- Market Commentary — COVID couldn’t close this party.

- Commentary — There is a lot of noise out there. Don’t be distracted.

- What Others at Tandem are Saying

Market Commentary— COVID couldn’t close this party.

Another remarkable year in the stock market has come to a close. Much of the commentary in these pages will address the uncertainty that lies ahead. Before we do that, we should celebrate what 2021 achieved for investors.

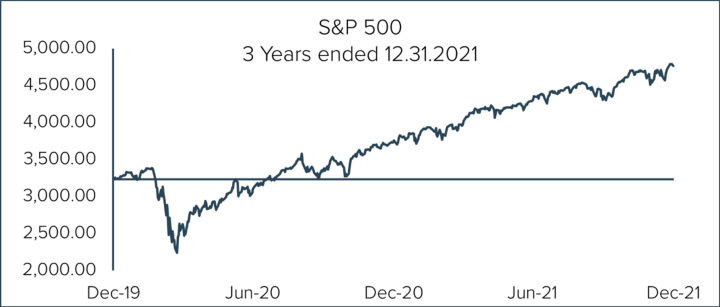

The year began with a surge in COVID cases, but vaccinations, substantial government stimulus and a zero interest rate environment served to minimize COVID’s impact on the markets. The S&P 500 finished the year up 26.89%. The Dow posted a respectable advance of 18.73%, while the technology-laden Nasdaq managed to return 21.39%. Smaller stocks, represented by the Russell 2000, fared a little worse, scratching out a less robust 13.70% gain. Ordinarily that would be a handsome return, but 2021 expected more.

TINA and FOMO have been regular market participants since the Financial Crisis recovery began, and these two party animals continued to drink from the punch bowl in 2021. There Is No Alternative, TINA’s given name, refers to the stellar performance of equities in a zero rate environment. Fear Of Missing Out, or FOMO, is TINA’s highly emotional party companion. Together they really have caused quite a stir in the markets.

For the most part, Asian markets couldn’t keep pace with TINA and FOMO. Europe sure did. But nothing, it seems, could keep pace with oil, as the cost of a barrel of crude jumped over 50%. During the depths of COVID in 2020, a seller of crude oil actually had to pay the buyer roughly $40/barrel to get rid of the stuff. Yes, the seller paid the buyer. Now crude is over $80/barrel. Wow.

Fear of missing out is not a sound investment strategy, and there will again be alternatives, but for 2021, TINA and FOMO certainly did the trick. As we consider what awaits us in 2022, words like inflation, shortages and rising rates come to mind. Buckle up!

Commentary— There is a lot of noise out there. Don’t be distracted.

It’s hard to believe that this miserable pandemic has been with us for nearly two years already. It is mildly depressing to think there is no obvious end in sight. And yet we soldier on, adjusting to our new world as best we can.

A lot has changed since COVID arrived. For one, there seem to be more rules now than there used to be. We must wear a mask in many public settings. We must present proof of vaccination to enter certain destinations. We must be vaccinated to work for many large companies and governments, and many of us are not even allowed in our office. Some of us are allowed back in our office, but only on select days. The same is true of schools, making the balance of work/life an even greater challenge for working parents. Having never been here before, no one knows the right answers. But we sure have come up with a lot of wrong ones.

It also seems we need to have more patience than we once did. We can still order our online purchases with next day delivery, but they don’t tell us which next day the package will actually ship. We have learned that cars, sofas and golf clubs are rarely in stock and may take months to arrive. We have become accepting of regular shortages of basic items in a seemingly prosperous economy. Who knew that supply chain management was even a job before COVID happened?

We behave differently too. We shake hands less and fist bump more. We hesitate before we hug. And we are overly suspicious of anyone that sneezes.

Many are investing differently as well. With more time and money on our hands, playing the stock market and cryptocurrencies has become like sport. It can provide thrill and entertainment, and potentially instant reward. It really has become akin to sports betting. “I’ll take the Chiefs -7, the moneyline on the Rams, and 5 S&P June 4,775 calls.”

For those of us old enough to remember, COVID in many ways has returned us to one of the more forgettable decades – the 1970’s. No, Soul Train and American Bandstand are not on the air again, but inflation, shortages and rising interest rates are back. We haven’t used these words together in serious conversation since, well, probably since the ‘70’s.

For investors, these are issues most haven’t faced before. Inflation was a serious problem in the ‘70’s, as it dramatically eroded the spending power of those living on fixed income. It is uncertain how many today are actually living on fixed income, since interest rates have been nearly zero for a decade. Maybe the Fed fixed that problem inadvertently. But inflation is still a tax on wage earners and savers. It is a gift to the indebted, like most governments. And it is a major contributor to a potentially new investment landscape.

Shortages are also a problem. We are told that our economy is quite robust, and by most traditional measures this is inarguable. Yet we have shortages of labor, raw materials, finished goods, transportation, fuel, and who knows what else. In many respects this feels more third world than first. How companies navigate these issues will, in large part, determine how productive our economy can remain.

Rising interest rates, if they persist, will also alter the investment landscape. For governments, companies and individuals that rely on debt, the cost of the debt is on the rise. This limits borrowing power for governments, profitability for companies and spending power for individuals. None of these are net positives for our economy.

Yet rates typically rise precisely because the economy is strong. If in fact this is the case, then bring on rising rates. Short term pain for long term gain is an acceptable trade-off.

The Federal Reserve is tasked with the dual mandate of promoting both maximum employment and price stability. The primary tool they have been handed by Congress is the ability to adjust short term interest rates. When the economy slows and unemployment rises, the Fed lowers rates. When the economy accelerates and unemployment declines, the Fed raises rates to tap the brakes and make sure things don’t get overheated.

You may recall that the definition of inflation is too much money chasing too few goods. For the last decade or so, the Fed has held short term rates at historically low levels, while adding new tools to their toolbox in the form of Quantitative Easing. The Fed now owns approximately a quarter of all U.S. government debt, plus enough mortgages to ensure those rates remain low as well. Ordinarily this would be inflationary. But these are not ordinary times. Yet, finally, these policies may indeed be promoting inflation.

The question waiting to be answered is whether the Fed is still in control of interest rates, or if the market is reasserting itself by sending rates higher. There is a nearby chart that shows the yield of the 10-year U.S. Treasury Bond for the past 60 years. The yield peaked in September 1981 at more than 15%. Since then, rates have been in a 40 year descent toward zero. The low yield to date was achieved in July 2020 at roughly 0.60%. At the time of this writing the yield stands at nearly 1.80%. The average yield over this 60 year span is 5.95%. We are not likely to get back to that level any time soon, as we haven’t seen it in more than 20 years.

Rates do seem poised to continue their rise. The Fed will no doubt pursue an orderly, well-telegraphed rate strategy, hoping to keep markets calm. The question is whether markets will fall in line.

That rates are rising is not a huge problem. After all, it is the sign of a healthy and growing economy. However, Fed policy has seemingly ignored the presence of economic growth and rates could now be coiled like a spring after being held artificially low for so long. A steeper than expected increase, coupled with all the other goings on, could create some turbulence investors haven’t faced in a while.

Companies and investors alike could potentially face a challenging environment. Being proactive, rather than reactive, seems like the better course of action. For companies, get your house in order. If you rely on debt, move from variable rates to fix and short term to long. This is likely prudent for individuals to do as well.

For investors, we suggest sticking with companies, not stock markets. Understand what you own, and try to own businesses whose success is not dependent upon things beyond their control. Look for businesses that have a track record of growth through nearly any economic cycle.

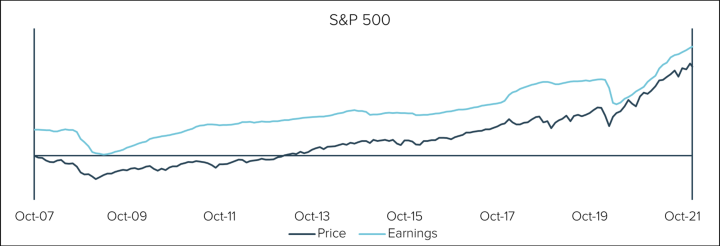

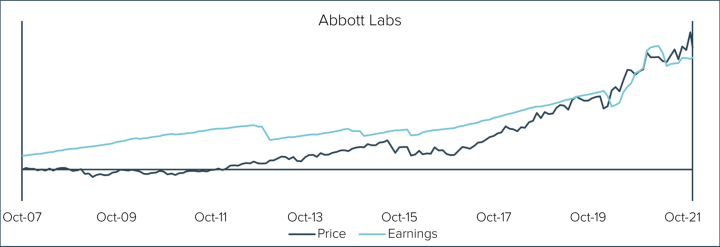

You may notice two charts nearby tracking earnings and price over time. The first chart is for the S&P 500, the second for Abbot Labs. Notice how closely price and earnings move together in each chart. The S&P 500 exhibits a more volatile earnings history than does Abbott Labs. Consequently, the price swings for the S&P 500 tend to be more volatile as well.

Tandem employs a time-tested discipline of seeking to own only those companies that produce consistent, repeatable growth over multiple economic environments. It is not always the best strategy for every market. It might not even be the very best strategy for any market! But limiting volatility during uncertain times has its benefits. At Tandem, we believe limiting volatility is one of the most important ingredients for consistent investment success.

Volatility makes most of us want to do the wrong thing at the wrong time for the wrong reason. We see prices high and rising and we fear we are missing out. Our emotions get the better of us, and we jump in, often causing us to buy high. Conversely, when prices are low and falling, our fear tells us to get out, and we sell low. This is not the sort of behavior that leads to successful investing.

There is a lot of noise out there. Don’t be distracted. Limit volatility and understand your risk. When things are nearly perfect, they rarely get better. Don’t be afraid to sell high, even though no one else is. And when things feel they can hardly get worse, they probably can’t. Buy low. Embrace volatility created by others’ emotions, not your own. The best time to buy is generally when few others are.

What Others at Tandem are Saying

Excerpted from Notes from the Trading Desk by Ben Carew, January 3, 2022:

Perhaps stoking some of the rise in stock prices last year was the potent combination of easy monetary policy and plenty of fiscal stimulus to boot. In early 2021, the Federal Reserve balance sheet was growing between 70-80% on a year-over-year basis. Today, that number has come down some, much closer to about 20% year-over-year growth. Despite the ever-expanding balance sheet, the Federal Reserve could not keep interest rates down. Market forces and inflationary concerns have proved to be a bit stronger. The 10-year U.S. Treasury closed the year around 1.51%, well above the 0.92% from the start of the year. The change in the 2-year has been even more remarkable. At the end of 2020, the 2-year U.S. Treasury yielded 0.12%. Today, it’s closer to 0.73%. The Federal Reserve’s actions coming out of the pandemic did a remarkable job of quelling volatility in equities, but those actions have been unable to stamp out any sort of volatility in the bond market.

So, what of the current backdrop and what lies ahead? COVID is still with us, and Inflation is still a concern. But both of these concerns were present throughout 2021. Perhaps then, a greater risk to the market is the removal of easy monetary policy. The Federal Reserve has already begun tapering its balance sheet purchases – which in and of itself could be construed as tightening monetary policy. The taper, which began in November, has also coincided with a broader market that has been rather range bound. Furthermore, the market is pricing in the first Fed rate hike in March, with another likely in June. Tighter financial conditions are typically a headwind, not a tailwind. Looking ahead, it also seems unlikely that 2022 is as devoid of volatility as 2021 was. 70 record closes in one year is impressive, as is the S&P 500’s 90% gain over the past three years. From a probability standpoint, it seems unlikely that the party is going to be as good as it has been. That certainly doesn’t spell doom and gloom though, perhaps just moderation…

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed in this writing are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Notes from the Trading Desk

A post-election surge in U.S. stocks drove major equity indices to all-time highs last week. The S&P 500 surpassed 6,000 and logged its 50th record high of the year, while the Dow Jones Industrials Average crossed 44,000 for the first time.

Observations

Major U.S. equity markets experienced some consolidation in October after several months of upward momentum. The S&P 500 broke a streak of five consecutive monthly gains, declining 0.99%.

The Tandem Report

The stock market continued its impressive run in the third quarter—albeit with a small hiccup in early August. The S&P 500 closed 5.5% higher, which brought the year-to-date gain through September to nearly 21%.