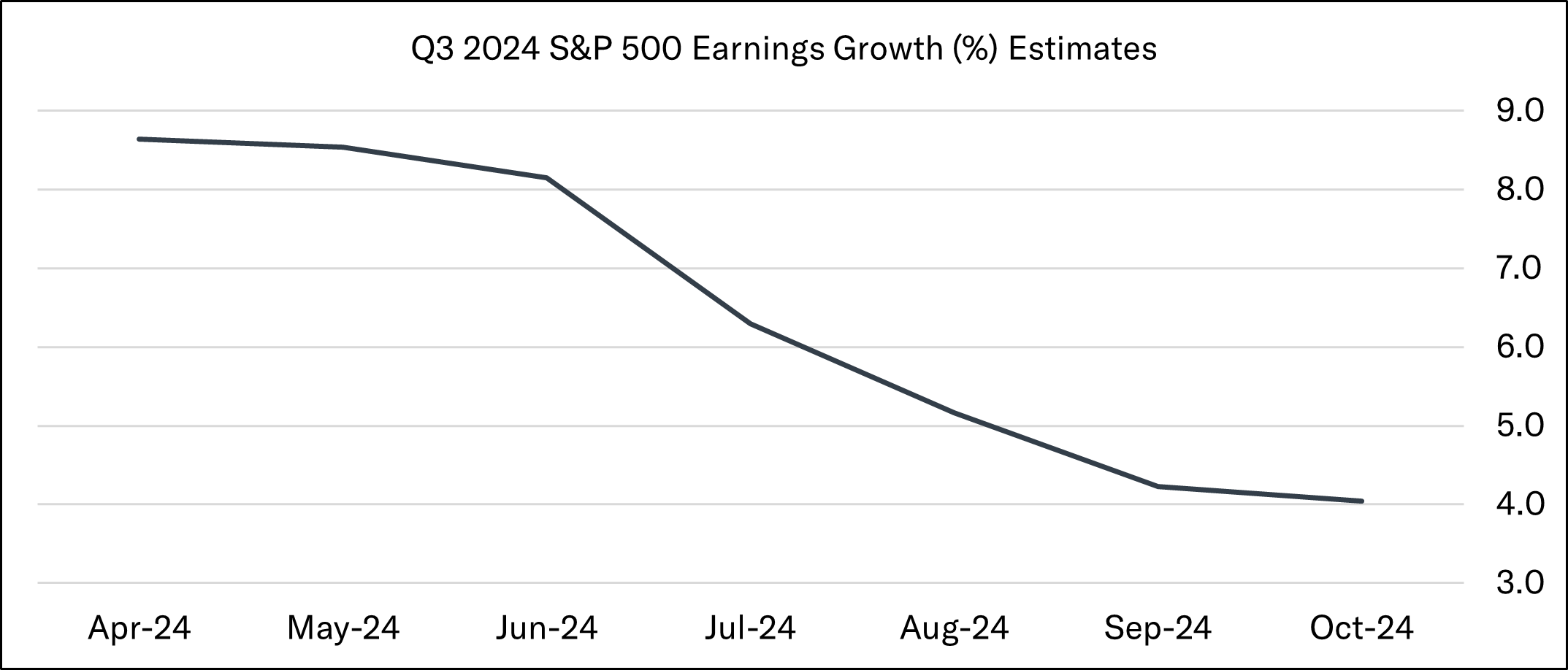

Third-quarter earnings season kicked off late last week as JPMorgan Chase and Wells Fargo reported results. The financial bellwethers provided mostly upbeat commentary on business trends and the economy’s overall health. As earnings season gets under way, analysts are currently forecasting a 4.0% year-over-year increase in third-quarter earnings, which would mark the fifth straight quarter of earnings growth. Q3 EPS estimates have come down meaningfully over the past few months. In mid-June, forecasts were for an 8.5% increase. Downward revisions have significantly lowered the bar for firms to beat estimates. The Magnificent Seven are expected to continue to deliver the bulk of the growth in earnings, with profits expected to rise 18% during the quarter compared to a 1.8% increase for the other 493 companies in the S&P 500. According to Bloomberg, profits for the S&P 493 are projected to accelerate substantially from here, with double-digit gains anticipated in the first quarter of 2025. The percentage of companies reporting earnings growth is expected to grow to ~72%, which would be the highest since the fourth quarter of 2021. Profit margins are expected to tick lower to 12.9%, less than the 13.1% reported in the second quarter though slightly higher than the 12.8% reported in the third quarter of 2023. Information Technology, Communication Services, and Health Care are expected to post the strongest earnings growth from a sector standpoint, while earnings growth for the Energy sector is expected to decline by more than 20% as crude oil prices have notably declined. The Q3 reporting cycle ramps up this week, with over 40 companies in the S&P 500 reporting results and 120 firms set to report in the week after next.

September’s U.S. jobs report was released at the start of the month and showed the labor market added far more jobs than economist forecasts. Data from the Bureau of Labor Statistics showed the economy added 254,000 jobs in September, higher than the average monthly gain of 203,000 over the prior twelve months and the highest number since March, outpacing estimates for 140-150k additions. July and August’s payrolls numbers were also revised higher by a combined 72,000 jobs. The unemployment rate unexpectedly ticked lower to 4.1% versus consensus for it to remain unchanged at 4.2%. Jobs gains were the strongest in leisure and hospitality, healthcare and government – these three industries accounted for roughly 70% of the gains. Hurricane Helene and Milton are being flagged as possible disruptors for October’s nonfarm payrolls report. The most recent weekly jobless claims data from the Department of Labor showed the number of Americans who applied for unemployment benefits jumped by 33,000 to 258,000 in the week ending October 5th. The four-week moving average of claims rose by 6,750 to 231,000. Impacts from Hurricane Helene and ongoing labor strikes contributed to the notable jump in initial claims. Continuing claims, the number of people receiving unemployment benefits after an initial week of aid, increased by 42,000 to a seasonally adjusted 1.861 million during the week ending September 28th.

Turning to inflation, September’s CPI report crossed the wires last week. Core CPI, which excludes the volatile food and energy categories, came in at 0.3% month-over-month, hotter than consensus estimates for a 0.2% increase. Annual core CPI rose to 3.3%, the first tick higher from the prior period since March 2023. Headline CPI rose 0.2% during September, the same pace as July and August, taking the annualized rate to 2.4%. Shelter and food contributed over 75% of the month-over-month increase, though on a positive note, shelter inflation did tick down from August and is showing signs of rolling over. Used vehicle prices, airline fares, and car insurance prices all rose last month, while lower gasoline prices provided some relief to consumers. Producer prices were unchanged in September as an incremental increase in the cost of services was offset by cheaper goods.

Updates & News*

As volatility at the headline level has remained on the higher side of its recent range, Tandem has had the opportunity to put money to work in new accounts and accounts with recent deposits at a faster clip than normal. Accounts that have been with Tandem for a month are ~60% of the way in-line with our strategies, while those that have been with us for three months are over 80% of the way transitioned. The latter part of the transition is moving at a much slower pace as our quantitative investment process suggests a handful of core holdings are trading at unsustainably overvalued prices. In other words, our process is more inclined to reduce exposure to these securities given their current valuations rather than add to them. Therefore, we remain patient with the final ~10-20% of the transition. With earnings season ramping up, we anticipate elevated individual stock volatility that may create idiosyncratic opportunities on a stock-by-stock basis to deploy cash.

On the portfolio news front, BlackRock reported Q3 results last week. The world’s largest asset manager reported a record $11.5 trillion in assets under management, up $2.4 trillion year-over-year driven by $456 billion of net inflows and positive market movements. BlackRock reported stronger than anticipated performance fees and net inflows that exceeded analyst expectations. Net inflows were well diversified across asset classes, with 9% growth in fixed income, 8% in multi-asset, 7% in alternatives, and 5% in equities. BlackRock also saw 350 basis points of operating margin expansion during the quarter as the firm continues to leverage its technology, scale, and global footprint to deliver profitable growth. Elsewhere, Costco reported net sales of $24.62 billion for the month of September, an increase of 9.0% from a year ago. Costco’s September total comparable store sales (excluding gas and foreign exchange) were up 8.9%, with U.S. comps up 9.3%, international comps up 9.6%, and e-commerce comps up 22.9%. Management noted that total and comparable sales for September benefitted by approximately 2% in the U.S. and 1.5% worldwide as a result of increased sales in the final week of the month due to consumer activity associated with Hurricane Helene and port strikes.

Source: Source of all data is FactSet, unless otherwise noted.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

A post-election surge in U.S. stocks drove major equity indices to all-time highs last week. The S&P 500 surpassed 6,000 and logged its 50th record high of the year, while the Dow Jones Industrials Average crossed 44,000 for the first time.

Observations

Major U.S. equity markets experienced some consolidation in October after several months of upward momentum. The S&P 500 broke a streak of five consecutive monthly gains, declining 0.99%.

The Tandem Report

The stock market continued its impressive run in the third quarter—albeit with a small hiccup in early August. The S&P 500 closed 5.5% higher, which brought the year-to-date gain through September to nearly 21%.