Market Commentary— The first half of the year was the worst since 1970. What now?

The first half of the year is now in the books, and with that comes a welcome new quarter. The previous six months have been especially tough for many investors. In fact, 2022 had the worst opening half to a year since 1970. Previous market leaders like Amazon, Meta (formerly Facebook), Alphabet (formerly Google), and Apple all fell by the wayside as tech and growth was sold off for much of the quarter. To add insult to injury, the bond market, which is usually a welcome reprieve during equity selloffs, has underperformed as well. Even supposed safe havens like Gold (down 7.5% for the quarter) or Bitcoin (down 60%) could not be saved.

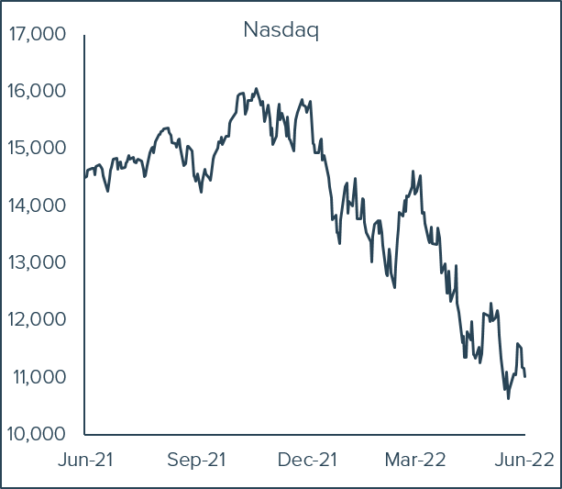

At its lowest point last quarter, the S&P 500 had fallen 24.52% from its January 4th high – its largest decline since March of 2020 during the initial COVID outbreak. During the COVID bear market, tech stocks helped dull the pain felt by many investors as growth-oriented stocks outperformed the broader indices. This time, tech stocks have not been spared. At its recent low, the Nasdaq had registered a 34.83% decline from its November all-time high – its steepest drop since the depths of the Financial Crisis.

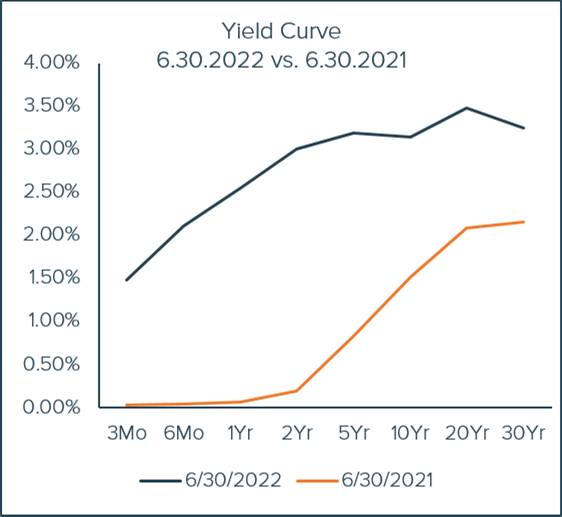

A potent combination of inflation and a Federal Reserve looking to tame said inflation has given investors a fit for much of the year. Inflation has come for nearly all asset classes. The few bright spots have been commodities, whose soaring prices create the very inflationary environment the Fed is looking to fight, and Energy stocks. These oil and gas related energy companies have benefitted throughout the year from supply chain constraints stemming from the Russian and Ukrainian war. As Russian oil has been banned from our shores, a key global supplier of oil has been effectively removed from the marketplace. As economics 101 tells us, if demand remains unchanged in the face of a decline in supply, prices will rise. And oh boy, have they. Recall, at one point during COVID, oil was trading at a negative price per barrel. Today, that price has surpassed $100 per barrel and in early June even exceeded $120 once more. With OPEC, one of the largest suppliers of oil and who is reportedly pumping oil at their max capacity, unable to add to global supply, there seems to be no end in sight for oil prices. Except, as economics 101 also tells us, should demand fall, price too, will fall.

Inflation has dominated the news cycle for much of the past 6 months. However, within the past few weeks, the oft-discussed inflation has been replaced by recession. Though inflation is still present, the Federal Reserve’s effort to stamp out inflationary effects is leading many investors, politicians and consumers to fear that a recession is around the corner. The most common and technical definition of a recession is that there have to be two consecutive quarters of negative growth in real GDP. Real GDP shrunk in the first quarter. The Atlanta Federal Reserve is also predicting another negative real GDP number to be reported for the second quarter. It seems that the fear of an approaching recession is misplaced. We are likely already in one.

Recessions can be a bit like forest fires. A forest fire is always a horrible sight to see. But the dead and overcrowded brush is what burns. This ultimately clears the way for the heathy and enduring growth to thrive in newfound space. The destruction the fire brings breeds future healthy growth in the forest. Recessions, though always painful, produce future opportunities.

Out of recession comes opportunity for growth. Healthy companies thrive in the fresh space is created with the exit of the unhealthy and weak. Recessions and bear markets actually create opportunities for those prepared to seize them. Good businesses can be bought at very reasonable valuations. For the prepared, regardless of market backdrop, there are always opportunities to be found – even in the midst of a recession.

– Ben Carew, CFA

Commentary— Finding the discipline to buy low and sell high.

Perhaps the single biggest key to a successful investment experience is exercising the discipline required to buy low and sell high. This seems so obvious that it shouldn’t even need to be mentioned, yet it is practiced so little in the real world that it merits our attention. Buying low and selling high does not require undertaking market timing and lots of trading. It simply requires discipline and patience.

Too often investors are influenced by the market’s direction as they make investment decisions. They see the market going higher, hitting all-time highs, and they perceive there to be less risk. So they buy. With the benefit of hindsight, we now know that the market was never riskier than on January 4th of this year. As of this writing, that was the day the S&P 500 hit its last record high. In the moment, few were discussing risk. Instead, everything seemed to be working, and investment dollars flowed into the market. Investors were buying high.

And when the market subsequently fell, how did investors react? By selling, of course. They perceived risk to be increasing and they wanted out. They sold low. They thought they were avoiding risk, but perhaps the better time to avoid risk would have been at higher valuations. From our perspective, cheaper stocks are generally less risky than expensive ones.

The market’s volatility too often drives investor behavior, leading to unfortunate experiences of buying high and selling low – the very opposite of what one should hope to accomplish. Investors fear missing out on something big as the market rises, so they want in. Investors are fearful of mounting losses as the market falls, and they want out. Emotions drive their decision-making, and rarely are emotional decisions our best.

Without delving too deeply into investor psychology, it seems there is a preoccupation with trying to know when to get out of the market. This notion of in vs. out is a false choice. If you are an investor, you should always be in the market. Stocks have an upward bias. They go up way more often then they go down.

During the bear market brought on by the Pandemic in 2020, the S&P 500 fell 34% in 22 trading days. Investors who got out before the bottom no doubt felt relief. But unless they got back in below where they got out, what was the point? On the 23rd trading day, the S&P soared more than 9% and never revisited the prior day’s low. The bear market was over, and the S&P was off to the races. Those that got out of the market likely fared worse than if they had simply stayed invested. Market tops and bottoms are impossible to time, so why try?

The best times to buy and the best times to sell do not exist simultaneously. A year ago in these pages we used a real estate analogy to illustrate this point. Some markets are buyers’ markets and some are sellers’ markets. A wise investor accepts this premise and behaves accordingly. When the market is willing to pay you more for something than you think it is worth, let it! This is a gift. What will you do with the proceeds? It’s not relevant. The appropriate decision is to simply accept overpayment and figure out what to do with the proceeds later. Opportunities will present themselves eventually. Similarly, when the market is willing to sell you something for less than you think it is worth, buy it!

Sometimes there are more things to sell than buy. Sell and be patient. The cash reserves in your portfolio will rise, and that is ok. It means you have the ability to strike when valuations become more compelling. Eventually there will be more things to buy than sell, and cash reserves will decline. This is the discipline of buying low and selling high.

It is impossible to buy low and sell high if you remain fully invested at all times. Yes, you may find opportunities to buy low, but you must also sell something low if you did not proactively sell high and build a cash reserve. Or you may find an opportunity to sell high, but if you reinvest those proceeds in something that is similarly high, what advantage have you gained?

If you would like to see how this discipline is put into practice, look no further than your Tandem portfolio. If you were with us at the end of last summer or early fall, you may recall that cash reserves in your portfolio were pretty high. For some of you, those levels were too high. But we believed then, and certainly do now, that reducing our exposure to overvalued securities, even with no place other than cash to park those reserves, reduced the overall risk to your portfolio. Yes, as the market was hitting all-time highs, we were certainly underperforming in the moment. But look how your portfolio has stood up since then.

We proactively reduced our exposure to those things with valuations we thought were unsustainably high. We were content to be patient. As valuations for attractive companies became more compelling, we were able to add to some of our existing holdings, as well as buy several companies for the first time. And now the cash in your portfolio is substantially less than it was 9 – 12 months ago. This is how it is supposed to work! We are buying low.

We are willing to be different. When others were buying a year ago, we happily sold our overvalued securities to them. Now that others are selling, we are finding value in companies we wish to own. This is what buying low and selling high looks like. Sometimes it gets a little lonely, but if we didn’t proactively sell high and build a cash reserve, would you send us more money to take advantage of bargains when stock valuations decline? Probably not! So it is our job to manage your portfolio for times such as these. When opportunity finally does present itself, we will be ready.

In this way, we hopefully are able to keep you in the market at all times. We simply manage the amount of risk we take at any given moment. As risk rises we want to reduce our exposure to those companies that are most susceptible to a downturn. Overvalued and fundamentally flawed securities tend to perform worse in down markets than sound, fairly priced companies.

Most investors are what we call trend aware. This is not meant derogatorily in any way. It is simply to say that most seek to identify some trend in the market, the economy, a particular sector, or a company that looks positive and worth participating in. There is nothing wrong with this approach, but it does make it harder to buy low and sell high, in our view.

As a refresher, Tandem has no view of the market, the economy, or any other macro trend. Every decision we make is company specific for fundamental and valuation reasons only. We seek companies that have demonstrated the ability to grow through any economic environment. That eliminates a lot of great companies from consideration. If we hope to limit the volatility of a portfolio, owning volatile companies would not be the best way to do that. Economically sensitive companies do not have the ability to control their own destiny because they are dependent on too many factors beyond their control. Companies that are less economically cyclical also tend to be less volatile. If we own a company that ceases to grow, our discipline requires us to sell it.

Once we have identified those companies that meet our very stringent fundamental criteria, we then look for opportunities in the ones that the market has “mispriced”. In this sense, we are mean-reversion aware, as opposed to trend aware. Most valuations fall within a fairly well-defined range, and the middle of this range is called the mean. It makes sense that most valuations are within a predictable range because in a free marketplace, where buyers and sellers meet every day, most things are fairly priced. But not always.

Sometimes we find valuations that fall outside of this well-defined range. We know that, statistically speaking, there is a very high probability that these outlier valuations are unsustainable, and will revert back toward the mean. When a valuation in our view is unsustainably overvalued, we perceive this as a gift. The market is offering us more than we believe a particular company is worth, so we gladly accept this gift. We want to reduce our holding in an unsustainably overvalued security, thereby reducing risk to the portfolio. This is how we hope to proactively sell high. We sell a portion of what we own in an unsustainably overvalued security.

Most probably, that valuation will revert back toward the mean as the security moves back toward its normal valuation range. Sometimes valuation goes too far and overshoots the mark, becoming unsustainably undervalued. When this happens, we consider adding to an existing holding, or perhaps buying for the first time if we don’t own the company. And this is how we seek to buy low.

Staying invested is important. To do so, one must buy and be vigilant. Reduce risk as it rises and take on risk as it decreases. Sell high in order to buy low. This requires discipline, patience, a willingness to hold cash when few compelling opportunities present themselves, and a willingness to buy as prices decline.

In vs. out is a false choice. Stay invested and manage the risk. At Tandem, our discipline is rooted in math, not opinion, interpretation or bias. Sometimes our process may feel a little uncomfortable. Just know that we follow our discipline. Buy low and sell high.

Tandem News

We have a new addition to the Tandem team to acknowledge and welcome. Ariel Davis joined us in June as an Investment Management Associate. A native of South Carolina, Ariel earned a B.S. in Finance and a minor in History from the College of Charleston Honors College. Prior to Tandem, Ariel spent four years with Raymond James. For her first 18 months, she was an analyst in the Raymond James Accelerated Development Program before joining the Investor Relations and Financial Planning & Analysis team. Welcome Ariel!

We also have some folks with new titles that recognize their significant contributions to Tandem. Elaine Natoli and Ben Carew have been named Vice Presidents of Tandem. Billy Little, who recently celebrated his 16th anniversary with the firm, is now Senior Vice President. Congratulations to all 3. We thank you for you hard work, dedication and passion for all things Tandem. Go Team!

As we near our 32nd anniversary as a business, we are grateful for the partnership and support of our fantastic financial advisors and loyal clients. You permit us to do what we most love to do, every day. Thank you. It has been a remarkable (and remarkably fast) 32 years. We look forward to the next 32. Cheers.

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed on this podcast are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Observations

In March, U.S. equities continued their steady ascent with all major indices experiencing gains. The S&P 500 extended its winning streak, marking its fifth consecutive monthly increase and closing higher for the 10th time in the past 13 months.

Notes from the Trading Desk

Major U.S. equity indices are coming off a winning first quarter. The S&P 500 gained more than 10% in the quarter, a second straight double-digit quarterly percentage gain and its best start to the year since 2019.

Notes from the Trading Desk

Stocks took a breather last week after their recent record-breaking climb. Declines were broad-based as the tech-heavy Nasdaq posted its second consecutive weekly decline while the small-cap Russell 2000 experienced its worst week of 2024.