- Market Commentary — The Market Marches Onward and Upward

- Commentary — Sometimes Analogies are Just Easier to Understand

- A Reminder About Cash as an Asset in Your Portfolio

- Tandem News

Market Commentary— The Market Marches Onward and Upward

The U.S. stock market continued its relentless move higher. Having posted its best 12 month return in more than 30 years last quarter (56.36%), the S&P 500 Total Return Index cooled off only slightly, recording a 40.33% return for the 12 months ended June 30. The 3– and 5-year returns are not approaching record levels yet, but they are at levels not seen since the market’s recovery from the financial crisis a decade or so ago.

The S&P’s annualized 3-year return through June is 18.68%, and the annualized 5-year return is 17.65%. Periods of outsized returns are rarely followed immediately by precipitous declines, but they are often followed by periods of more modest returns. Unusually robust market returns most often come at the expense of future returns, but only time will tell if that is to be the case this time.

Despite volatile bond yields, soaring energy costs, fears of inflation, and supply chain issues that may have derailed less spectacular markets, stocks surged for the 5th consecutive quarter. Growth once again outperformed value, after value enjoyed a brief moment last quarter. Clearly the investing public anticipates the continuation of a very strong recovery.

As the world reopens from COVID, just about everything seems to be in demand. Travel is booming, leisure and hospitality are nearly back to pre-COVID levels, and the consumer is spending. People are ready to get out and enjoy themselves, clearly. About the only sector of the economy that has yet to experience this resurgence is business travel. As long as work-from-home continues to be acceptable for businesses, this sector will continue to be slow to recover. Yet hotels and airplanes seem to be full in spite of the absence of the customers they once valued most.

There are things bubbling below the surface that need not be cause for concern yet, but certainly warrant monitoring. One such thing is the ever-growing presence of investment allocation models sponsored by large investment firms. To be sure, there is nothing inherently disturbing about an investment firm offering advice as to how to allocate your investment portfolio across asset classes. What could be troubling at some point, however, is the degree to which the investing public follows these models. If everyone owns the same thing, it could be difficult to get out or in when changes are recommended. If models ever suggest lessening exposure to stocks, it is not hard to envision a messy decline as everyone rushes to sell in order to stay in line with the model.

This concern was highlighted in a recent Wall Street Journal article by Dawn Lim. She points out that models now control $4.8 Trillion in U.S. fund assets as of March 31st. This is up from $3 Trillion a year prior. That is a lot of money following models. If they all make similar recommendations, all that money will be moving in the same direction. That can be good news when the direction is higher, but could pose a challenge when the direction is lower.

Also worth noting is the persistently low dividend yield. With interest rates near zero, dividends yields have understandably been low for some time now. It is worth noting that, historically, dividends account for approximately 1/3 of market returns. The S&P 500 yields less than 2%, and has for some time. If this continues to be the case, and the contribution of the dividend to total return remains 1/3, then future stock returns will be less robust than they are presently. Time will tell how these things play out. For now, the market seems carefree, so enjoy it.

Commentary— Sometimes Analogies are Just Easier to Understand

Imagine that I have successfully persuaded you to manage my money. Specifically, I have convinced you to construct a portfolio for me of residential real estate located exclusively within your home town. You no doubt have a decent understanding of residential real estate, and likely some pretty strong opinions about the local market as well. No matter. You have agreed, and so you proceed.

There is no way for you to easily or immediately replicate the “market”. There is no ETF or fund you can put my money into in order to satisfy my demands. Instead, you must construct this portfolio thoughtfully, one property at a time.

You will employ your own criteria to identify properties worth owning, and you will seek out those that meet your criteria at a price you think reasonable to pay. The day I hand you the money is certainly not the same day all properties will be identified and purchased. This will take time.

If your local real estate market is a buyer’s market, your task might be easier. There will likely be plenty of opportunities to chose among. If, instead, your market favors the seller, you must search more deliberately to find properties for my portfolio. There are always bargains available. Sometimes, it simply requires greater effort and patience to identify them.

The process takes however long it takes. It may even be the case that you don’t spend (invest) all the money, because there just aren’t enough opportunities to use every dollar. And that is okay, because you continue to search for opportunities for the uninvested cash. Maybe you will find an unexpected bargain, and having the extra cash will be a blessing.

After initial construction of the portfolio is complete, the process of actually managing this real estate portfolio begins. Suppose someone offers you 3 times what you just paid for a property. This is obviously more than you consider the property’s fair value. You have been given a gift by an anxious purchaser. Since this is my money (remember), I beg you to accept this gift and sell the property!

Are you selling because you have some other property you want to buy? Or because you have a particular view of the market that informs you to sell? Not at all! You are selling this property because it is the right thing to do.

And now you have more cash. You continue to search for properties that meet your criteria, whatever they may be, at prices you think are reasonable to pay. Suppose that while you are searching, zoning regulations for one of your properties changes and a highway is to be constructed through the back yard. Understandably, this property needs to be sold as well.

Again, are you selling because you have some other property you want to buy, or because you have a particular view of the market that informs you to sell? No. You are selling this property because it is the right thing to do.

With the sale of the second property complete, you have even more cash than before. That is because there have been more properties to sell than there have been to buy. This will eventually change, and when it does, you will be well-positioned to take advantage of opportunities. You avoided the temptation to buy simply because you had cash, so now you have the ability to make the appropriate buys when they present themselves. This is sound management on your part. Congratulations, and thank you for treating my money this way.

For whatever reason, most of us understand real estate and can relate to this analogy. When it comes to stocks, the notion of diligence with patience seems less readily understood or accepted.

Among the investing public, media and other observers, there seems to be some sort of mystique around “the market”. There is great excitement when “the market” goes up, and much handwringing when it goes down. And bizarrely, the more the market goes up, the less risk the public perceives. Similarly, during market declines, risk is perceived to be rising.

At Tandem, we take a very different view. We will never invest your money simply for the sake of being invested. Your money is not invested in “the market”. Much like the real estate analogy, we try to identify those businesses (instead of properties) that meet our criteria at prices we think are reasonable to pay. We are not attempting to replicate “the market”. We are attempting to make sound investments, one at a time, on your behalf.

Unlike with real estate, we can sell some of what we own in a company without having to sell all of it. So when a company we own is trading at a price we think is unreasonably and unsustainably high, we take advantage of this gift and sell a piece of our holding, not all of it. Recall in the real estate portfolio someone offered 3 times what we paid for a property, so the property was sold. In your Tandem portfolio, we can use the same philosophy, yet still own that company, just in a smaller amount.

We do not liquidate overvalued companies, but we do reduce our exposure to the risk of an overpriced security. And we do this not because we have another company to buy, or because we have a negative view of the market and want to hold more cash. We do this because it was the right thing to do for a particular company at a particular price.

If a particular company ceases to meet our criteria, we will sell all of our holdings in that company. Whether we have something else to buy is not part of the decision-making process. We sell the company because it is the right thing to do, and we will redeploy the cash when opportunities present themselves, but not before.

When real estate prices rise unrelentingly, most would-be buyers rightly become skeptical. However, when stock prices rise unrelentingly, most want to participate more. If you doubt this, please check the data. Purchases of mutual funds and ETFs historically are greatest at or near market tops. Conversely, sales of mutual funds and ETFs are greatest at or near market bottoms. But in real estate this would be called a buyer’s market!

Why do so many perceive less risk when stock prices are higher and greater risk as prices fall? I can’t say. But at Tandem, we believe that lower prices and higher prices both present opportunities.

Lower prices, in our view, make for more compelling investments than do higher prices. Higher prices are often gifts to be taken advantage of by selling a partial stake, while lower prices are a chance to put that money back to work. This is how to buy low and sell high. Too often investors actually do the reverse – buy when prices are high and sell when prices are low.

Most investors tend to be trend aware. They try to identify the next big thing, or jump into whatever seems to be working now. But eventually trends reverse, and the investor must know when to move on.

Tandem prefers to try to be opportunistic when the market misprices companies. We call this mean-reversion investing. Mean-reversion is about math, not anticipation or guesswork. Rather than hoping to identify the next trend, we rely upon a simple statistical concept based on the notion that most of the time, stocks are fairly valued. And whenever they are not, there is a very high statistical probability that they will revert back to fair value eventually.

In the short term, or sometimes even the medium term, this practice can seemingly put us at odds with the market. And that is okay, because those odds favor a reversion to a more normal valuation eventually.

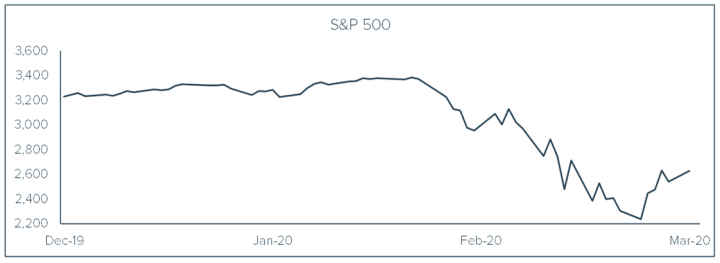

By allowing cash to accumulate when there are more things to sell than buy, we are setting up our portfolio to take advantage of the lower prices that often follow. If you doubt this is so, allow me to remind you of last year. We began 2020 with a relatively high percentage of cash in the portfolio. Some questioned this tactic, but we explained this is what buying low and selling high looks like. There just hadn’t been any buying opportunities in a while, so we gave the appearance of just being sellers. Until March came and the steep price declines gave us numerous opportunities to put that cash to work. In fact, some of the same people that were concerned about the large amount of cash became concerned when the cash was largely gone! Emotions are a tricky thing, no doubt.

Imagine if we had acquiesced and not followed our discipline. We would not have had all the cash we had accumulated. Two things likely would have happened.

First, the decline to the portfolio would have likely been much more severe. Not because cash stemmed losses, but rather because what we sold to accumulate cash was either overvalued or fundamentally flawed. These types of companies generally perform worse in a market downturn, so we reduced our exposure to them.

The second likely thing to happen would be that we would not have been able to take advantage of the market’s dramatic decline. If we didn’t have cash at our disposal, we would have asked you to send us more. Imagine that call. The market is down 34% in a month. Can you please send us more cash?

In following this discipline, Tandem has historically been able to reduce risk in portfolios as prices rise, and we have added back to the portfolio when prices have fallen. Simply put, we may not go as high as the market, but we likely won’t go as low, either. A smoother, less volatile, more repeatable experience is what we seek to deliver, and we believe this is the best way to do it.

When mean reversion is applied to the real estate market, everyone gets it. There are buyer’s markets and seller’s markets. When this discipline is applied to the stock market, it may seem less intuitive, but it is no less effective. Buying low and selling high always makes sense.

A Reminder About Cash as an Asset in Your Portfolio

In a world with interest rates near zero, or even less than zero in some cases, it may be difficult to consider cash an asset. But it most certainly is an asset, and an important one in your Tandem portfolio.

We never allocate to cash. We have no view of the market that causes us to increase or decrease the amount of cash in your portfolio. The amount of cash is dynamic, not static or targeted. As more opportunities to buy than to sell present themselves, cash levels, by default, decrease. Or, when there are more things to sell than buy, cash levels will rise.

The return on cash is less important to us than the simple availability of cash. Cash cannot go down in value and is completely liquid and always available, without cost to access. These features are important. When opportunities present themselves, the money absolutely has to be there! We cannot afford any fluctuation in or risk to principal. It simply has to be available when we need it.

Prior to the COVID crisis and the Federal Reserve’s response to it, Tandem was able to better manage returns on cash without risking principal or liquidity. During the financial crisis, the vulnerability of money market funds was exposed. Most had previously assumed that money market funds protected principal. During the crisis, some funds owned assets that lost value, thereby causing the fund itself to be worth less than stated value.

In response to this, most custodians now use some form of a Bank Deposits program instead of a money market fund, because bank deposits are insured by the FDIC and money market funds are not. In normal times, a Bank Deposits program will yield less than money market funds. So, prior to COVID, Tandem was able to either use money market funds invested in government obligations, or directly invest in Treasury bills, to produce a higher yield on a portion of the cash in the portfolio. We actively managed how the cash in a portfolio was invested.

Now that the Fed has reduced rates virtually to zero, the yield on short-term Treasury securities is actually less than the yield on the Banks Deposits program in your portfolio. Believe it or not, your cash is safe, liquid, protected and providing a competitive rate of return. When other instruments with similar characteristics again yield more than Bank Deposits, we will move a portion of your cash to the appropriate vehicle. But for now, you are in the appropriate place.

Tandem News

In May, Julia Hoffman joined Tandem as a Communications Associate. A native of Hingham, MA, Julia is a recent graduate of The College of Charleston, where she received a BA in Communication and a minor in Writing, Rhetoric, and Publication. Welcome to Tandem, Julia.

Annie Klopstock joined the Tandem team in June as an Investment Operations Specialist. A native of Walnut Creek, CA, Annie is a recent graduate of San Diego State University with a BA in Quantitative Analysis Economics and a minor in Statistics. Welcome to Tandem, and the East Coast, Annie.

We are also excited to have interns back. This summer we are joined by André Limón, a rising Senior at The College of Charleston. He is double majoring in mathematics, with a statistics concentration, and data science while minoring in finance. We are also joined by Grant d’Adesky, a rising Junior at Emory University. He is pursuing a double major in Business Administration and Classical Guitar. Welcome interns!

Disclaimer: Tandem Investment Advisors, Inc. is an SEC registered investment advisor.

This audio/writing is for informational purposes only and shall not constitute or be considered financial, tax or investment advice, or an offer to sell, or a solicitation of an offer to buy any product, service, or security. Tandem Investment Advisors, Inc. does not represent that the securities, products, or services discussed on this podcast are suitable for any particular investor. Indices are unmanaged and not available for direct investment. Please consult your financial advisor before making any investment decisions. Past performance is no guarantee of future results. All past portfolio purchases and sales are available upon request.

All performance figures, data points, charts and graphs contained in this report are derived from publicly available sources believed to be reliable. Tandem makes no representation as to the accuracy of these numbers, nor should they be construed as any representation of past or future performance.

Insightful Updates

Delivered

Timely and engaging information—right to your inbox.

More Commentary

Observations

In March, U.S. equities continued their steady ascent with all major indices experiencing gains. The S&P 500 extended its winning streak, marking its fifth consecutive monthly increase and closing higher for the 10th time in the past 13 months.

Notes from the Trading Desk

Major U.S. equity indices are coming off a winning first quarter. The S&P 500 gained more than 10% in the quarter, a second straight double-digit quarterly percentage gain and its best start to the year since 2019.

Notes from the Trading Desk

Stocks took a breather last week after their recent record-breaking climb. Declines were broad-based as the tech-heavy Nasdaq posted its second consecutive weekly decline while the small-cap Russell 2000 experienced its worst week of 2024.