Financial Markets Review

In September 2024, U.S. equities continued their upward trajectory, with major indices closing the month higher, extending a strong year-to-date performance. As has been the case for much of the year, the Nasdaq led the way with a 2.68% increase, while the S&P 500 rose by 2.02%. Departing from a recent trend over the prior two months of most other stocks outperforming large-cap growth, the S&P 500 Equal-Weight Index and small caps, represented by the Russell 2000, posted more modest gains of 1.87% and 0.56%, respectively. The S&P 500 and Nasdaq both ended September up over 20% year-to-date, marking an impressive fifth consecutive monthly gain for the S&P 500.

While the monthly performance was positive overall, the market’s path was anything but smooth. Early September saw a significant pullback, with the S&P 500 dropping more than 4% in the first week of the month, which marked the largest weekly decline of 2024. Investor sentiment shifted towards a “bad news is bad news” mentality, driven by a softer-than-expected August employment report that revealed downward revisions to prior months. The ISM Manufacturing Index also contracted, with new orders at their lowest level since May 2023. This wave of disappointing economic data weighed on sentiment as concerns mounted over an economic slowdown.

Despite the rocky start, markets regained their footing, and sentiment became more positive. One of the most significant developments in September was the Federal Reserve’s pivot towards a more accommodative stance. In a somewhat surprising move, the Fed cut rates by 50 basis points, more aggressive than many had anticipated, given the more positive tone in economic data as the month progressed. Initial jobless claims fell to their lowest level since May, and the Atlanta Fed’s Q3 GDP estimate exceeded 3%, consistent with the above-trend growth seen in the second quarter. Lower energy and gas prices provided further support for consumers, while a pickup in refinancing activity also contributed to a positive backdrop. By the end of the month, the market was pricing in an additional 70 basis points or more of cuts by the end of the year. This shift in policy, coupled with a resilient labor market, as seen by the most recent blowout September jobs report, added support to the “soft landing” narrative that has been gaining traction.

As the quarter came to a close, the corporate earnings picture remained broadly constructive. S&P 500 companies posted 11.3% year-over-year earnings growth for Q2, the highest level since Q4 2021. Moreover, 80% of companies exceeded earnings expectations, surpassing the five-year average of 77%. However, consumer sentiment remained mixed, as transcript mentions of both “consumer strength” and “consumer weakness” spiked. The conflicting corporate commentary has matched up with the wide dispersion amongst economic reports throughout the year with some showing strength, while others show weakness. Although, exiting Q2 the general tone was one of stability as there were only 67 companies within the S&P 500 that issued negative guidance, which was the lowest since Q4 2022, suggesting optimism for future earnings.

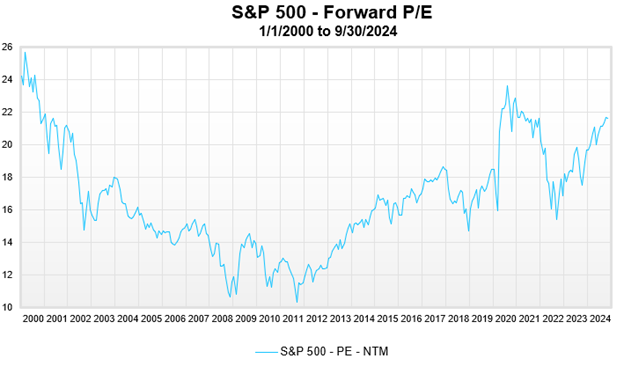

Looking ahead, analysts currently expect S&P 500 earnings to remain positive in Q3, though growth is projected to slow meaningfully to a 3.9% year-over-year pace. Given three months ago analysts were projecting Q3 earnings to grow 7.7%, while companies were not issuing negative guidance en masse through Q2, the bar seems to be set low for future beats. Going forward, it will be exceedingly important for companies to beat the lowered expectations and show continued growth, considering valuations remain historically high. The S&P 500 is currently trading at a forward P/E of 21.5x, which puts the valuation close to where the S&P 500 peaked in 2021 and within reach of valuations seen at the height of the Tech Bubble. In and of itself, elevated valuations don’t mean a correction is imminent, but rather the market becomes increasingly more vulnerable to negative surprises.

Source: FactSet

Tandem Strategy Update*

In the September edition of Observations, we noted that given the growing uncertainty surrounding the economy, geopolitical tensions and the U.S. Presidential election, our expectation was for equity market volatility to remain elevated for the foreseeable future. Most people associate volatility with a down market; however, the truth is volatility can be present in both up and down markets. Last month, the S&P 500 got off to a rocky start, only to rebound swiftly to record highs by month-end. That is volatility and the type of market where you typically see our transaction activity increase at the strategy level.

Although, the S&P 500 trades at a historically high valuation, it doesn’t necessarily mean every company in the market is expensive. As a bottom-up manager, who is solely focused on the individual company, there are times we find opportunities to initiate new positions or add to existing positions in undervalued companies even though the broad market may be considered “expensive”. Across all three strategies, we initiated a new position in Genpact (G). Genpact is a multinational information technology services, consulting and outsourcing company that spun out of General Electric in 2005. The company works with businesses across a multitude of industries – banking, insurance, consumer goods, healthcare, technology and media. Throughout all these industries, companies hire Genpact to transform and modernize their businesses to better operate and compete in today’s world. For years, Genpact has proven the ability to grow revenues, earnings and cash flows through any economic environment. As a result, the company initiated their first quarterly dividend in 2017 and has since been able to grow the dividend at a 14% compound annual growth rate.

Last month, we discussed the start of the liquidation process in Henry Schein (HSIC) within our Equity and Mid Cap Core strategies and MarketAxess Holdings (MKTX) across all strategies. That process continued throughout September, while another long-time core holding joined in on being liquidated – Brown Forman (BF. B). All three companies have failed to jump start growth since the Covid pandemic and no longer fundamentally pass through our quantitative screen. Each company has had fits and starts to only go on and disappoint, which has led HSIC, MKTX and BF. B to fail at sustaining consistent growth in revenues, earnings and cash flows.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Source: Source of all data is FactSet, unless otherwise noted.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

A post-election surge in U.S. stocks drove major equity indices to all-time highs last week. The S&P 500 surpassed 6,000 and logged its 50th record high of the year, while the Dow Jones Industrials Average crossed 44,000 for the first time.

Observations

Major U.S. equity markets experienced some consolidation in October after several months of upward momentum. The S&P 500 broke a streak of five consecutive monthly gains, declining 0.99%.

The Tandem Report

The stock market continued its impressive run in the third quarter—albeit with a small hiccup in early August. The S&P 500 closed 5.5% higher, which brought the year-to-date gain through September to nearly 21%.