Market Movers & Shakers

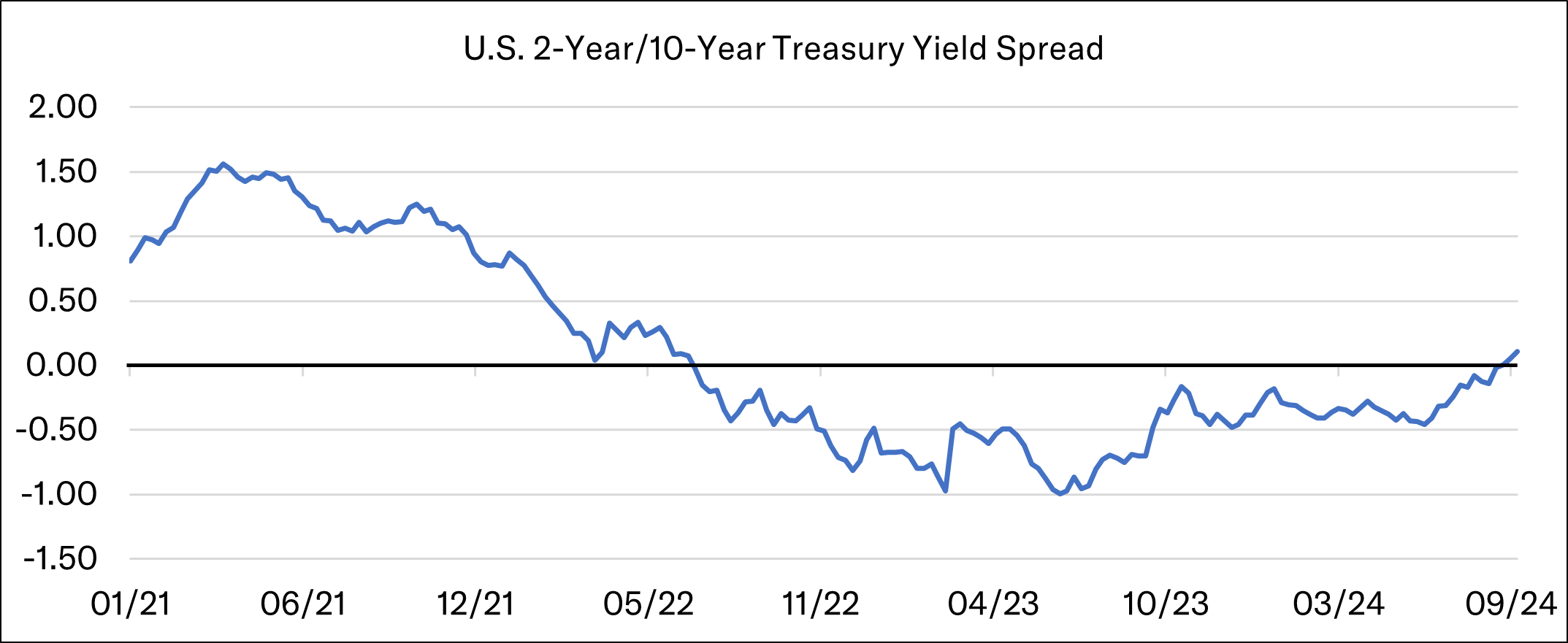

The S&P 500 set fresh all-time highs last week, logging its 39th record close of the year, while the Dow Jones Industrial Average and equal-weight S&P 500 also notched record closes. Major U.S. equity indices are coming off two straight weeks of gains following weakness in early September. The Nasdaq Composite remains roughly 3.5% off its mid-July highs, while the small-cap Russell 2000 remains nearly 9% off its record highs set back in November 2021. All sectors of the S&P 500, aside from the Information Technology sector, have positive total returns over the past month. Utilities, Consumer Discretionary, and Real Estate have been the top performing sectors over the last month, while Health Care, Energy, and Information Technology have been the largest underperformers. Market breadth remains resilient with 75% of stocks trading above both their 50-day and 200-day moving averages. According to Bespoke, the share of S&P 500 constituents that have gained since the July 16th top is significantly higher than the share that are lower. Just 173 stocks (34.6%) are in the red since July 16th, while nearly twice that many stocks (327) are higher. The U.S. Treasury curve has steepened over the past couple of weeks as short-term yields have fallen while intermediate and longer-term yields have moderated. The U.S. 2-Year/10-Year Treasury yield spread is now at the steepest level in 27 months at 15 basis points. Oil prices recorded back-to-back weekly gains for the first time since early July as WTI crude oil prices regained the $70/barrel level. Gold prices continue to hit record highs as prices topped $2,600 an ounce last week. So far, stocks are bucking the trend and rallying amid one of the toughest seasonal periods of the year. The 2nd half of September has historically been the worst two-week trading period of the year. The S&P 500 is currently on track for its first positive performance in the month of September since 2019.

The Federal Reserve cut interest rates last week for the first time since 2020, after keeping policy on hold for the last 14 months. The Fed kicked off the easing cycle with a 50 basis point rate cut, opting to go with a larger cut than the usual 25 basis point increment the central bank has traditionally used to recalibrate monetary policy. Just a couple of weeks ago, in our last edition of Notes from the Trading Desk, we pointed out how markets were pricing in a 70% chance that the Federal Reserve would cut rates by 25 basis points in September, according to the CME FedWatch tool. The odds of a half-point versus quarter-point cut moved to 50-50 a week before the Fed’s policy meeting and continued to move in the direction of a half-point cut in the days leading up to the rate decision. Despite the late shift in market expectations leading into the FOMC meeting, most economists and large financial institutions were still anticipating a 25 basis point cut. Just as Wall Street was split on the decision, so was the Federal Reserve. The decision to go with the larger cut was not unanimous—Fed governor Miki Bowman dissented in favor of a smaller 25 basis point cut, marking the first dissent by a Fed governor since 2005. Bowman wrote that the economy remains strong and labor market near full employment, while inflation remains above the 2% goal, warning that larger policy action could be interpreted as premature declaration of victory over inflation. The Federal Reserve also released its Summary of Economic Projections (SEP) which showed Fed officials anticipate an additional 50 basis points of interest rate cuts by the end of the year, and another 100 basis points of cuts by the end of 2025. Avoiding a recession and significant further weakness in the labor market will be key for the Federal Reserve to maintain its current policy outlook going forward. The unemployment rate is still low from a historical perspective at 4.2%, though it is up from 3.7% at the start of the year. According to the SEP, Fed officials forecast unemployment to tick higher to 4.4% in the fourth quarter of 2024 and remain there through the end of next year.

Updates & News*

Even with major averages at or near all-time highs, we continue to find opportunities to put cash to work across new accounts and accounts with recent deposits. Accounts that have been under Tandem’s management for two weeks are roughly ~40% of the way transitioned into our strategies. After a month, new accounts and recent deposits are just over 50% of the way transitioned, while those that have been here for three months are more than 80% in-line with our strategy. As always, it is important to note that we put money to work on a stock-by-stock basis and not based on any sort of market timing mechanism or macroeconomic outlook. Our transition process is dynamic and the speed in which new money is invested may accelerate or decelerate based on the opportunities that arise in each individual stock held across our strategies.

On the portfolio news front, Microsoft recently announced a $60 billion share buyback program while simultaneously announcing a 10% increase in its quarterly dividend. Microsoft also recently announced a 20-year agreement with Constellation Energy to purchase electricity from the Three Mile Island nuclear plant in Middletown, Pennsylvania. The deal highlights the immense power needed to build out data centers to support artificial intelligence projects. Speaking of artificial intelligence, BlackRock recently announced that they are planning to launch a more than $30 billion artificial intelligence investment fund with Microsoft to build data centers and energy projects to meet growing demands from AI. According to the Financial Times, the fund would be one of the largest investment vehicles ever raised on Wall Street. Elsewhere, Apple recently received FDA approval of a new Apple Watch feature that can detect sleep apnea in device-wearers, which may stand to benefit ResMed, who manufactures and sells devices to treat the condition. ResMed’s Chief Medical Officer, Carlos Nunez, commented on Apple’s update saying, “smartwatch capabilities like these can be the impetus for those conversations that are oftentimes ignored”. ResMed’s CEO Mick Farrell said last week that detection capabilities to wearables could trigger a “tidal wave” of patients and create “an opportunity of a generation”. Lastly, Walmart announced it would be enhancing its partnership with Fiserv on its Walmart Pay offering. Utilizing Fiserv’s NOW Network, the new system would reflect transactions immediately in a customer’s bank account balance rather than showing as a pending charge for several business days.

Source: Source of all data is FactSet, unless otherwise noted.

*The transition level activity taken by Tandem is applicable to new accounts and new money, not the composite or firm-wide level. New accounts and new money are not automatically invested on the first day. Rather, they are transitioned into our strategy over a longer time period that is dependent upon market conditions. Strategy level activity is applicable to the composite and action is taken at the firm-wide level.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

U.S. stocks continued their march higher during last week’s holiday-shortened trading week. The S&P 500 finished the week at a record high and closed out the month of November 5.73% higher, its best monthly performance of the year, closing higher for the...

Notes from the Trading Desk

A post-election surge in U.S. stocks drove major equity indices to all-time highs last week. The S&P 500 surpassed 6,000 and logged its 50th record high of the year, while the Dow Jones Industrials Average crossed 44,000 for the first time.

Observations

Major U.S. equity markets experienced some consolidation in October after several months of upward momentum. The S&P 500 broke a streak of five consecutive monthly gains, declining 0.99%.